Hub Group (HUBG) has caught investor attention after recent share price moves, with the stock last closing at $47.56. That puts fresh focus on how its returns and fundamentals line up.

See our latest analysis for Hub Group.

That recent 30 day share price return of 8.19%, building on a 33.11% move over 90 days, sits alongside a 1 year total shareholder return of 5.06% and 5 year total shareholder return of 79.48%. This suggests momentum has picked up after a slower patch.

If Hub Group’s recent strength has you reviewing the transport space, it could also be a good moment to broaden your search with auto manufacturers.

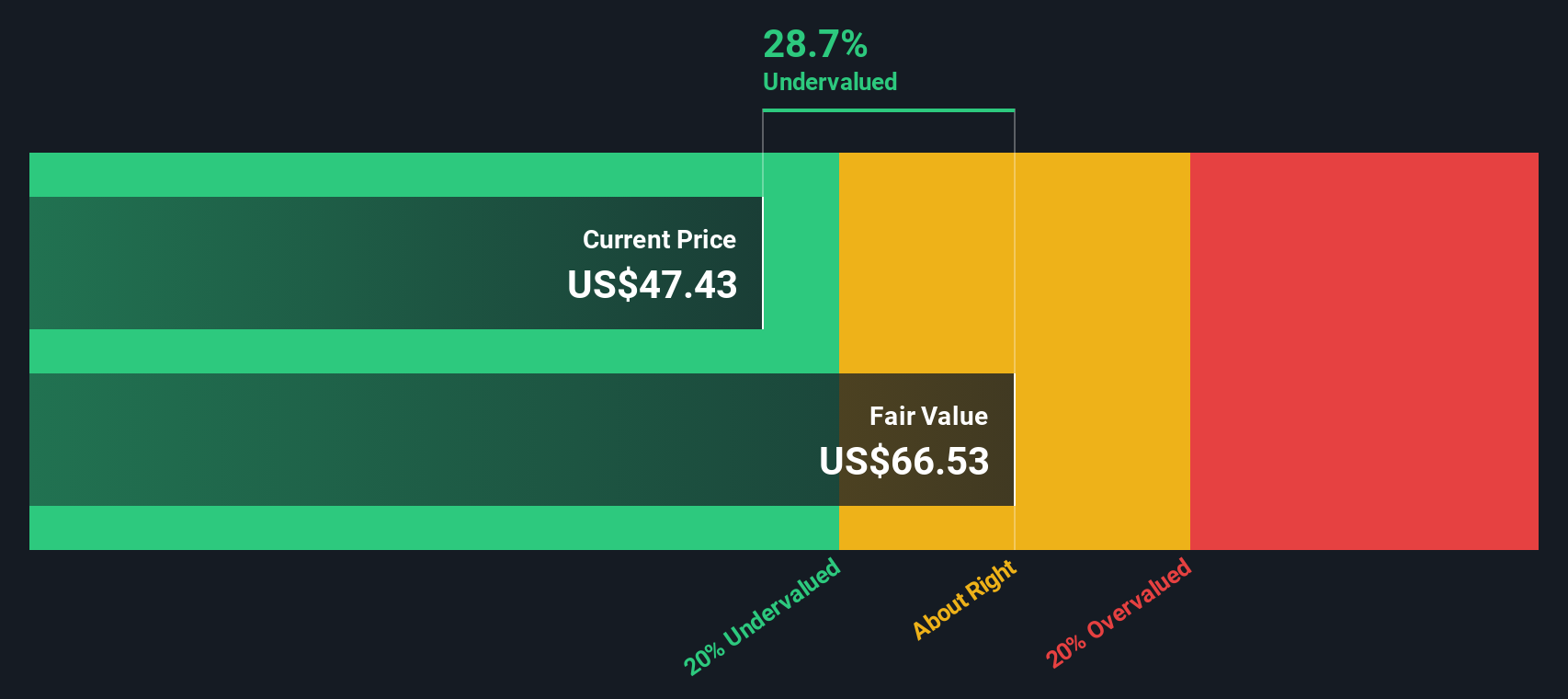

With Hub Group trading close to the latest analyst price target and an estimated intrinsic discount of about 29%, the key question is whether the market is overlooking value here or is already pricing in future growth.

Most Popular Narrative: 8% Overvalued

Hub Group’s most followed narrative puts fair value at about $44.06 per share versus the last close of $47.56, framing the current debate around upside versus caution.

The company’s strategy of targeted, accretive acquisitions (e.g., Marten Transport’s refrigerated intermodal business), along with a strong balance sheet and cash flow generation, provides catalysts for both inorganic top-line growth and earnings acceleration, as Hub Group leverages synergies, broadens its service offering, and scales differentiated solutions across its national footprint.

Curious what kind of revenue path, margin lift, and future P/E multiple need to come together to back that fair value outcome? The narrative lays out a detailed playbook you can test against your own expectations.

Result: Fair Value of $44.06 (OVERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, there are still a few watchpoints, including softer logistics demand and customer concentration, that could challenge the fair value story if they persist.

Find out about the key risks to this Hub Group narrative.

Another View: What Earnings Multiples Are Signalling

Our DCF work suggests Hub Group could be worth about $66.53 per share, which is above both the $44.06 narrative fair value and the current $47.56 price. That gap raises a simple question for you: are earnings expectations too low, or is the cash flow model too generous?

Look into how the SWS DCF model arrives at its fair value.

HUBG Discounted Cash Flow as at Jan 2026 Build Your Own Hub Group Narrative

HUBG Discounted Cash Flow as at Jan 2026 Build Your Own Hub Group Narrative

If you see the numbers differently or prefer to back your own work, you can test your assumptions and shape a fresh story in minutes with Do it your way.

A great starting point for your Hub Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Hub Group is on your radar, do not stop there. Use the Simply Wall St Screener to quickly spot other opportunities that fit the way you invest.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Discover if Hub Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com