Company Logo

Key market opportunities in the oil and gas pipeline construction sector include the expansion of global energy demand, investment in midstream infrastructure, environmentally responsible construction, automated monitoring, and modernization initiatives. Rising demand for pipeline repair and offshore energy transport adds further growth potential.

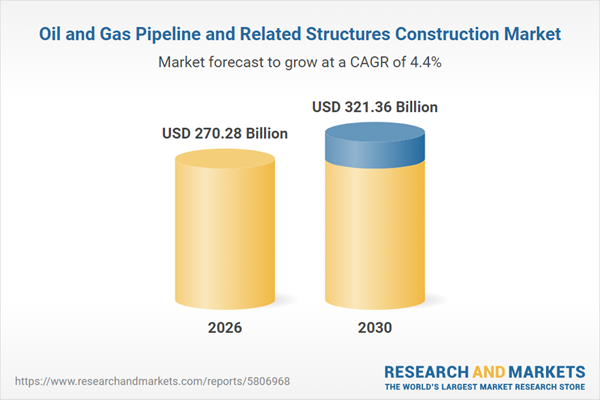

Oil and Gas Pipeline and Related Structures Construction Market

Oil and Gas Pipeline and Related Structures Construction Market · GlobeNewswire Inc.

Dublin, Jan. 27, 2026 (GLOBE NEWSWIRE) — The “Oil and Gas Pipeline and Related Structures Construction Market Report 2026” has been added to ResearchAndMarkets.com’s offering.

The oil and gas pipeline and related structures construction market has witnessed steady growth, expanding from $262.5 billion in 2025 to an anticipated $270.28 billion in 2026 at a CAGR of 3%. This growth stems from rising global energy demand, increased crude oil and natural gas production, and significant advancements in pipeline and infrastructure projects. Future growth projections indicate the market will reach $321.36 billion in 2030, driven by a CAGR of 4.4%. Key growth factors include investment in midstream infrastructure, a shift towards environmentally responsible construction, and advancements in automated monitoring systems.

The forecast period highlights significant market trends such as the construction of extensive onshore and offshore pipeline networks, increased demand for pipeline rehabilitation, and enhanced energy transport capacity. These trends accompany a heightened focus on safety and regulatory compliance, continuing to shape the market landscape positively.

Investment in infrastructure is a pivotal driver for this market segment. For instance, the UK’s Infrastructure and Projects Authority plans a substantial investment of £164 billion ($214.18 billion) for 2024/25, which exceeds previous fiscal allocations. Projections over the next decade anticipate total investments ranging from £700 billion ($914.16 billion) to £775 billion ($1,012.11 billion).

Innovation is at the forefront as companies in the oil and gas pipeline construction sector, such as Automation Technology, Inc., introduce solutions like the Zero Emission Electro-Hydraulic actuator to mitigate environmental impact. This technological advancement highlights the industry’s commitment to reducing emissions and enhancing efficiency in pipeline operations.

Strategic acquisitions fuel market consolidation, illustrated by STRACON Group’s acquisition of AMECO’s South America business, strengthening its portfolio with elite expertise in oil and gas infrastructure from Fluor Corporation. This acquisition aligns with industry trends aimed at bolstering operational capabilities and project execution excellence.