C.H. Robinson is a major freight broker and logistics provider, so any change in how it handles LTL freight can matter for a wide range of customers. Automating routine pickup checks fits with a broader push across logistics to cut manual workloads and improve how trucks are routed. For you as an investor, it is another data point on how NasdaqGS:CHRW is using technology in its core operations.

What comes next is whether these AI agents meaningfully change costs, service quality, or customer adoption over time. As more operational data comes through, investors can watch for updates on how often missed pickups are prevented, how many truck miles are avoided, and how shippers and carriers respond to the new tools.

Stay updated on the most important news stories for C.H. Robinson Worldwide by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on C.H. Robinson Worldwide.

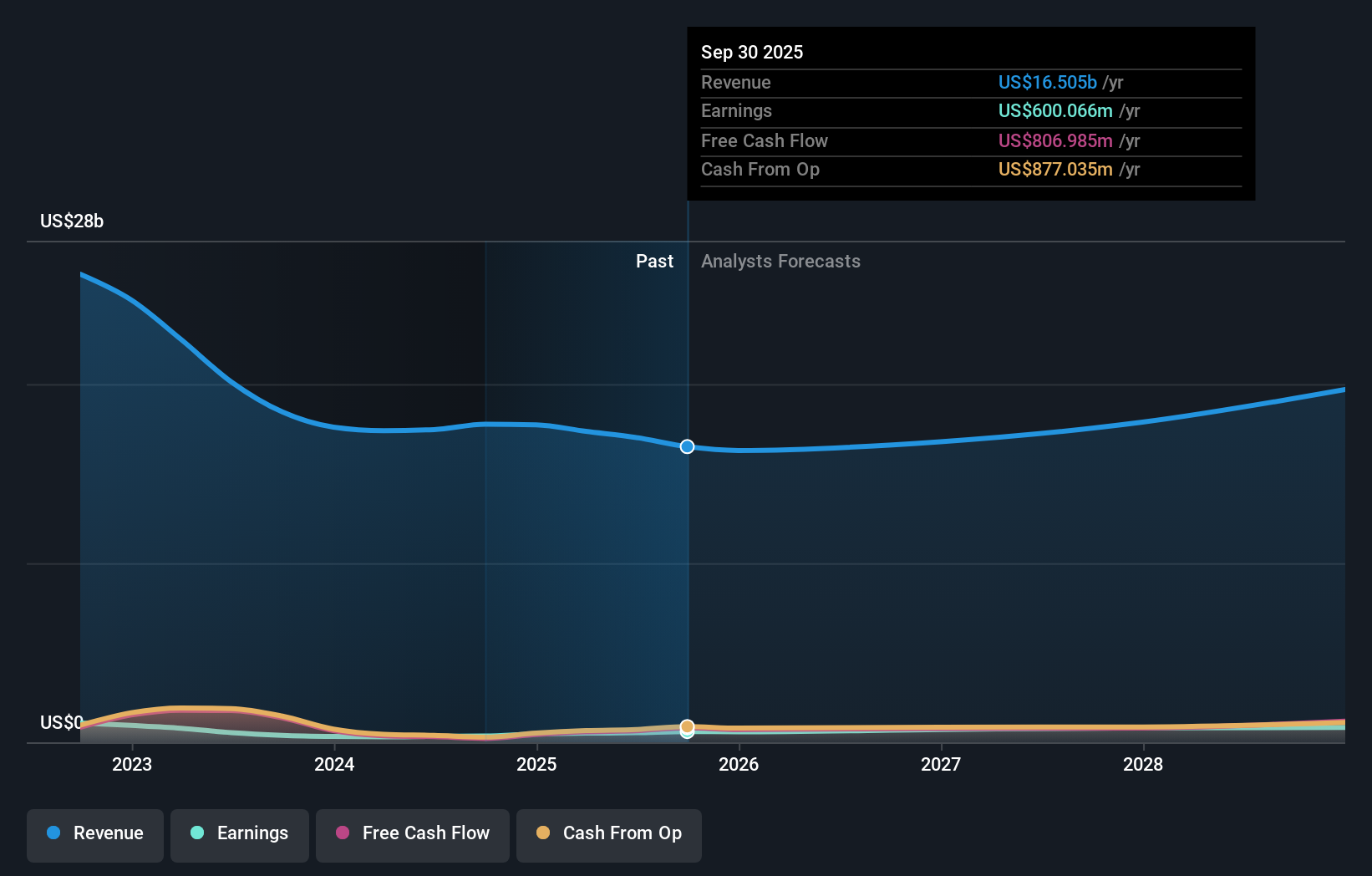

NasdaqGS:CHRW Earnings & Revenue Growth as at Jan 2026

NasdaqGS:CHRW Earnings & Revenue Growth as at Jan 2026

How C.H. Robinson Worldwide stacks up against its biggest competitors

The launch of AI agents that automate 95% of missed LTL pickup checks and cut unnecessary return trips by 42% points to a clear push to squeeze more efficiency out of C.H. Robinson’s existing network. For you, the key angle is that this kind of automation targets operating costs and service reliability, which can matter for margins and customer retention if the gains hold at scale.

C.H. Robinson Worldwide Narrative, How this product launch fits the story

There is no formal narrative data provided here, but this rollout sits within a broader theme of C.H. Robinson leaning into automation and AI to manage complex freight flows. If you already see the company as a logistics platform rather than just a broker, this update adds another example of how it is using software to handle repetitive tasks and keep freight moving.

Risks and rewards investors should weigh Automation of 95% of missed pickup checks and more than 350 hours saved per day suggests scope for lower manual workload and potentially leaner operations. A 42% reduction in unnecessary return trips may support carrier relationships and service reliability for shippers. Earnings growth of 72.8% over the past year and forecasts for 8.95% yearly earnings growth, together with a 1.4% dividend yield, suggest existing earnings power that this product could complement. Analysts flag that the company has a high level of debt, so investors may watch how much capital and ongoing spend is required to build and maintain these AI tools. What to watch next

Looking ahead, you may want to keep an eye on how often management ties these AI agents to concrete metrics like LTL margin performance, carrier satisfaction, and customer adoption, especially with revenue expected to decline 4.7% year on year this quarter. For a broader view of how others are thinking about this story, you can check out the narratives shared by other investors through community insights on C.H. Robinson Worldwide.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com