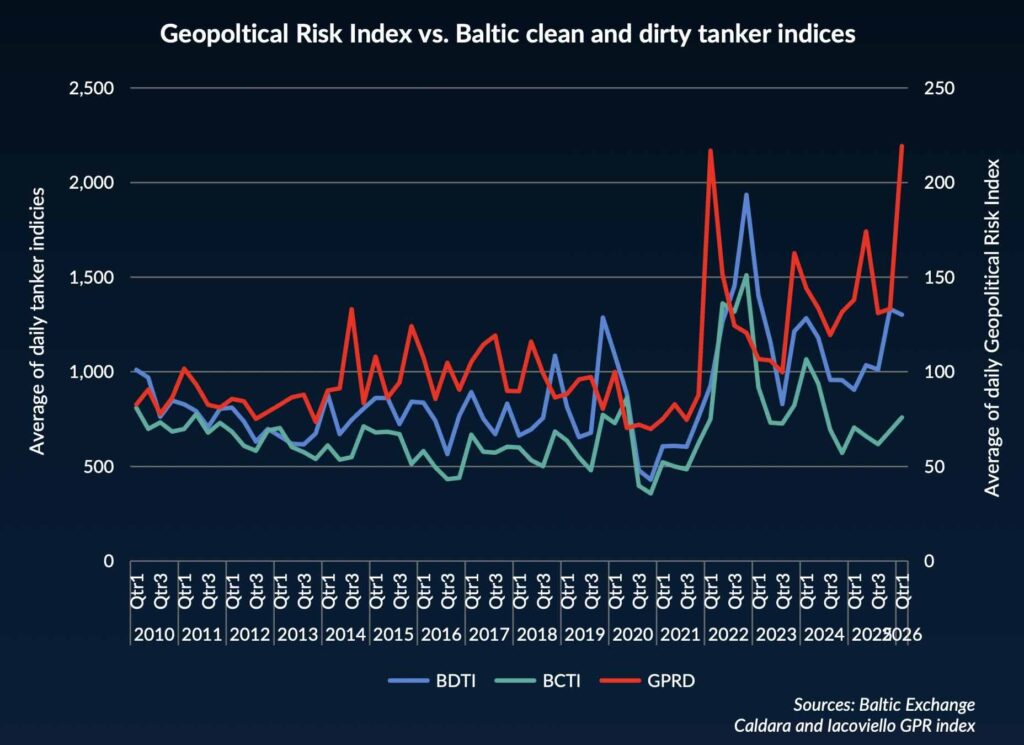

Geopolitical risk indicators are at highs not seen since the start of the full-scale invasion of Ukraine by Russia four years ago, and the heightened uncertainty is spilling over into freight rates, with the correlation between the two especially visible in tankers.

Singapore’s Sentosa Shipbrokers has highlighted the correlation between heightened global geopolitical risk and rising tanker freight rates in the chart carried below. January has got off to a remarkable start of the year, with crises breaking out in Venezuela, Iran and Greenland to go alongside the ongoing war in Ukraine.

Sentosa Shipbrokers noted the tight vessel availability and a strong volume of cargoes as the primary forces supporting rates across both clean and dirty segments this month. Nonetheless, analysts at the brokerage stressed how the broader backdrop of heightened geopolitical risk is likely reinforcing market sentiment.

The correlation between geopolitically uncertain times and freight rate spikes is something Mark Williams, head of consultancy Shipping Strategy, has been covering for many years.

“The challenge,” he told Splash Extra, “is that geopolitical assumptions tend to underlie industry forecasts, rather than be the input variable for the forecasts.”

Shipping can benefit from increased geopolitical risk, because freight rates can spike, Williams said, before cautioning that the increased uncertainty, if sustained, cuts investment in productive assets, cuts trade, and cuts shipping demand growth.

“In a deglobalised, partly decarbonised, less efficiently organised world, goods will travel more slowly over shorter distances less frequently and at greater expense,” Williams said, adding: “That may mean higher charter hire rates for shipowners. But it will probably also mean higher opex and higher capex costs, higher regulatory and administrative burdens, greater physical risk to ships and seafarers, and reduced opportunities.”

Matthew Wheatley, principal analyst, maritime at Wood Mackenzie, told Splash Extra: “Recent strength in tanker freight has clearly followed rising geopolitical tensions, and 2026 looks like another year where ship availability, sanctions, and the shadow fleet all play a major role in how rates move. With the world breaking into more rival trading blocs, tighter checks on sanctioned vessels, and longer detours around the Cape of Good Hope becoming routine, tankers are sailing farther, and that’s keeping freight rates firm.”

Veteran financier Dagfinn Lunde recalled his old boss, the Norwegian shipowner Torvald Klaveness, who regularly said political instability is good for shipping. While political instability often leads to tanker spikes, it can spread to containers and gas, too, Lunde said, suggesting that dry bulk is probably the least influenced.

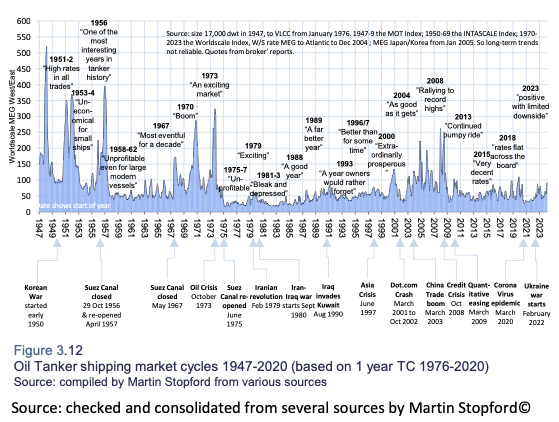

Dr Martin Stopford, the world’s most famous maritime economist, weighed in on the geopolitical correlation argument, going all the way back to the Boer war at the turn of the 20th century, when the British government chartered lots of ships to move the army to South Africa and owners made a fortune. The same thing happened during the Korean War in 1951, and the Suez crisis in 1956 diverted tankers around the Cape. Aristotle Onassis supposedly made $60m over that summer.

“All three of these geopolitical crises supercharged rates, because the world economy was already booming,” Stopford explained.

However, this is not always the case, as Stopford highlighted.

“The mother of all geopolitical crises, the 1973 and 1979 oil crises devastated the tanker industry, leaving over 100 VLCCs laid up and those still trading got years of rock bottom rates,” he recalled.

Looking at the Sentosa chart, Stopford argued the correlation for crises since 2010 has been “patchy”. As an example, he pointed to the spike in the GPR index in the second quarter of 2022 that coincided with the invasion of Ukraine. This came on the heels of a massive spike in trade and logistics disruption as the global economy recovered from covid, Stopford said.

“Be careful what you wish for,” Stopford concluded. “Geopolitical events can supercharge tight markets, but if they coincide with a downturn, or damage demand, watch out.”