Austin, Jan. 28, 2026 (GLOBE NEWSWIRE) — GCC Natural Gas Market Size & Growth Insights:

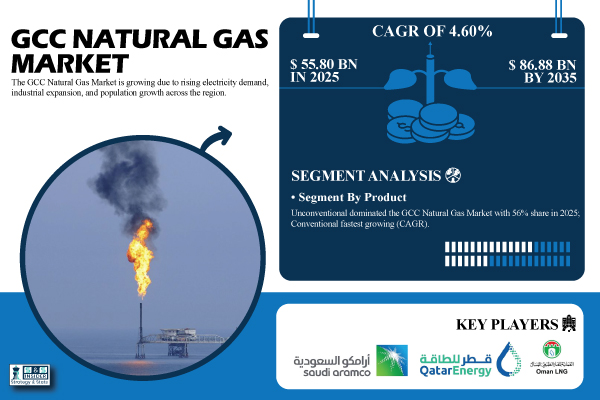

According to the SNS Insider, “The GCC Natural Gas Market Size was valued at USD 55.80 billion in 2025 and is expected to reach USD 86.88 billion by 2035, growing at a CAGR of 4.60% from 2026-2035.”

Expanding Liquefied Natural Gas Infrastructure is Boosting the Market Growth Globally

Large-scale exports to international markets are made possible by significant investments in LNG facilities, pipelines, and storage throughout Qatar, the United Arab Emirates, and Oman. QatarEnergy’s and state-owned companies’ expansion boosts production capacity, guaranteeing dependable supply and economical transportation. Cutting-edge shipping and liquefaction technologies streamline processes, while cross-border pipelines like Dolphin Energy improve regional connection. The GCC is positioned as a major global supplier of natural gas thanks to this expanding LNG infrastructure, which also increases export possibilities and fortifies long-term contracts.

Get a Sample Report of GCC Natural Gas Market Forecast @ https://www.snsinsider.com/sample-request/9624

Leading Market Players with their Product Listed in this Report are:

Saudi AramcoQatarEnergy (Qatar Petroleum)Abu Dhabi National Oil Company (ADNOC)Kuwait Petroleum Corporation (KPC)Oman LNGBahrain Petroleum Company (BAPCO)Dolphin EnergyBP (British Petroleum)Royal Dutch ShellExxonMobilChevronTotalEnergiesEni S.p.A.EquinorGazpromOccidental Petroleum (Oxy)RosneftPetrobrasConocoPhillipsLukoil

GCC Natural Gas Market Report Scope:

Report AttributesDetailsMarket Size in 2025EUSD 55.80 BillionMarket Size by 2035USD 86.88 BillionCAGRCAGR of 4.60 % From 2026 to 2035Report Scope & CoverageMarket Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast OutlookKey Segmentation• By Product (Conventional, Unconventional)

• By Application (Residential, Commercial, Industrial)

• By End Use (Transportation, Steam Generation, Cooking, Space Heating, Others)

• By Distribution Channel (Pipeline Natural Gas, LNG (Liquefied Natural Gas), CNG (Compressed Natural Gas))

Purchase Single User PDF of GCC Natural Gas Market Report (20% Discount) @ https://www.snsinsider.com/checkout/9624

Key Segmentation Analysis

By Product

Unconventional dominated the GCC Natural Gas Market with 56% share in 2025 due to abundant shale and tight gas reserves, advanced extraction technologies, and growing industrial demand. Conventional natural gas is expected to grow at the fastest CAGR from 2026 to 2035 as new pipeline expansions, discovery of gas fields, and improved extraction methods enhance supply.

By End-Use

Transportation dominated the GCC Natural Gas Market with 41% share in 2025 owing to widespread adoption of compressed natural gas for vehicles, cost efficiency, and government initiatives promoting cleaner fuels. Steam generation is expected to grow at the fastest CAGR from 2026 to 2035 due to expanding power plants and industrial facilities relying on natural gas for reliable, low-emission energy.

By Distribution Channel

Pipeline Natural Gas dominated the GCC Natural Gas Market with 51% share in 2025 as the region has well-established infrastructure connecting production fields to industries and households. LNG is expected to grow at the fastest CAGR from 2026 to 2035 due to the rising global demand for liquefied gas and expansion of export terminals in Qatar, UAE, and Oman.

By Application

Industrial dominated the GCC Natural Gas Market with 46% share in 2025 due to extensive use in power generation, petrochemicals, cement, and metal industries. Reliable supply through pipelines and cost efficiency compared to alternative fuels supported high consumption. It is also expected to grow at the fastest CAGR from 2026 to 2035 as industrial expansion, modernization of manufacturing facilities, and increasing energy demand drive higher adoption of natural gas.

Regional Insights:

Qatar dominated the GCC Natural Gas Market in 2025 with the highest revenue share of about 41% due to its position as the world’s largest LNG exporter. Extensive production capacity, advanced liquefaction facilities, and well-established infrastructure enable consistent supply to international markets.

Saudi Arabia segment is expected to grow at the fastest CAGR of about 6.18% from 2026-2035 as the country expands its natural gas production and infrastructure. Investments in pipeline networks, LNG projects, and unconventional gas exploration drive growth.

High Infrastructure and Operational Costs are Limiting Market Growth Globally

Large capital expenditures and sustained financial commitments are required for the development of pipelines, LNG terminals, and gas processing facilities in the GCC. High costs of drilling, liquefaction, storage, maintenance, and technological upgrades limit smaller market entrants. Returns are further impacted by price volatility in the world’s energy markets, and operational difficulties are exacerbated by adverse environmental factors, such as intense heat and corrosive terrain. Together, these elements limit market penetration, moderate growth throughout the region, and hinder the extension of natural gas projects.

Do you have any specific queries or need any customized research on GCC Natural Gas Market? Submit your inquiry here @ https://www.snsinsider.com/enquiry/9624

Recent Developments:

2025: Aramco signed an USD 11 billion lease and leaseback deal for its Jafurah midstream gas assets, supporting natural gas scale-up and GCC gas infrastructure expansion.2025: ADNOC signed a 15‑year LNG supply agreement with Shell for the Ruwais LNG project, securing long-term global offtake.

Exclusive Sections of the GCC Natural Gas Market Report (The USPs):

PRICING ANALYSIS & MARKET FORECAST METRICS – helps you evaluate gas pricing dynamics through average natural gas prices by end-use segment, producer and utility price benchmarking, regional price variations across GCC countries, and emerging pricing models including long-term contracts, spot markets, and LNG trading.REGULATORY & ENERGY SECURITY COMPLIANCE METRICS – helps you understand regulatory pressure by analyzing GCC gas market frameworks, safety and environmental compliance standards, policies supporting domestic gas production and LNG exports, and strategic guidelines linked to long-term energy security.PRODUCTION CAPACITY & TECHNOLOGY ADOPTION INDICATORS – helps you assess supply strength by tracking annual gas production volumes by country and type, adoption rates of advanced extraction and processing technologies, and R&D investment in exploration and gas-to-liquids (GTL) innovations.INFRASTRUCTURE UTILIZATION & SUPPLY CHAIN RESILIENCE METRICS – helps you identify infrastructure readiness by analyzing transmission and distribution network lengths, LNG terminal capacities and utilization rates, storage capacity benchmarks, and ongoing infrastructure investment and maintenance trends.INVESTMENT & CAPITAL FLOW INTELLIGENCE – helps you track market attractiveness through venture capital, private equity, and government investment trends, key M&A activity, strategic partnerships, and joint ventures shaping the competitive environment.INNOVATION & DIGITALIZATION READINESS METRICS – helps you uncover modernization opportunities by evaluating adoption of smart pipelines, automation systems, and advanced leak detection technologies across GCC gas networks.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company’s aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.