MSA Safety, trading at around $175.78, has delivered a 31.1% return over the past 3 years and 16.4% over the past 5 years, with a 7.6% move over the past 30 days. The recent interview on LNG gas detection provides a current view of how the company is positioning its safety technology for demanding industrial sites.

The focus on LNG facilities indicates that MSA Safety is seeking to deepen its role in large scale energy and infrastructure projects. For investors, the interview offers additional context on how its product roadmap aligns with complex use cases such as leak detection, continuous monitoring, and worker safety in LNG operations.

Stay updated on the most important news stories for MSA Safety by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on MSA Safety.

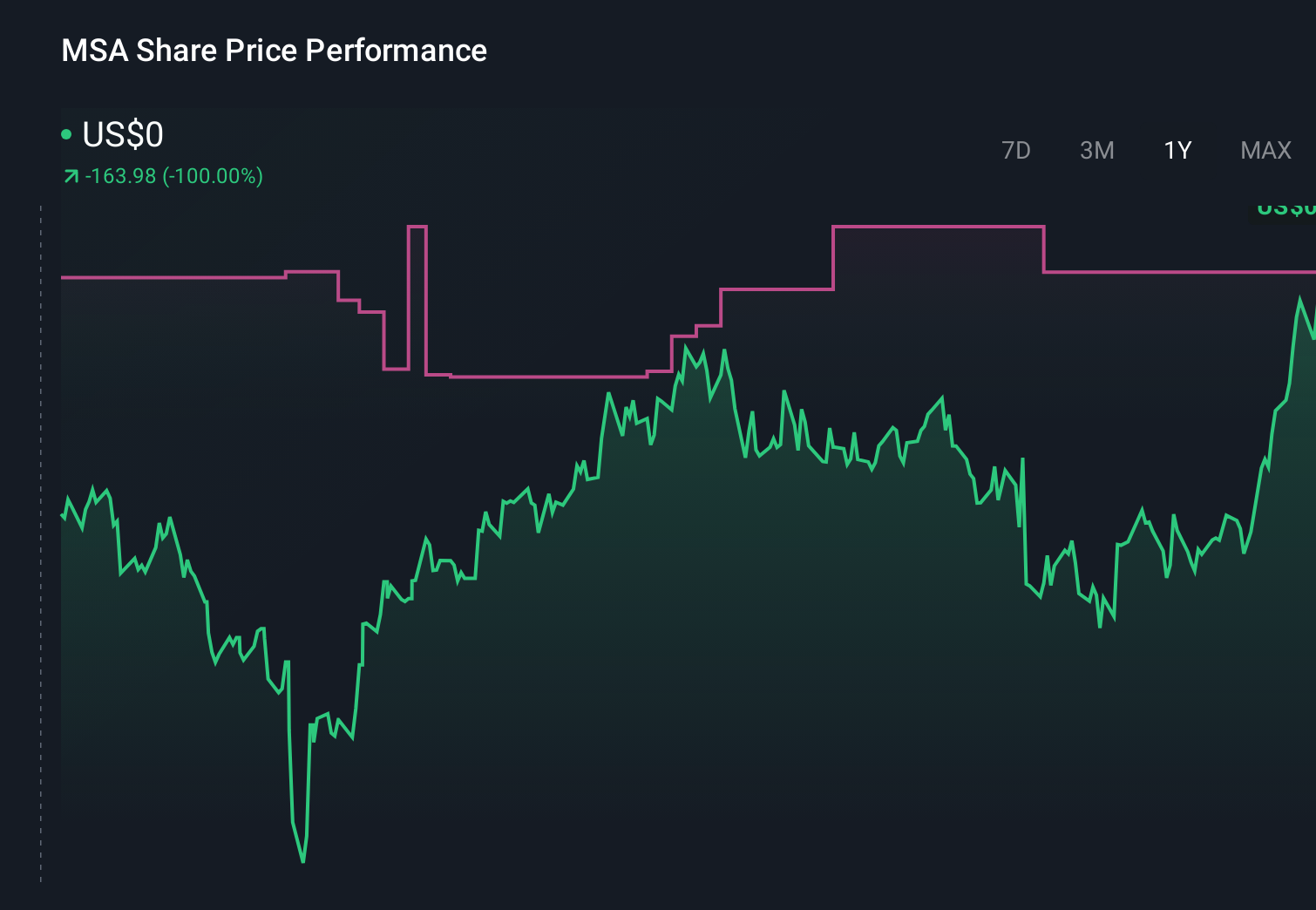

NYSE:MSA 1-Year Stock Price Chart

NYSE:MSA 1-Year Stock Price Chart

Why MSA Safety could be great value

Quick Assessment ✅ Price vs Analyst Target: The current price of $175.78 sits about 8% below the US$189.50 analyst target, leaving a gap to the consensus view. ✅ Simply Wall St Valuation: Shares are described as trading 15.6% below estimated fair value, which points to an undervalued status in that model. ✅ Recent Momentum: A 30 day return of 7.6% shows positive short term sentiment as the LNG gas detection story gains visibility.

Check out Simply Wall St’s

in depth valuation analysis for MSA Safety.

Key Considerations 📊 The LNG focused interview spotlights how gas detection capability ties into MSA Safety’s role in complex industrial facilities, which some investors watch as part of the growth story for its safety technology. 📊 You may want to track how LNG related orders, margin trends and any commentary on product adoption align with the current P/E of 24.6 compared with the Commercial Services industry average of 25.9. ⚠️ With no specific company risks flagged in the data, the main watchpoint here is execution risk in tailoring and deploying gas detection solutions that meet specialized LNG requirements. Dig Deeper

For the full picture including more risks and rewards, check out the

complete MSA Safety analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com