DroneShield (ASX:DRO) has drawn fresh attention after its FY25 results, with A$216.5 million in revenue, strong Q4 figures and sizeable international contracts raising questions about how sustainable this pace and revenue mix might be.

See our latest analysis for DroneShield.

At A$3.95, DroneShield’s recent share price pullback, including a 5.5% one day decline and 8.6% seven day share price return, comes after a 26.2% 30 day share price return and very large multi year total shareholder returns that reflect how strongly investors have reacted to contract wins, the A$2.09b sales pipeline and the latest revenue figures, with sentiment now more sensitive to cash conversion and pipeline updates.

If DroneShield’s story has you looking at the broader defence and security theme, it could be worth sizing up aerospace and defense stocks as a way to spot other potential opportunities.

With A$216.5 million in FY25 revenue, a very large A$2.09b pipeline and A$95.6 million already contracted for FY26, plus a pullback from recent highs, is DroneShield now mispriced, or is the market already banking on future growth?

Most Popular Narrative: 16% Undervalued

With DroneShield at A$3.95 and the most followed narrative pointing to fair value of A$4.70, the gap between price and expectations is hard to ignore.

The analysts have a consensus price target of A$3.65 for DroneShield based on their expectations of its future earnings growth, profit margins and other risk factors.

In order for you to agree with the analyst’s consensus, you’d need to believe that by 2028, revenues will be A$359.8 million, earnings will come to A$96.1 million, and it would be trading on a PE ratio of 41.3x, assuming you use a discount rate of 7.2%.

Curious what justifies a higher fair value than the consensus target? The widely followed narrative leans on fast revenue compounding, rising margins and a punchy future earnings multiple. The exact mix of those assumptions is where the story gets interesting.

Result: Fair Value of A$4.70 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, this upbeat fair value story still leans heavily on lumpy defense contracts arriving on time, and on R&D spending not eating into those forecast margins.

Find out about the key risks to this DroneShield narrative.

Another View: Price To Sales Sends A Different Signal

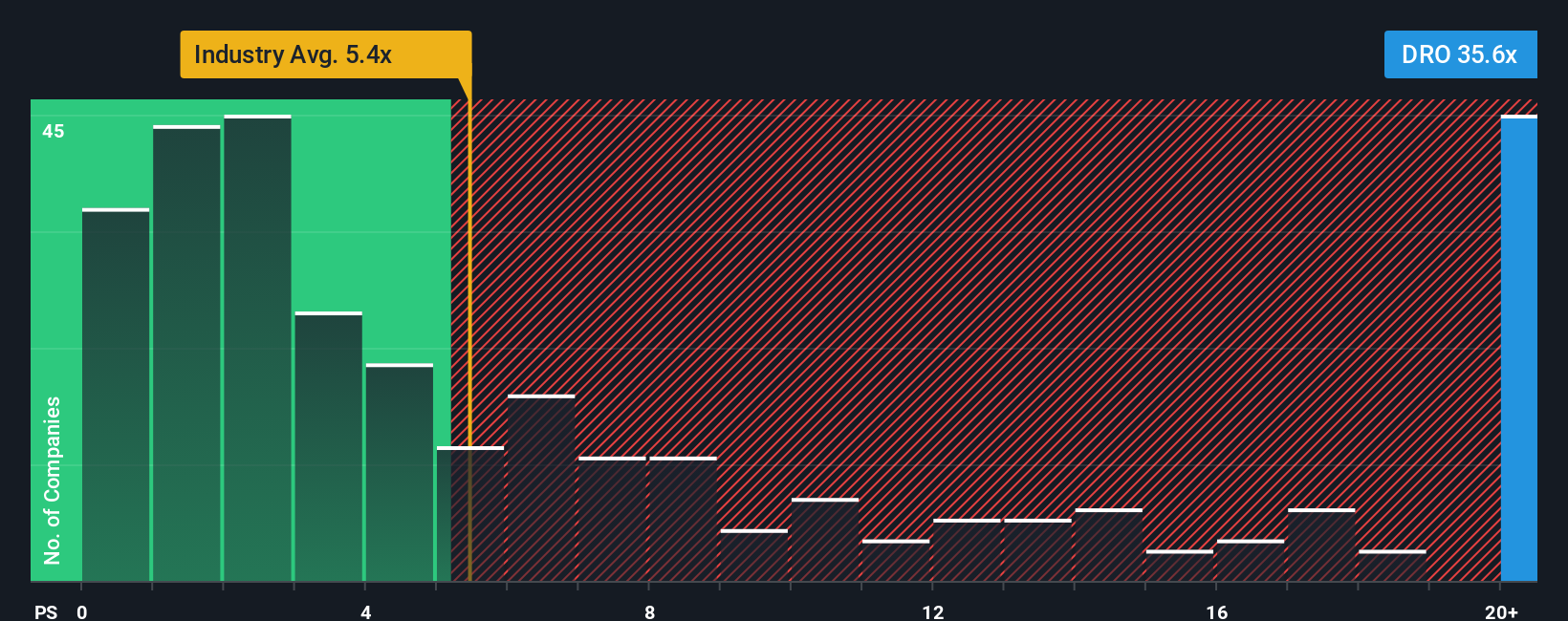

While the most followed narrative and our DCF work point to DroneShield being undervalued, the P/S ratio of 33.7x paints a tougher picture. It is well above the global Aerospace & Defense peer average of 5.5x and above its own fair ratio of 27.9x. This points to meaningful valuation risk if expectations cool.

See what the numbers say about this price — find out in our valuation breakdown.

ASX:DRO P/S Ratio as at Jan 2026 Build Your Own DroneShield Narrative

ASX:DRO P/S Ratio as at Jan 2026 Build Your Own DroneShield Narrative

If you see the data differently or want to test your own assumptions, you can build a complete DroneShield view in just a few minutes by starting with Do it your way.

A great starting point for your DroneShield research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Ready to hunt for more investment ideas?

If DroneShield has sharpened your interest, do not stop here. Use the Simply Wall St Screener to turn that curiosity into a broader, well researched watchlist today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com