Circle Internet Group (CRCL) is back in focus after Mizuho shifted its rating higher, pointing to rising USDC usage on prediction platform Polymarket. Ark Invest recently added shares, and new institutional stablecoins are sharpening competitive pressure.

See our latest analysis for Circle Internet Group.

Circle’s recent Mizuho upgrade and Ark Invest buying arrived after a tougher stretch, with the 90 day share price return of 40.64% decline and a year to date share price return of 12.74% decline contrasting with today’s US$72.84 level and 1 day share price return of 4.12%. This may hint that sentiment is stabilising after a sharp reset.

If you are watching how stablecoin and crypto related names are trading around news like this, it could be a good moment to check out high growth tech and AI stocks as a way to spot other potential ideas in the same broad theme.

With Circle trading at US$72.84, a recent 40.64% 90 day share price decline sits alongside an analyst average price target of US$102.29 and a value score of 1. Is this real mispricing, or is the market already baking in future growth?

Most Popular Narrative: 49.7% Undervalued

At $72.84, the most followed narrative implies a fair value of $144.67, suggesting analysts see a very different long term path compared with what the market is currently pricing in.

Accelerating mainstream adoption of USDC for cross border and B2B payments via Circle Payments Network, with over 100x growth in trailing 30 day volumes and a pipeline of 500 institutions, should translate into sustained transaction driven revenue expansion and higher operating leverage.

Curious what kind of revenue ramp and margin shift would need to sit behind that sort of gap to fair value? The narrative leans on rapid top line expansion, a swing from losses to profits and a future earnings multiple more often seen in high growth software leaders. If you want to see how those moving parts fit together, the full narrative lays out the assumptions step by step.

Result: Fair Value of $144.67 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, there are still clear pressure points, including interest rate driven reserve income risk and tighter stablecoin regulation, both of which could challenge USDC growth and Circle’s profitability path.

Find out about the key risks to this Circle Internet Group narrative.

Another View on Valuation

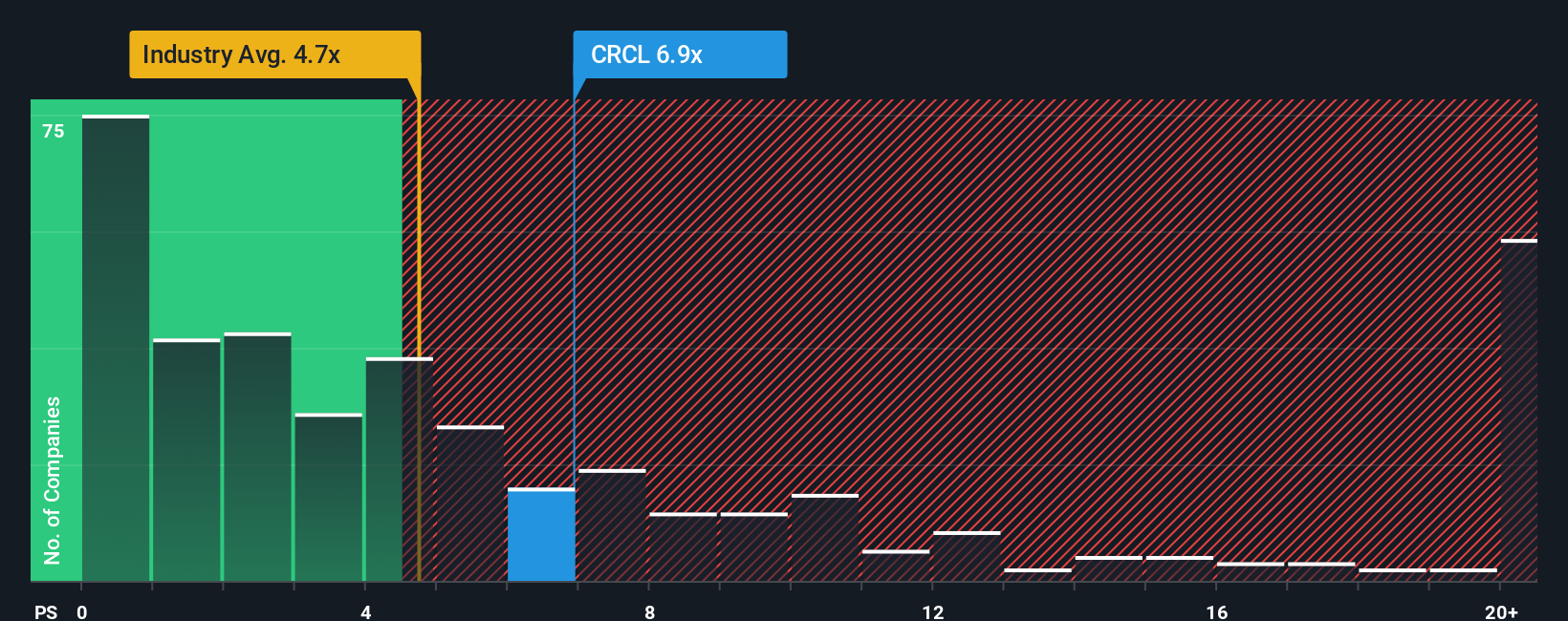

While the narrative focuses on long term earnings forecasts and price targets, Simply Wall St’s fair ratio work with the P/S tells a different story. At 7.1x P/S, Circle trades richer than the US Software average at 4.5x and above its own fair ratio of 4.6x. This could mean there is less room for error if growth disappoints.

See what the numbers say about this price — find out in our valuation breakdown.

NYSE:CRCL P/S Ratio as at Jan 2026 Build Your Own Circle Internet Group Narrative

NYSE:CRCL P/S Ratio as at Jan 2026 Build Your Own Circle Internet Group Narrative

If this view does not quite match your own thinking, or you prefer to work from the raw numbers yourself, you can build a custom thesis in just a few minutes. To get started, use Do it your way.

A great starting point for your Circle Internet Group research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

If Circle has caught your attention, do not stop here. The next opportunity you are looking for could be sitting in another corner of the market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com