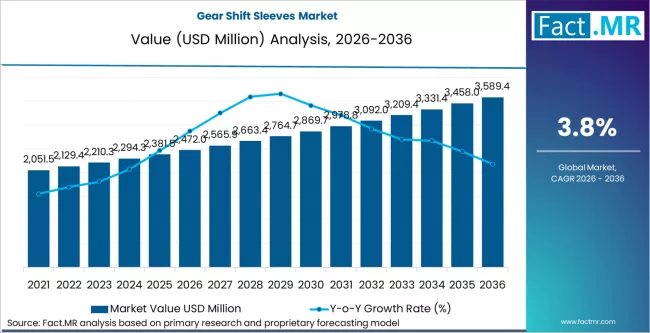

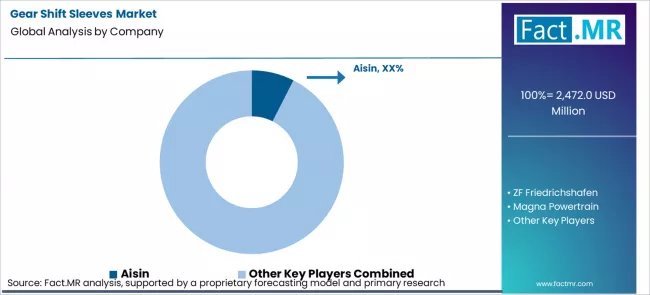

The global gear shift sleeve market is expected to be valued at USD 2,472.0 million in 2026, projected to grow to USD 3,589.4 million by 2036, the market will rise at a CAGR of 3.8% driven by the rise of multi-speed EVs and hybrid drivetrains. The shift from traditional manual transmissions to high-precision, electrified drivetrain components has redefined the role of gear shift sleeves.

Gear Shift Sleeves Market Key Takeaways

Gear Shift Sleeves Market Value (2026): USD 2,472.0 million

Gear Shift Sleeves Market Forecast Value (2036): USD 3,589.4 million

Gear Shift Sleeves Market Forecast CAGR (2026-2036): 3.8%

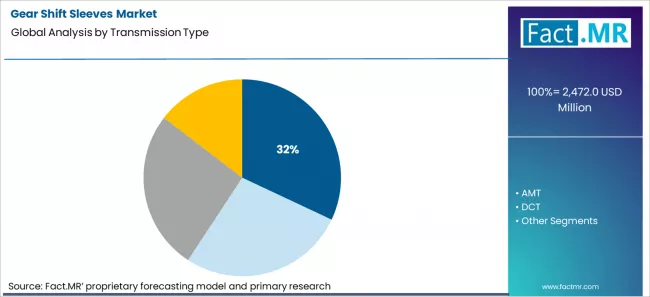

Leading Transmission Type in the Market: Manual (32.0%)

Key Growth Region in the Market: Asia Pacific

Key Players: Aisin, ZF Friedrichshafen, Magna Powertrain, BorgWarner, Tremec, Schaeffler, Eaton

As Schaeffler and ZF restructure their portfolios to focus on electrification, they are de-prioritizing legacy components like shift sleeves for internal combustion engine (ICE) vehicles. However, companies such as Aisin and Magna are successfully transitioning, leveraging high-durability synchronizer sleeves for hybrid and EV applications.

“Electric vehicles demand more precise and seamless torque handover, which is where the shift sleeve’s role is evolving,” says an executive at Magna International, emphasizing the precision needed for multi-speed transmissions. Regional market growth is being driven by Asia-Pacific and North America, where the demand for e-axles and hybrid drivetrains is accelerating. Green manufacturing has also become a key driver, with companies like Aisin achieving 100% renewable energy usage in their European production bases, setting a new standard for the industry. This evolution reflects the increasing integration of high-performance shifting solutions into the electric powertrain.

Gear Shift Sleeves Market

Metric

Value

Estimated Value in (2026E)

USD 2,472.0 million

Forecast Value in (2036F)

USD 3,589.4 million

Forecast CAGR 2026 to 2036

3.8%

Category

Category

Segments

Transmission Type

Manual; AMT; DCT; Automatic

Material

Case-Hardened Steel; Sintered Metal; Composites; Others

Vehicle

Passenger Cars; LCV; M&HCV; Off-highway

Sales Channel

OEM; Aftermarket; Remanufactured; Tier-2 / Other

Region

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Segmental Analysis

What Is the Impact of Transmission Type on the Gear Shift Sleeves Market?

In the gear shift sleeves market, transmission type directly impacts the choice of gear shift sleeve designs due to their differing demands on torque handling, engagement precision, and durability. Manual transmissions lead with a 32.0% market share, driven by their continued use in a variety of vehicle segments, particularly in regions where manual transmission is still preferred for driving engagement, lower cost, and fuel efficiency. Despite the global shift towards automatic transmissions, manual gearboxes remain essential in performance cars and entry-level vehicles, where the driver’s control over the gear shift is highly valued. Furthermore, the manual transmission market is sustained by cost-conscious consumers in certain regions, who prefer the affordability of manual vehicles. The reliability and lower maintenance costs of gear shift sleeves designed for manual transmissions are key factors driving their demand.

How Does Material Influence Demand in the Gear Shift Sleeves Market?

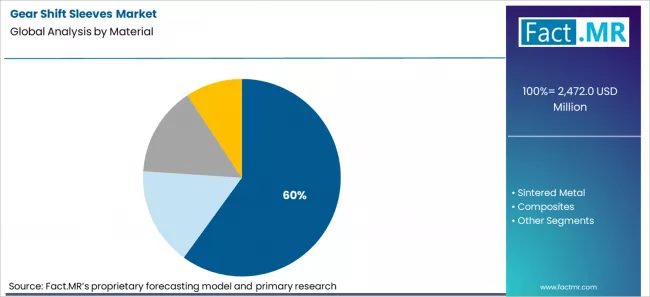

Case-hardened steel holds the leading position in the market with a 60.0% share due to its exceptional ability to withstand the high-stress conditions typical of automotive gearboxes. In particular, case-hardened steel offers the required combination of surface hardness and core toughness, essential for manual and automatic transmissions, where frequent engagement and disengagement are common. This material is favored for heavy-duty applications, where durability and long-lasting performance are paramount. Its dominance is reinforced by its ability to maintain dimensional stability under high torque conditions, making it suitable for use in high-performance vehicles, including luxury cars and commercial vehicles. The growing need for reliable, low-maintenance gear shift components in both manual and automatic transmission systems further propels the demand for case-hardened steel.

What are the Drivers, Restraints, and Key Trends in the Gear Shift Sleeves Market?

Drivers: Demand for gear shift sleeves is primarily driven by shifts in global transmission architectures and the performance demands of specific vehicle segments. In 2025-26, manual transmissions remain significant in light commercial vehicles and entry level passenger cars in India, Southeast Asia and parts of Latin America, keeping demand for precision shift sleeves active. Truck and bus OEMs in North America and Europe specify sleeves with hardened surfaces to maintain synchronization precision under high torque and thermal cycling associated with stop start urban operations.

Restraints: Market growth is uneven because the rise of direct drive electric vehicles (EVs) erodes demand for multi gear transmissions in many developed markets. EVs from leading manufacturers in Europe and China require only single speed gearsets, which eliminate shift sleeve requirements entirely. In regions with high adoption of AMTs (automated manual transmissions) rather than traditional manuals, demand patterns shift to sleeves designed for automation actuation forces rather than purely human shift loads, which fragment specifications and increase engineering effort per series.

Trend 1: Gear shift sleeve producers are increasingly specializing in material specific grade families tailored to transmission type and control logic.

Trend 2: Major transmission tier suppliers are integrating in line optical and contactless measurement systems directly into sleeve machining workflows.

Analysis of the Gear Shift Sleeves Market by Key Country

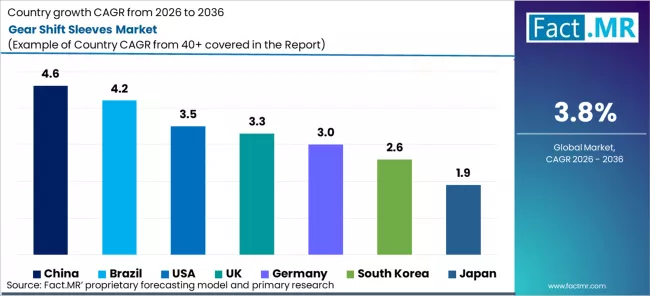

Country

CAGR (%)

China

4.6%

Brazil

4.2%

USA

3.5%

UK

3.3%

Germany

3.0%

South Korea

2.6%

Japan

1.9%

The report covers an in-depth analysis of 40+ countries; top-performing countries are highlighted below.

What drives growth in China for gear shift sleeves?

China is projected to grow at 4.6% CAGR, underpinned by its enormous automotive production and burgeoning domestic market. China remains the world’s largest vehicle manufacturer, producing over 20 million units annually prior to 2024, with a significant percentage involving automatic and dual clutch transmissions that require high precision gear shift sleeves. According to China Association of Automobile Manufacturers (CAAM) data, demand for transmission components is supported by robust local production and the expansion of domestic automakers into global markets.

“We are seeing continuous demand for precision transmission parts as automakers optimize shift quality and transmission lifespan,” states Li Wei, Director of Components at a major Chinese supplier.

What fuels the rapid rise in Brazil?

Brazil’s gear shift sleeves market is expected to grow at 4.2% CAGR, driven by sustained production of passenger and commercial vehicles and a large installed base that sustains replacement demand. Brazil’s automotive sector remains a key industrial pillar, with local manufacturers producing millions of vehicles annually and strong regional export ties across South America. The Automotive Manufacturers Association (ANFAVEA) reports that transmissions with manual and automated manual configurations remain prevalent in regional fleets, particularly in cost sensitive segments where durability and serviceability are priorities.

“Durable transmission components are essential for fleets operating in diverse Brazilian terrains, and precision sleeves contribute directly to reliability,” explains Carlos Souza, Head of Powertrain Engineering at a regional OEM.

How is the USA market evolving in the Gear Shift Sleeves sector?

The USA market is forecast to grow at 3.5%, a pace that reflects a stable automotive manufacturing and aftermarket landscape where transmission systems remain a focal point of drivetrain refinement. Demand for gear shift sleeves in the United States continues despite electrification because automatic, manual, and dual clutch transmissions still account for a significant portion of light vehicle sales and aftermarket rebuilds. According to the Motor & Equipment Manufacturers Association (MEMA), North America’s transmission parts segment, including synchronizers and shift mechanisms, remains resilient due to ongoing vehicle maintenance and replacement activity.

“Precision in transmission components directly impacts shift feel and durability, and that continues to drive investment in high quality sleeves,” says James Putnam, Senior Engineer at a U.S. transmission supplier.

Although electrified powertrains reduce the number of traditional shift components, hybrid systems and performance vehicles still depend on advanced gear shift sleeves, underpinning steady demand.

Why is the UK market critical for gear shift sleeves?

The UK market is expanding at 3.3%, driven by both domestic vehicle production and the strength of its automotive engineering sector, particularly in performance and specialty vehicles. The UK’s automotive ecosystem, including suppliers serving brands such as Jaguar Land Rover and niche sports car manufacturers, places a premium on transmission reliability and responsiveness. Gear shift sleeves are integral to achieving precise engagement in manual, automated manual, and dual clutch transmissions widely used in these segments.Professor David Crolla, Head of Automotive Engineering at Loughborough University, comments.

“Transmission refinement defines vehicle dynamics, and components like gear shift sleeves remain crucial even as electrification progresses.”

The UK’s aftermarket for European imports also bolsters demand, as high vehicle parc age supports continuous replacement activity.

What is driving expansion in Germany?

Germany is projected to grow at 3.0% CAGR, anchored in its reputation as an automotive engineering and technology leader. German manufacturers emphasize transmission refinement to balance performance and efficiency, driving demand for high precision gear shift sleeves. The VDA (German Association of the Automotive Industry) highlights that even as EV adoption accelerates, hybrid and high performance segments still represent a meaningful share of production that relies on refined transmission mechanics.

“In precision engineering, every component must meet exacting standards, and transmission sleeves are no exception,” says Dr. Katrin Müller, Senior Powertrain Specialist at a German automotive firm.

Germany’s aftermarket for premium European vehicles also supports ongoing replacement demand for transmission components.

How is South Korea shaping demand for gear shift sleeves?

South Korea’s market is growing at 2.6% CAGR, supported by strong automotive production and export performance. Major Korean OEMs produce millions of vehicles annually, with a substantial portion featuring automatic and dual clutch gearbox systems where gear shift sleeves play a critical role. As Korean manufacturers push into higher transmission efficiencies and refinement, demand continues for precision engineered sleeves that withstand rigorous operational profiles.

“In competitive global markets, transmission component quality is a differentiator, and we continue to invest in durable sleeves for both OEM and service applications,” notes Ji Ho Kong, Transmission Systems Manager at a leading Korean Tier 1 supplier.

What fuels the gradual rise in Japan?

Japan’s gear shift sleeves market is forecast to grow at 1.9% CAGR, reflecting a more conservative growth environment influenced by slower vehicle production expansion and earlier electrification adoption compared with peers. Japanese automakers are global leaders in reliability, and transmission design continues to emphasize durability and refined shift quality, especially in hybrid models that still depend on complex gearbox systems. According to Japan Automobile Manufacturers Association (JAMA) data, even with electrification trends, significant production volumes of automatic and hybrid transmissions sustain stable demand for gear shift sleeves.

“Transmission components in Japanese vehicles have always been engineered for longevity, and this continues to sustain replacement markets,” explains Yoshihiko Tanaka, Senior Powertrain Engineer.

The domestic aftermarket also supports consistent replacement activity due to the large existing vehicle fleet.

What Strategic Moves Are Defining Competitive Landscape?

The gear shift sleeves market is navigating a transition where the ability to integrate digital precision into heavy-duty mechanical components determines long-term profitability. Fact.MR analysis indicates that the competitive landscape is being reshaped by a move toward shift-by-wire and modular powertrain architectures that prioritize both weight reduction and electronic response. The industry is focusing on the synergy between software-defined control and structural integrity which represents the next frontier of value creation in the automotive supply chain. Klaus Rosenfeld, CEO of Schaeffler, noted this shift toward a more intelligent approach to motion technology.

‘As a pioneer in motion technology we are demonstrating how our advanced solutions are accelerating the digital transformation of key industries by seamlessly combining mechanical excellence with digital intelligence.’ – Klaus Rosenfeld, CEO of Schaeffler

Companies like ZF Friedrichshafen and BorgWarner are leveraging their leadership in electrification to establish the next generation of drivetrain standards. The competitors like Magna and Eaton are optimizing their portfolios to support a resilient mix of hybrid and electric applications. This strategic pivot ensures they remain indispensable as the global market moves away from simple gear engagement toward fully automated and highly efficient power delivery systems.

Key Players in the Gear Shift Sleeves Market

Aisin

ZF Friedrichshafen

Magna Powertrain

BorgWarner

Tremec

Schaeffler

Eaton

Hyundai Transys

Linamar

Musashi Seimitsu

Scope of the Report

Items

Values

Quantitative Units

USD million

Transmission Type

Manual; AMT; DCT; Automatic

Material

Case-Hardened Steel; Sintered Metal; Composites; Others

Vehicle

Passenger Cars; LCV; M&HCV; Off-highway

Sales Channel

OEM; Aftermarket; Remanufactured; Tier-2 / Other

Regions Covered

Asia Pacific, Europe, North America, Latin America, Middle East & Africa

Countries Covered

China; Brazil; USA; UK; Germany; South Korea; Japan

Key Companies Profiled

Aisin; ZF Friedrichshafen; Magna Powertrain; BorgWarner; Tremec; Schaeffler; Eaton; Hyundai Transys; Linamar; Musashi Seimitsu

Additional Attributes

Dollar sales by transmission type, material, and vehicle segment; market trends in AMT and DCT systems; impact of electric vehicles on demand for gear shift components; regional market differences driven by consumer preferences and regulations; growth in commercial vehicle applications and their specific requirements for durability.

Gear Shift Sleeves Market Key Segment

Transmission Type :

Material :

Case-Hardened Steel

Sintered Metal

Composites

Others

Vehicle :

Passenger Cars

LCV

M&HCV

Off-highway

Sales Channel :

OEM

Aftermarket

Remanufactured

Tier-2 / Other

Region :

North America

Europe

Germany

UK

France

Italy

Spain

Nordic Countries

BENELUX

Rest of Europe

Asia Pacific

China

Japan

South Korea

India

Australia

Rest of Asia Pacific

Latin America

Brazil

Argentina

Rest of Latin America

Middle East and Africa

Kingdom of Saudi Arabia

United Arab Emirates

South Africa

Rest of Middle East and Africa

Other Regions

Oceania

Central Asia

Other Markets

Bibliographies

International Organization for Standardization. (2023). ISO 6336-1: Calculation of load capacity of spur and helical gears-Basic principles. ISO.

SAE International. (2024). SAE J3067: Synchronizer and shift system performance in manual and automated transmissions. SAE International.

European Automobile Manufacturers’ Association. (2024). Powertrain technology outlook: Manual, hybrid, and automatic transmission persistence. ACEA.

China Association of Automobile Manufacturers. (2024). Automotive transmission production and component demand report. CAAM.