NIO (NYSE:NIO) has drawn fresh attention after recent price swings, with the stock showing a 1% decline over the past day and weaker performance over the past month and past 3 months.

For investors tracking electric vehicle makers, these moves raise questions about how NIO’s current share price lines up with its fundamentals, recent financial results, and long term business profile in China and abroad.

See our latest analysis for NIO.

At a share price of US$4.59, NIO’s recent 30 day share price return of 14.04% and 90 day share price return of 34.52% point to fading momentum. The 1 year total shareholder return of 8.77% sits against a much weaker 3 year total shareholder return of 62.07% and 5 year total shareholder return of 92.08%.

If NIO’s recent swings have you reassessing the sector, it could be a good moment to scan other auto makers through Simply Wall St’s auto manufacturers.

So with NIO trading at US$4.59, modestly below some estimates of intrinsic value and analyst targets, you have to ask yourself: is this lingering weakness a genuine opening, or is the market already factoring in future growth?

Most Popular Narrative: 32% Undervalued

With NIO last closing at $4.59 against a narrative fair value of about $6.75, the current price sits well below that central estimate.

In-house technological advancements, including proprietary smart driving chips and high integration 900V architecture, are reducing production costs, supporting aggressive but profitable pricing, and setting the stage for higher net margins as scale increases. Operational improvements in R&D and SG&A efficiency, underpinned by the Cell Business Unit mechanism, are leading to substantial reductions in fixed costs and improved operating leverage, providing a clear path to breakeven and eventually to positive net earnings.

Want to see what kind of revenue ramp, margin shift, and earnings profile that quote is built on? The narrative leans on bold growth, tighter costs, and a premium valuation multiple that is not usually attached to loss making auto makers. Curious which specific financial swing has to materialize to support that fair value gap?

Result: Fair Value of $6.75 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, this upside depends on NIO overcoming intense EV competition and sustained net losses, which could keep margins under pressure and challenge the upbeat narrative.

Find out about the key risks to this NIO narrative.

Another View: Multiples Paint a Tighter Picture

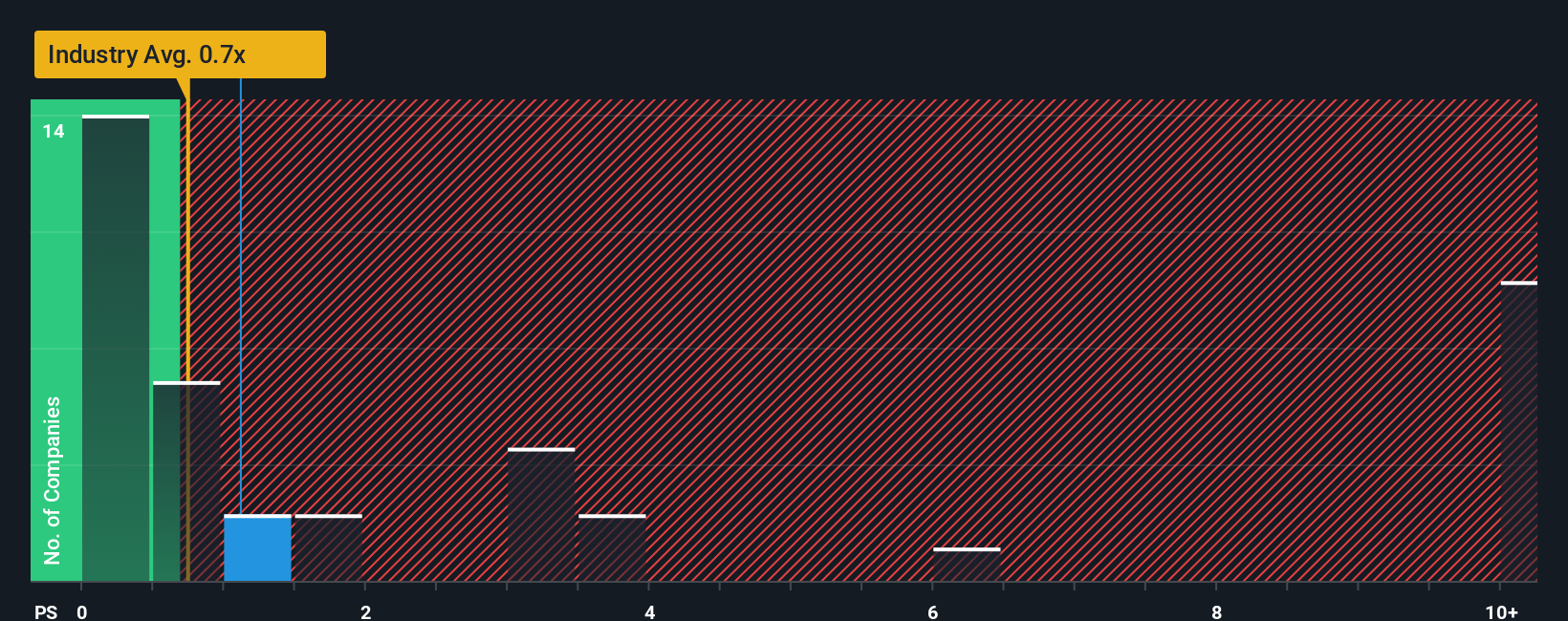

That 32% upside story runs into a different signal when you look at simple sales-based pricing. NIO trades on a P/S of 1.1x, richer than the US Auto industry at 0.7x and above its own fair ratio of 1.0x, even though it screens cheaper than peers at 2.2x. Is the discount to peers enough to offset paying above the industry and fair ratio for a loss making name?

See what the numbers say about this price — find out in our valuation breakdown.

NYSE:NIO P/S Ratio as at Jan 2026 Build Your Own NIO Narrative

NYSE:NIO P/S Ratio as at Jan 2026 Build Your Own NIO Narrative

If this storyline does not quite match your view, or you prefer to weigh the figures yourself, you can build a custom thesis in minutes with Do it your way.

A great starting point for your NIO research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready to hunt for more investment ideas?

If you stop with NIO, you might miss other opportunities that fit your style. Use the screener to quickly surface ideas that actually match your goals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Discover if NIO might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com