For you as an investor, this move sits at the intersection of cybersecurity and crypto market infrastructure. Coinbase runs a large digital asset trading and custody business, where trust in security is central to how users and institutions choose platforms. As attacks on crypto platforms become more sophisticated, coordinated information sharing can be an important part of limiting disruption and protecting market participants.

Looking ahead, closer integration with Crypto ISAC may influence how regulators, institutional clients, and partners view Coinbase’s operational risk profile. While it does not directly address trading activity or revenue, the focus on collective defense and faster threat response is one way major intermediaries in digital assets aim to support long-term ecosystem resilience and user confidence.

Stay updated on the most important news stories for Coinbase Global by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Coinbase Global.

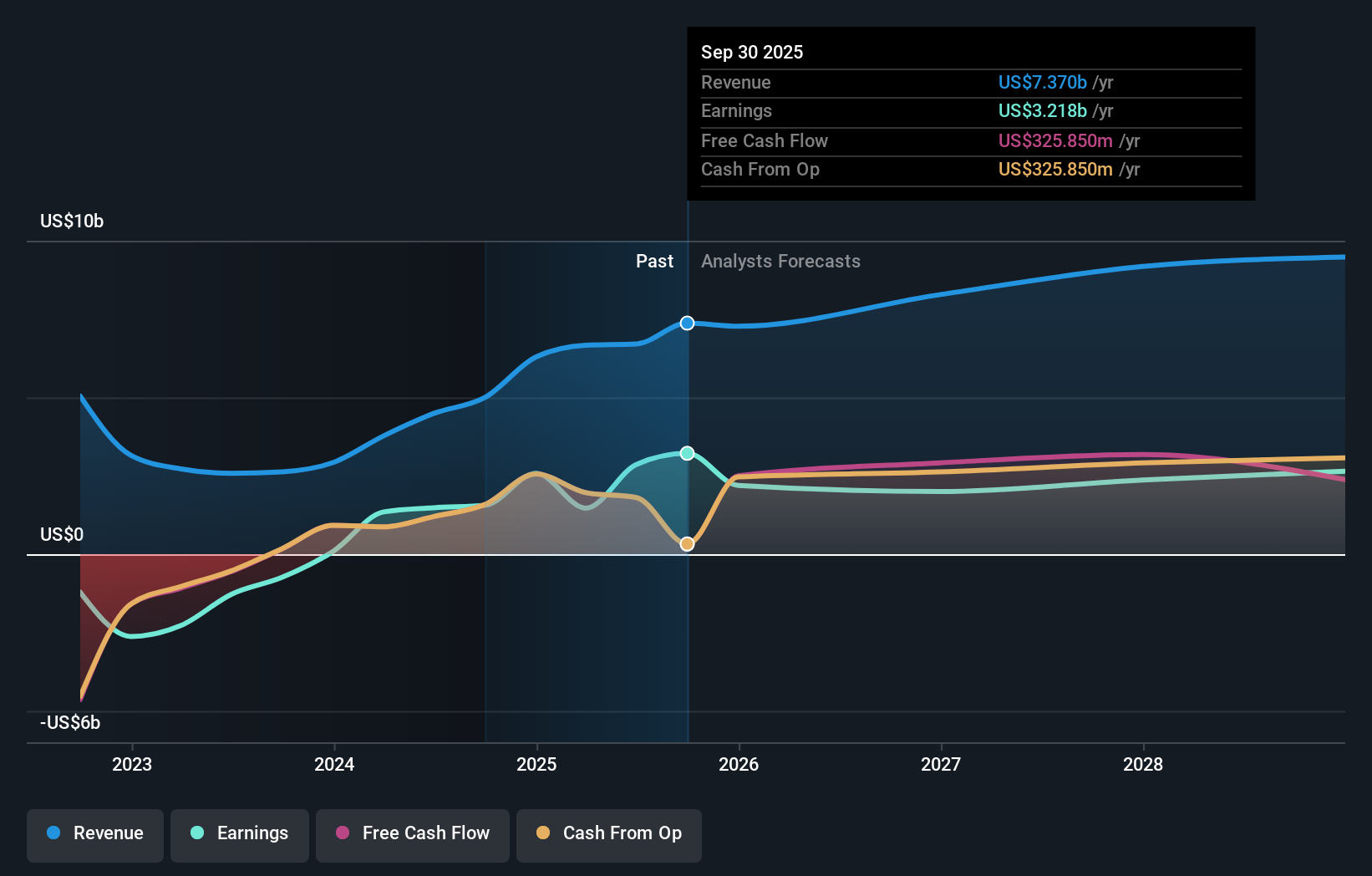

NasdaqGS:COIN Earnings & Revenue Growth as at Jan 2026

NasdaqGS:COIN Earnings & Revenue Growth as at Jan 2026

How Coinbase Global stacks up against its biggest competitors

Quick Assessment ⚖️ Price vs Analyst Target: At US$199.18 versus a consensus target of US$337.46, the price sits about 41% below where analysts on average mark it. ❌ Simply Wall St Valuation: Simply Wall St flags the shares as trading roughly 82.5% above its estimated fair value, which points to an overvaluation signal. ❌ Recent Momentum: The 30 day return of about a 14% decline shows recent negative momentum despite the security focused news.

Check out Simply Wall St’s

in depth valuation analysis for Coinbase Global.

Key Considerations 📊 Expanded threat intelligence sharing supports Coinbase’s role in crypto market infrastructure, where platform security is a core part of the investment case. 📊 Watch how institutional adoption, user growth and any security incident disclosures evolve in light of this Crypto ISAC integration. ⚠️ Simply Wall St highlights two major risks around earnings quality and forecasts, so stronger security does not remove financial or valuation related uncertainties. Dig Deeper

For the full picture, including more risks and rewards, check out the

complete Coinbase Global analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com