Mild wage pressure is also emerging. The expected wage increase of 2.8% is “hardly strong but has turned higher,” while the share of firms that actually raised wages in the past 12 months has climbed from 67% to 72%, “the highest since April 2024.” The average reported wage increase has ticked up from 2.6% to 2.8%.

ANZ: first OCR hike pencilled for December, but risk is earlier

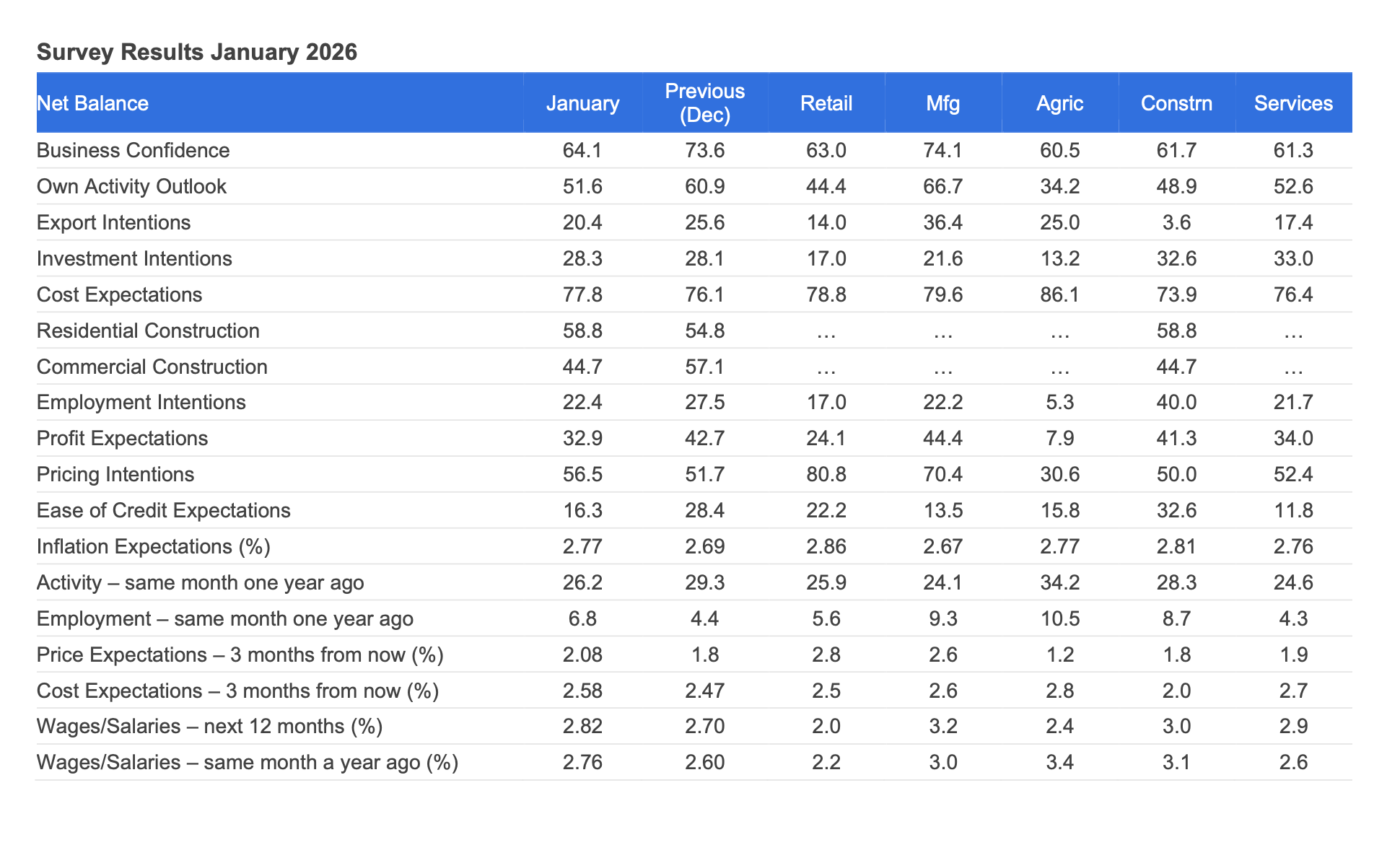

Zollner describes the survey as a blend of “good news and bad news”. The good news is that “much of the surge in activity indicators in December has been largely maintained into January, despite the bounce in interest rates” after the November Monetary Policy Statement.

The bad news is that “signals that inflation pressures could be turning higher… doesn’t look consistent with the RBNZ’s (or our) inflation forecasts.” she said, “We are forecasting the first OCR hike to come in December this year, but if these pricing intentions manifest in hard data, it’ll come earlier than that.”

For mortgage advisers, that means building 2026 plans around a still‑improving economy, but with a clear risk that higher‑than‑expected inflation and pricing behaviour could bring rate hikes forward – making loan structure, refix timing, and borrower buffers more important than ever.

Check out the full ANZ Business Outlook here.

Check out the full ANZ Business Outlook here.