Company Logo

Key market opportunities in Europe’s smart parking sector include the integration of EV charging, scalable cloud platforms, and mobile payment solutions. The growth is driven by real-time data mandates, sustainability goals, and digital payment adoption, despite challenges such as sensor costs and GDPR compliance.

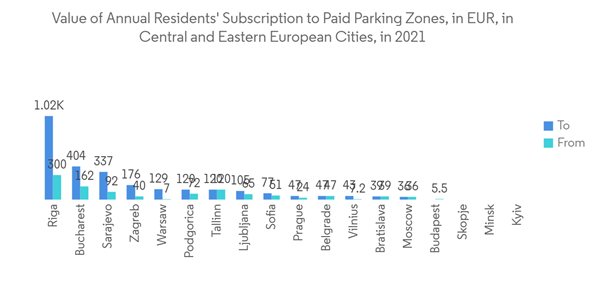

Europe Smart Parking Market Value Of Annual Residents Subscription To Paid Parking Zones In E U R In Central And East

Europe Smart Parking Market Value Of Annual Residents Subscription To Paid Parking Zones In E U R In Central And East · GlobeNewswire Inc.

Dublin, Jan. 30, 2026 (GLOBE NEWSWIRE) — The “Europe Smart Parking – Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026-2031)” has been added to ResearchAndMarkets.com’s offering.

The European smart parking market is set for significant growth, with projections indicating an increase from USD 4.08 billion in 2025 to USD 4.81 billion in 2026 and further to USD 10.99 billion by 2031, achieving a 17.96% CAGR from 2026 to 2031. This rapid expansion is fueled by mandates for real-time parking data, swift EV adoption, and stringent corporate Scope 3 reporting requirements, pushing investments in intelligent parking systems across the region.

Municipalities demand scalable cloud platforms that seamlessly integrate with existing ITS architecture, while corporations seek space-efficient solutions that align with sustainability goals. The market is seeing consolidation among platform vendors, increasing competitive intensity and fostering the development of integrated mobility ecosystems, which blur the lines between parking, charging, and ticketing services. Compliance with GDPR adds complexity but also drives suppliers to offer higher-value managed services and analytics.

Europe Smart Parking Market Trends and Insights

EV-Driven Parking Space Stress

The transition to electric vehicles is placing pressure on city infrastructures, necessitating the retrofitting or repurposing of parking spaces. By 2025, under the Energy Performance of Buildings Directive, one charger is required per 20 parking spaces, escalating to one per 10 by 2027. Operators like APCOA are incorporating charging hardware in existing facilities and using real-time analytics to optimize space usage, reduce queuing, and balance revenue with EV incentives. This trend is especially prominent in German and Nordic cities, where analytics-driven projects are integral to larger ITS deployments.

Rise of Mobile Payments and Parking Apps

Digital payment systems have gained traction, with over 75% penetration in major Dutch cities. Emerging technologies such as interoperable mobile wallets and in-vehicle apps are reducing enforcement costs, enhancing demand forecasts, and enabling congestion-responsive pricing. BMW’s operating system now offers seamless parking fee payments across 12 European countries. In the UK, the National Parking Platform processes over 500,000 monthly transactions across 10 councils, leveraging machine-learning models to optimize turnover and minimize revenue leakage. GDPR-mandated privacy measures, like tokenization and edge processing, are simultaneously increasing the demand for outsourced compliance expertise.