This story has been updated.

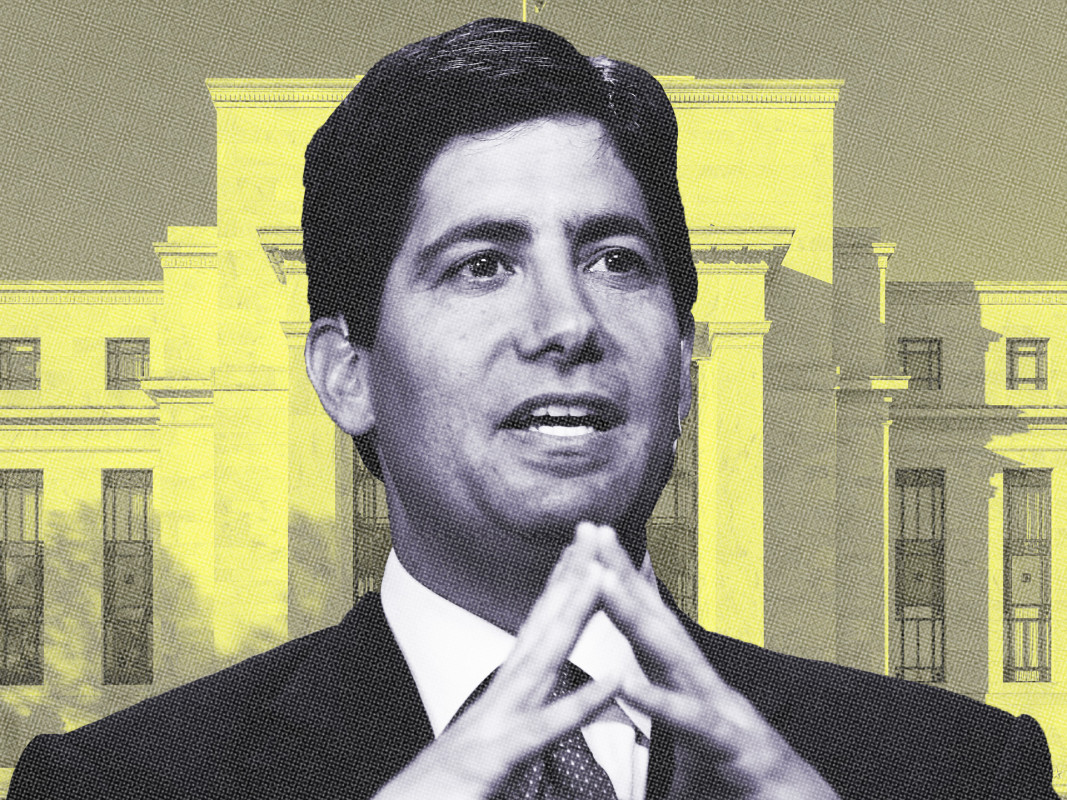

President Donald Trump’s nomination of Kevin Warsh to serve as the next Federal Reserve chair faces market concerns over Fed independence as well as a bitter battle in the Senate.

Seen as a relatively hawkish choice, Warsh is a former Fed governor with strong ties to Wall Street who has been calling for multiple reforms of the central bank.

President Trump has blasted Fed Chair Jerome Powell and other Fed officials for not easing interest rates as aggressively as he would like.

The president made it clear late last year that he expected the next chair to follow his administration’s lead on monetary policy.

That sparked global concerns about the independence of the central bank in setting benchmark interest rates that shape the cost of borrowing in markets around the world.

Warsh will need to forge a consensus on rate policy across the Federal Open Market Committee’s 12 voting members.

Powell, whom Trump appointed as chair in 2017, will step down as chair on May 15, though his term as a governor of the Federal Reserve board will run until 2028.

Federal Funds Effective Rate ChartBoard of Governors of the Federal Reserve System · Board of Governors of the Federal Reserve System

“The market is twist steepening on the nomination of Kevin Warsh as the market remains notably worried about Fed independence,’’ said Gennadiy Goldberg, head of U.S. rates strategy at TD Securities.

“Warsh will also be difficult for markets to read over a longer horizon since he has been critical of the Fed for a long time, but much of that criticism is about the Fed being too dovish,’’ Goldberg said.

More Federal Reserve:

David Robin, an interest-rate strategist at TJM Institutional Services LLC, described Warsh as a “data-dependent, Fed-credibility choice, so Fed watchers can breathe a bit of a sigh of relief.”

“Conversely I’m hard-pressed to think Trump would appoint anyone that didn’t commit to lower rates over time starting in June,’’ Robin added. “But I think any definitive longer-term market reaction needs time and data.”

“Warsh has always been the most vocal about reducing the size of the Fed’s balance sheet over time, so while he may favor further cuts in Fed funds, his appointment may maintain pressure on longer-dated yields while also reducing the need for hedges against much higher inflation in the future due to potential fears of debt monetization,” Michael Metcalfe, senior managing director and head of macro strategy at State Street Bank & Trust Co., said of the potential pool of chair candidates.

Sen. Thom Tillis (R-N.C.) said in a Jan. 30 post on X (formerly Twitter) that he will oppose Warsh’s nomination until the Department of Justice’s unprecedented criminal investigation of Powell is “fully resolved.”

Story Continues