Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is SAP’s Investment Narrative?

To stay invested in SAP today, you really have to believe that its pivot from legacy on-premise ERP to cloud subscriptions and embedded Business AI is still intact, even if the path looks bumpier than it did a few months ago. The 2025 results support that longer-term story, with higher revenue and earnings and a record €77 billion cloud backlog, but the new 2026 cloud revenue guidance of €25.8 billion to €26.2 billion has clearly reset expectations. The stock’s sharp pullback and sector-wide software sell-off suggest that, at least in the short term, the key catalyst has flipped from “AI-fueled cloud acceleration” to “proof that SAP can hit its cloud and AI monetization targets without sacrificing profitability.” At the same time, concerns about AI disruption, slightly softer backlog growth and security vulnerabilities flagged by CERT-In are now front and center as the risks investors are watching most closely.

However, one emerging risk around AI and customer cloud adoption is easy to underestimate.

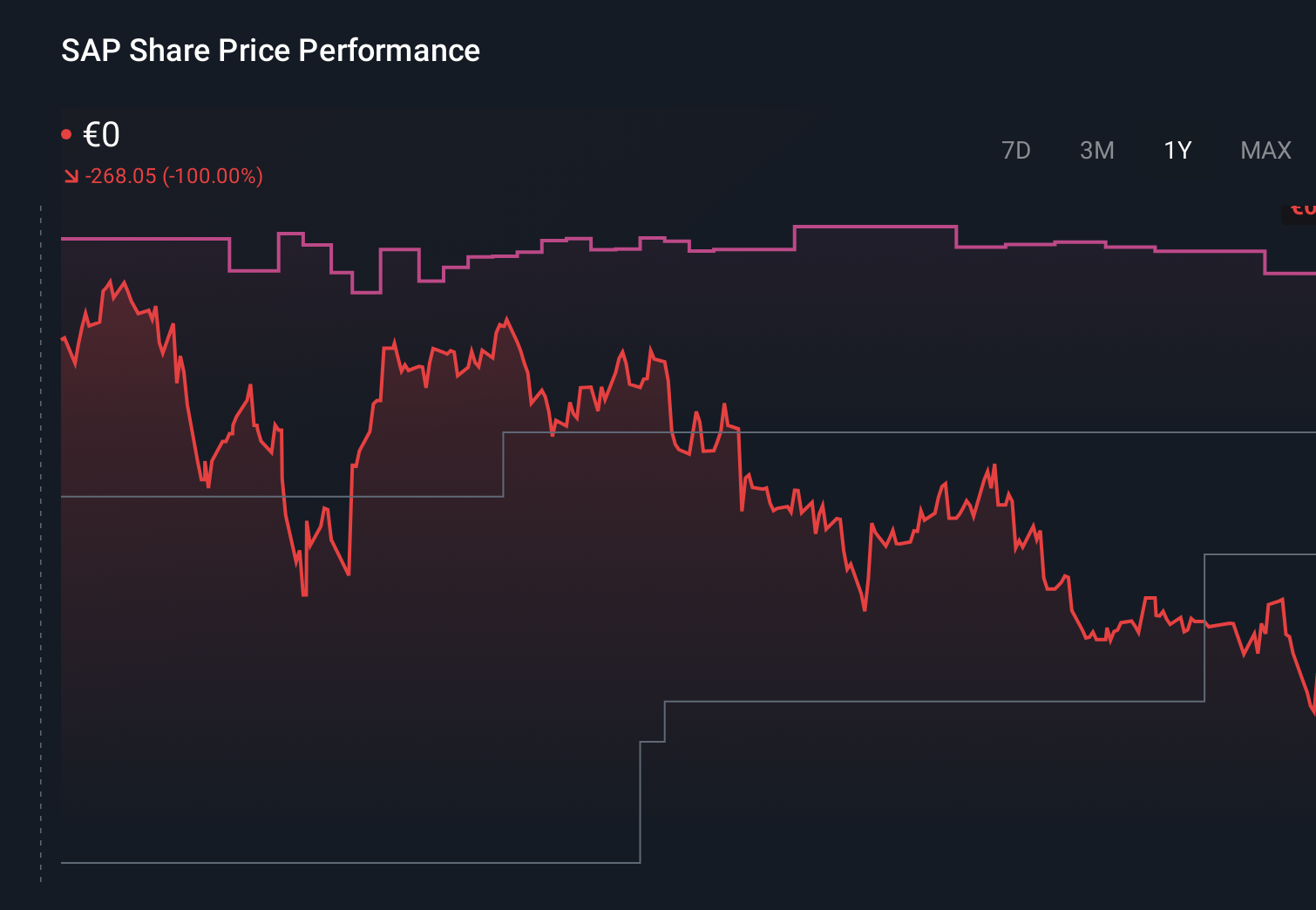

Despite retreating, SAP’s shares might still be trading 44% above their fair value. Discover the potential downside here.Exploring Other Perspectives XTRA:SAP 1-Year Stock Price Chart

XTRA:SAP 1-Year Stock Price Chart

Twenty one members of the Simply Wall St Community see SAP’s fair value between €180 and €330, with opinions spread across this full range. When you set that against the recent hit to sentiment from softer 2026 cloud guidance and AI related worries, it underlines how differently people are weighing SAP’s cloud transition and risk profile. You might find it useful to compare several of those viewpoints before deciding how you interpret the same set of numbers.

Explore 21 other fair value estimates on SAP – why the stock might be worth as much as 93% more than the current price!

Build Your Own SAP Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes – extraordinary investment returns rarely come from following the herd.

A great starting point for your SAP research is our analysis highlighting 4 key rewards that could impact your investment decision.Our free SAP research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate SAP’s overall financial health at a glance.Ready To Venture Into Other Investment Styles?

Opportunities like this don’t last. These are today’s most promising picks. Check them out now:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com