Altria Group, the tobacco company behind Marlboro in the US, is reshaping its senior leadership at a time when the industry continues to face regulatory pressure and evolving consumer preferences. For you as an investor, a planned CEO handoff with a long timeline can matter for how consistently the company executes on its priorities, from product mix to capital allocation.

With Salvatore Mancuso set to move from CFO to CEO and also take a Board seat, investors will be watching how this affects Altria’s approach to risk, balance sheet management, and long term planning. The transition timeline into 2026 gives the market time to assess management’s messaging on priorities and any adjustments to the company’s direction.

Stay updated on the most important news stories for Altria Group by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Altria Group.

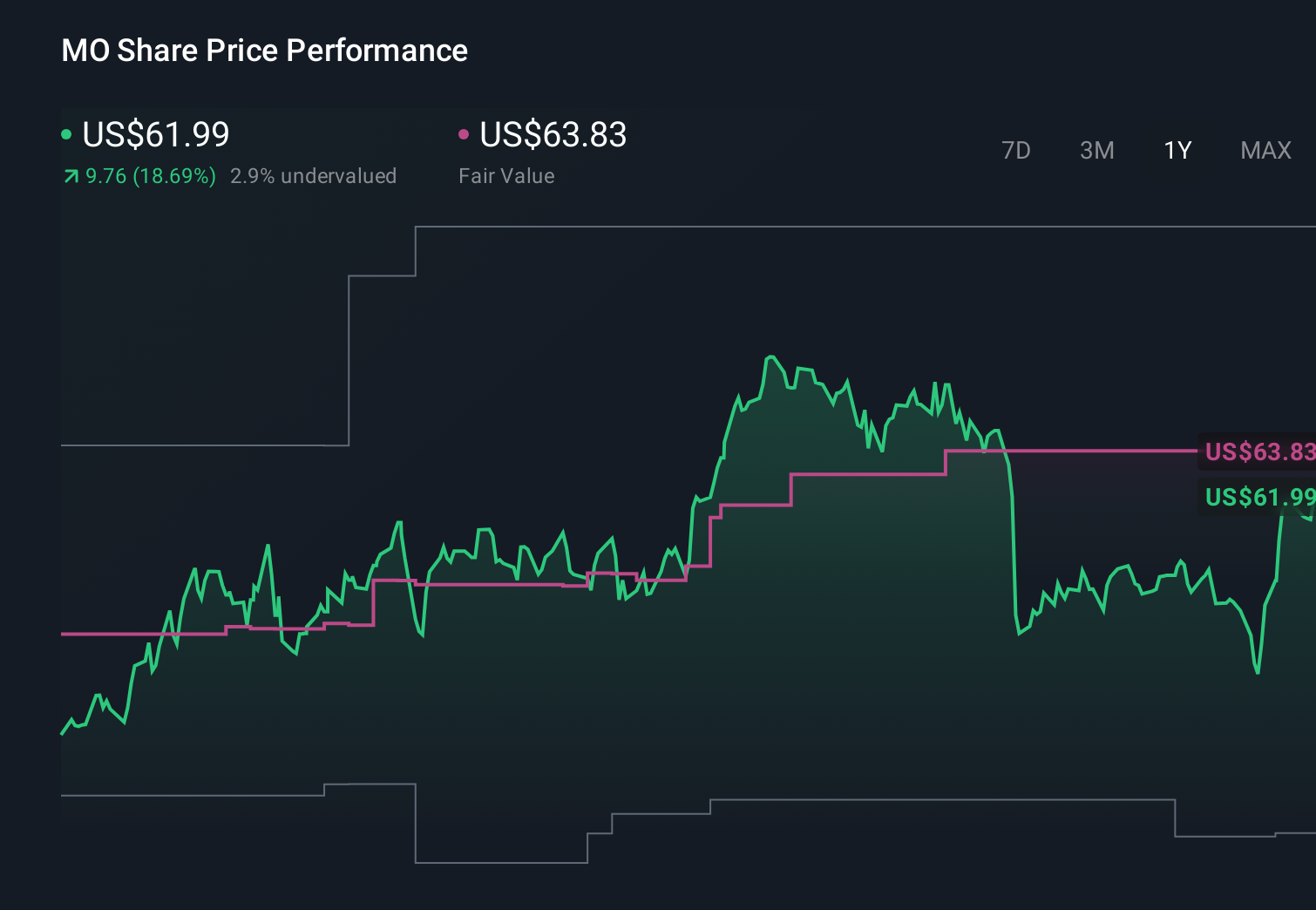

NYSE:MO 1-Year Stock Price Chart

NYSE:MO 1-Year Stock Price Chart

How Altria Group stacks up against its biggest competitors

Quick Assessment ⚖️ Price vs Analyst Target: At US$61.99, Altria trades about 1% below the US$62.58 analyst target, so pricing is close to consensus. ✅ Simply Wall St Valuation: Simply Wall St estimates the shares are trading 44.2% below its fair value, which flags a large valuation gap. ✅ Recent Momentum: The 30 day return of 7.5% shows recent positive price momentum as the leadership transition is outlined.

Check out Simply Wall St’s

in depth valuation analysis for Altria Group.

Key Considerations 📊 A planned CEO handoff to the current CFO suggests continuity in capital allocation and dividend policy that you can monitor through upcoming updates. 📊 Watch how the expanded Board and new CEO describe priorities for cash flow use, debt levels and any changes in product focus on future calls. ⚠️ Simply Wall St flags high debt and a profit margin of 29.8% compared with 55% last year, so track whether the new leadership addresses balance sheet and margin pressures. Dig Deeper

For the full picture including more risks and rewards, check out the

complete Altria Group analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com