IQVIA Holdings, trading at $230.15, sits at the intersection of healthcare data and technology, working with large pharmaceutical groups that rely on consistent, high quality information. The stock is up 14.3% over the past year and 23.7% over five years, which reflects how the market has been reacting to IQVIA’s role as a key data and analytics provider. For investors watching NYSE:IQV, this new collaboration fits within that broader context of IQVIA acting as a core infrastructure partner to global pharma.

This long term DaaS+ agreement with Boehringer Ingelheim indicates that large clients are committing deeply to IQVIA’s platform and data capabilities. Investors may find it useful to monitor how IQVIA uses this type of deal to expand its footprint across more regions and therapy areas, and whether similar collaborations emerge with other large drugmakers over time.

Stay updated on the most important news stories for IQVIA Holdings by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on IQVIA Holdings.

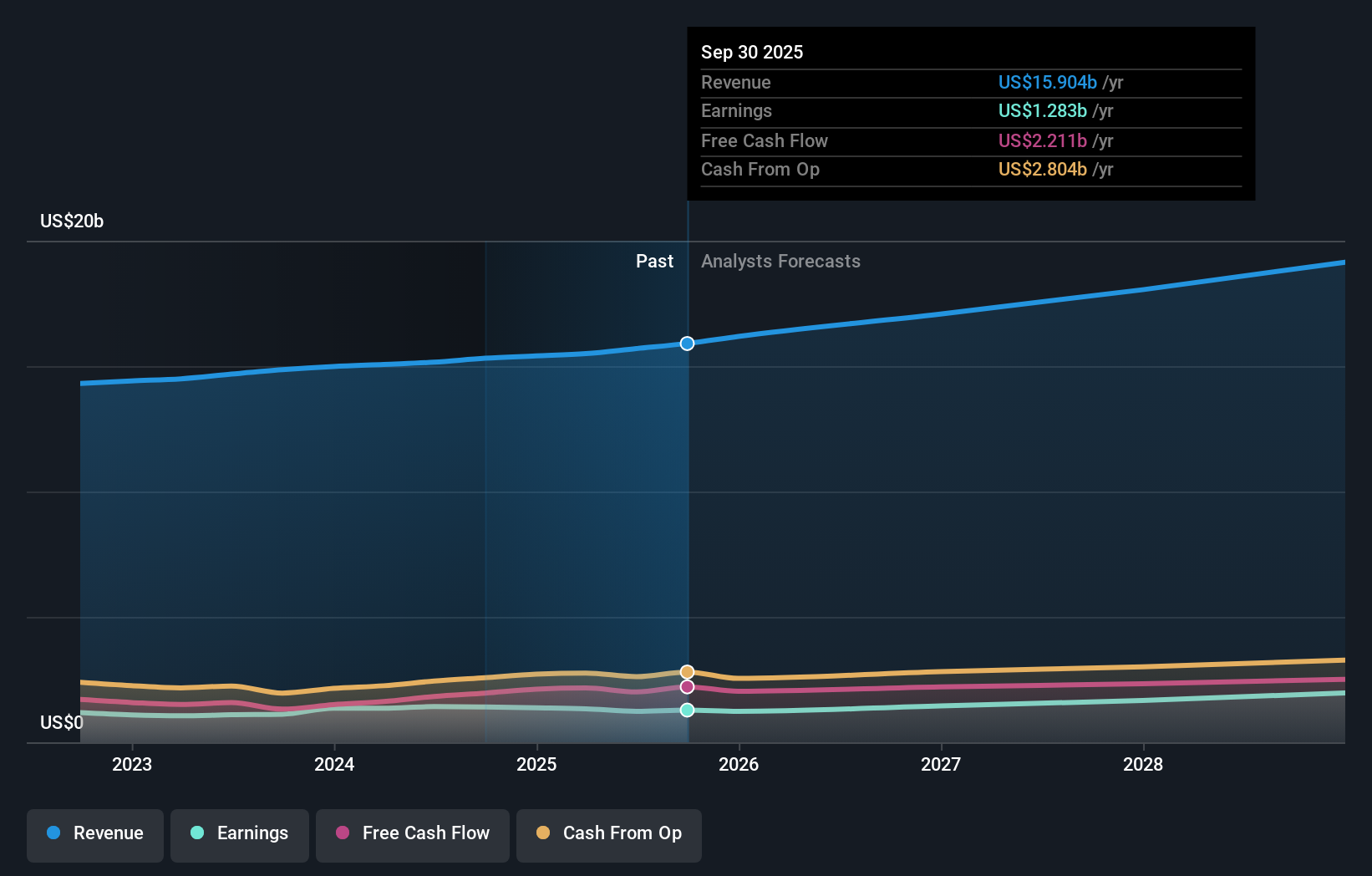

NYSE:IQV Earnings & Revenue Growth as at Jan 2026

NYSE:IQV Earnings & Revenue Growth as at Jan 2026

How IQVIA Holdings stacks up against its biggest competitors

Quick Assessment ✅ Price vs Analyst Target: At US$230.15 versus a consensus target of US$261.15, IQVIA trades about 13% below where analysts cluster. ✅ Simply Wall St Valuation: Simply Wall St estimates the shares are trading 28.2% below fair value, which screens as undervalued. ✅ Recent Momentum: A 30 day return of 2.1% points to modest positive short term momentum.

Check out Simply Wall St’s

in depth valuation analysis for IQVIA Holdings.

Key Considerations 📊 The long term DaaS+ deal with Boehringer Ingelheim reinforces IQVIA’s role as a core data partner to large pharma clients using its healthcare data platform. 📊 Watch how this collaboration influences commercial data volumes, cross region adoption and any reference to pipeline deals with other large drugmakers. ⚠️ Simply Wall St flags that debt is not well covered by operating cash flow, so higher investment in data infrastructure could keep balance sheet quality in focus. Dig Deeper

For the full picture including more risks and rewards, check out the

complete IQVIA Holdings analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com