For investors watching NasdaqGS:TXN, this update puts fresh attention on a business many associate with older line card products. The shares recently traded at $215.55, with returns of 11.5% over the past week and 24.2% over the past month. Those short term moves suggest that the market is actively reacting to the AI and data center narrative around the company.

The new demand trends in data center and industrial markets frame Texas Instruments as more closely tied to AI infrastructure build outs than some might assume. If these end markets stay healthy and orders remain firm, the mix of growth drivers around NasdaqGS:TXN could differ from the past, with AI related use cases taking a larger share of attention.

Stay updated on the most important news stories for Texas Instruments by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Texas Instruments.

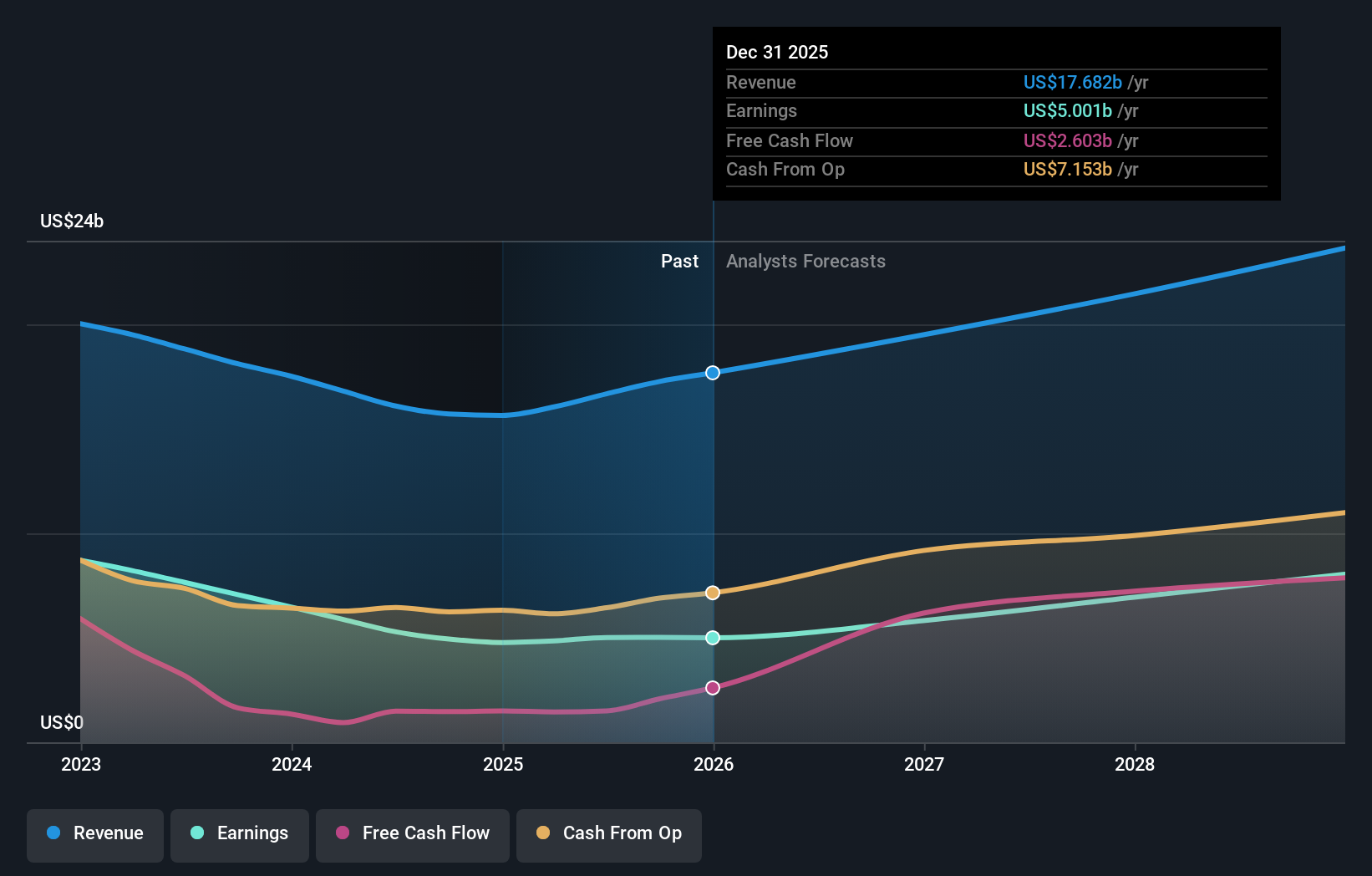

NasdaqGS:TXN Earnings & Revenue Growth as at Jan 2026

NasdaqGS:TXN Earnings & Revenue Growth as at Jan 2026

How Texas Instruments stacks up against its biggest competitors

Texas Instruments’ 70% surge in data center orders, combined with management guiding to US$4.32b to US$4.68b in Q1 2026 revenue and the first sequential quarterly revenue growth in 16 years, points to a business that is increasingly tied to AI infrastructure rather than just traditional industrial demand. For you, the key takeaway is that its analog and embedded chips are now sitting inside the same AI build outs that are driving interest in names like Nvidia, Broadcom and Analog Devices, with industrial and vehicle demand also helping to support the order book.

How This Fits The Texas Instruments Narrative

The latest guidance and commentary line up with existing narratives that focus on industrial automation, automotive content and domestic manufacturing as long-term demand anchors, now with AI-heavy data centers becoming a more visible fourth pillar. For investors who have been watching debates about factory utilization, tariffs and inventory discipline, this inflection in orders and backlog gives fresh context to those earlier concerns without resolving them outright.

Risks And Rewards In Focus AI driven data center and industrial demand is starting to contribute meaningfully to revenue, which supports the idea of multiple end markets rather than a single growth engine. Management is calling out improving orders and a broader industrial recovery, which some analysts view as consistent with early stages of a chip cycle upturn. Analysts have flagged two key risks, including balance sheet quality and a dividend yield that they see as not well covered by earnings and free cash flow. Heavy investment in new manufacturing and exposure to cyclical industrial and automotive customers could still weigh on margins if order strength fades. What To Watch Next

From here, it is worth tracking whether data center strength persists across multiple quarters, how industrial and automotive revenue mix evolves, and whether margins hold up as capital spending trends change. If you want context beyond this quarter and prefer to see how different investors connect these pieces into a bigger picture, you can check community narratives on Texas Instruments here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Discover if Texas Instruments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com