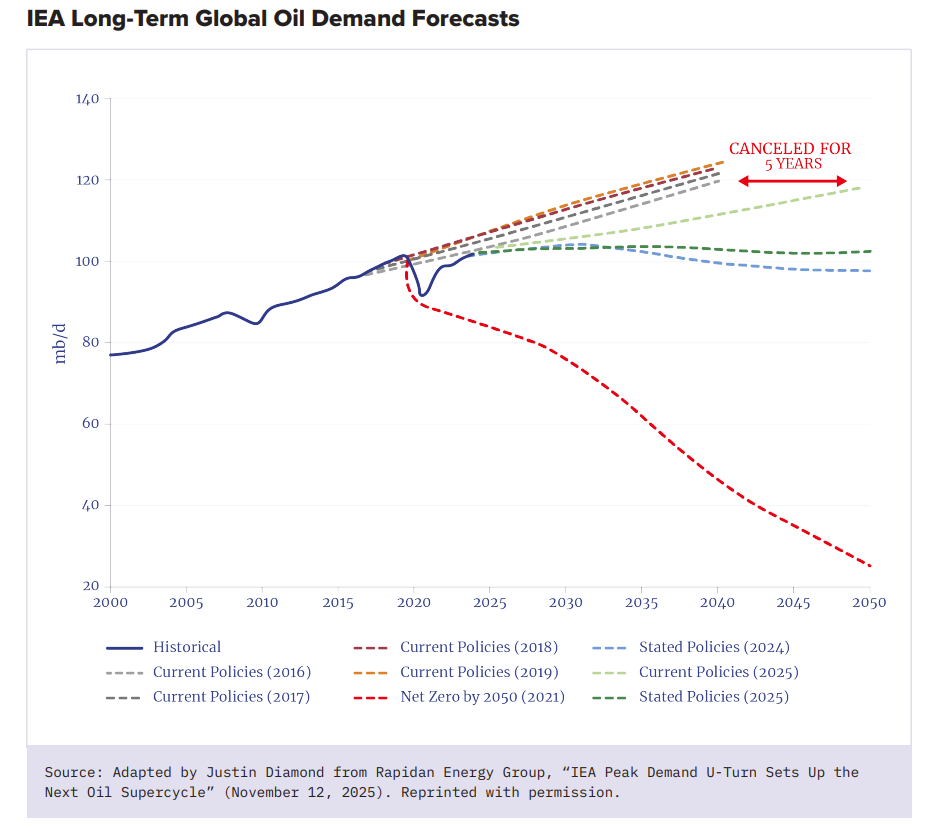

For the past five years, lawmakers and investors planned for an oil decline that never came.

However, following ample criticism from policymakers and energy experts, IEA returned to form in 2025 and resumed publishing a policy-neutral oil reference case. Last week, The National Center for Energy Analytics (NCEA) published an analysis of the IEA’s latest oil demand scenarios and assessed how IEA’s previous forecasts threatened energy security.

IEA: Oil Demand to Rise Through 2050

After straying from its original energy security mission in favor of championing renewable energy, in 2025 IEA reinstated its policy-neutral reference case: the “Current Policies Scenario” (CPS). A return to CPS fulfills IEA’s founding mission to provide factual, reliable information about current and future energy demand.

Last year’s IEA’s World Energy Outlook (WEO) projected an increase in oil demand through 2050 – a far cry from the “peak oil by 2030” claims that littered IEA’s previous reports.

Under the policy-neutral reference case, global oil and gas demand is projected to grow through 2050. Even in the IEA’s Stated Policies Scenarios (STEPS), which assumes that nations execute planned energy and climate policies, oil demand continues to rise.

Source: National Center for Energy Analytics

Increased Upstream Oil and Gas Investments are Needed

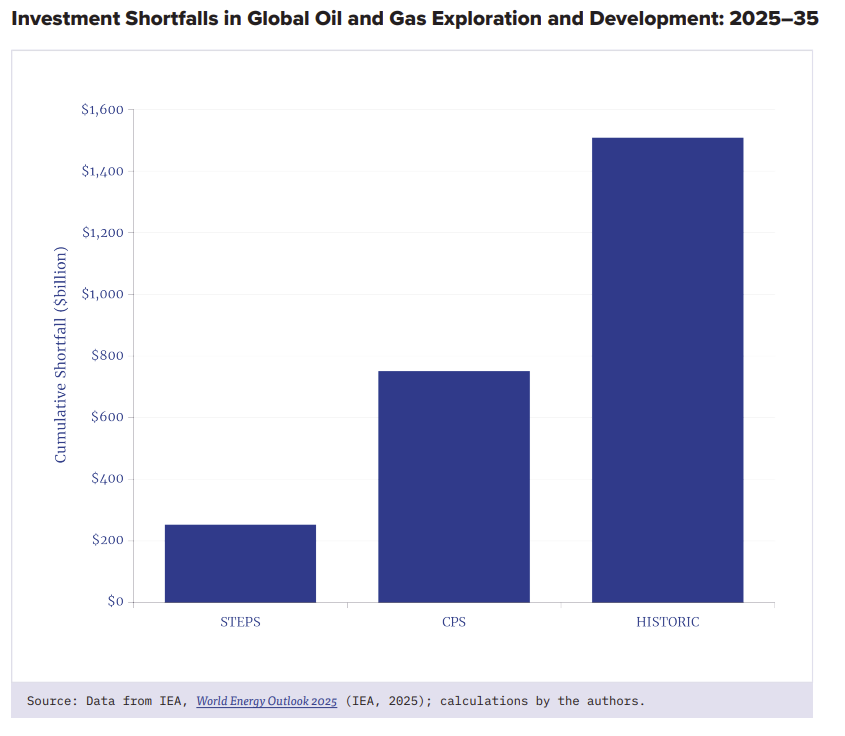

While reinstating a policy-neutral reference case for oil and natural gas projections is a step in the right direction, NCEA’s report explains IEA’s five-year absence of reality-based projections “constituted a significant gap in the analytical framework” with disastrous impacts on investment and policymaking. According to NCEA:

“The IEA’s projection of peak oil demand by 2030, which functions more as a de facto forecast than a scenario due to its short time frame, has been highly influential in promoting a mindset and even investment decisions that, should the CPS reflect the actual outcome, risk the emergence of a severe global undersupply of oil.”

Speaking at a NCEA event launching the report, Founder of the Rapidan Group Robert McNally pointed out that the decreased prioritization of oil development resulted in discovery investments hitting the lowest amount in decades, with the consequence being that the world may not have adequate supply to meet oil demand going forward.

Source: National Center for Energy Analytics

IEA recognizes this fact – perhaps too late. In its latest WEO, IEA called for investment in new oil production throughout the next decade to maintain market equilibrium, “contradict[ing] the IEA’s previous calls to halt all such new investments.”

Ultimately, NCEA’s analysis makes clear that years of flawed forecasting have left the world unprepared to deal with increasing energy demand. Increased investment and pragmatic energy policy are essential to avoid future shortages, price shocks, and threats to global prosperity.

Energy Delusions vs. Reality

IEA’s return to reality-based forecasting takes place as governments across the world are turning away from overly ambitious climate policies as the realities of budgetary issues, security risks, and political resistance set in. For example, the European Union recently announced a modification of its internal combustion ban by 2035 in response to outrage from Europe’s automotive industry.

NCEA explains:

“It is clear that any energy transition will proceed, at best, at a far slower pace than the IEA anticipated in WEO 2024.”

Emissions reduction goals remain a priority, but they should be balanced with economic reality. As Senior Advisor to KAPSARC Adam Sieminski said at the NCEA report launch:

“Fossil fuels will remain central to global prosperity far longer than previously acknowledged by the IEA and others, requiring policies that balance emissions goals with affordability, security, and development.”

The divergence between stated climate policies and their actual implementation is precisely why a reliable, policy-neutral reference case is essential for investors and policymakers.

Bottom Line: While IEA’s reinstatement of the policy-neutral reference case in its oil and natural gas projections is a welcome development, more work is to be done to rebuild the agency’s credibility as an unbiased source for energy markets data.