For investors tracking NYSE:MPC, these updates arrive with the stock at $195.83 and multi year returns that are described as very large over five years, including gains of 11.4% over the past week and 31.8% over the past year. The new labor proposal is notable because Marathon is negotiating on behalf of much of the U.S. refining sector, so the outcome could influence operating conditions across multiple facilities.

The California water recycling education partnership provides another data point for investors who pay attention to sustainability and social impact alongside financial metrics. How labor relations and community initiatives develop from here may shape how some investors assess Marathon’s risk profile, operating resilience and environmental priorities.

Stay updated on the most important news stories for Marathon Petroleum by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Marathon Petroleum.

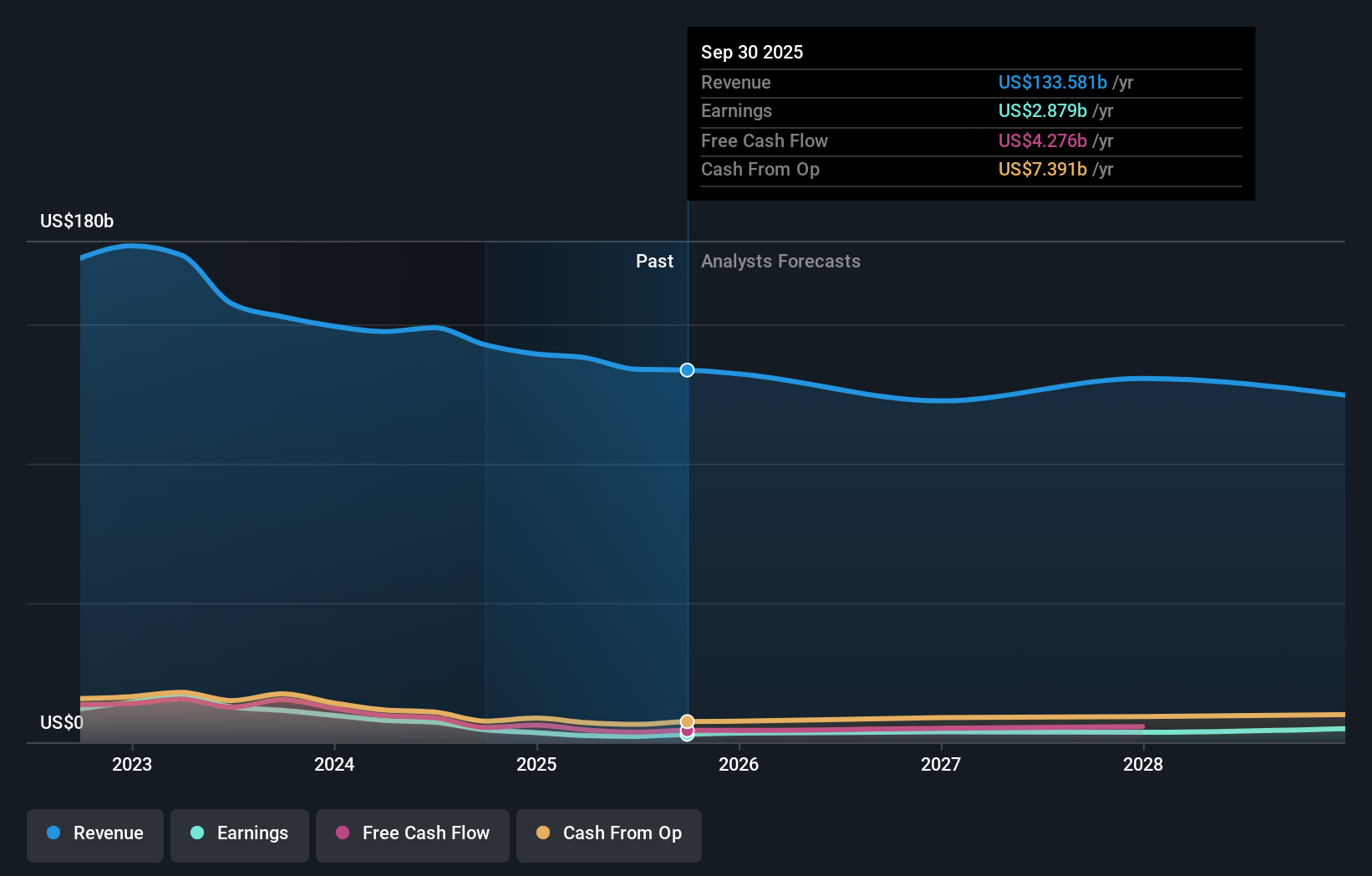

NYSE:MPC Earnings & Revenue Growth as at Feb 2026

NYSE:MPC Earnings & Revenue Growth as at Feb 2026

How Marathon Petroleum stacks up against its biggest competitors

The proposed four-year labor contract and the California education partnership both speak to how Marathon Petroleum is managing its operating footprint and social profile at the same time that it is reporting sizeable quarterly earnings. As the lead negotiator for 26 refiners, including Exxon Mobil, Chevron and Valero Energy, Marathon’s approach to wage terms could influence cost structures across the U.S. refining sector, while the Los Angeles water recycling initiative gives investors a small but visible example of how the company is engaging on sustainability topics that are increasingly watched around heavily regulated refineries.

How This Fits The Marathon Petroleum Narrative

This news lines up with existing investor narratives that focus on capital discipline, high refinery utilization and community engagement as support for long term resilience. Recent results, including net income of US$1.54b for the fourth quarter of 2025, continued share repurchases and a US$1.00 per share dividend, show management pairing operating execution with capital returns, while labor negotiations and local partnerships help frame how durable that model might be in comparison with peers like Exxon Mobil and Chevron.

Risks and Rewards To Keep In Mind Potential for greater labor stability over four years if the contract is accepted, which could support consistent operations across Marathon’s refining network. Community and sustainability programs at sites such as the Los Angeles refinery may support permitting relationships and brand perception in tightly regulated regions. A 15% proposed wage increase for roughly 30,000 workers could lift long term operating costs if not offset by efficiency gains or favorable refining conditions. If sector wide labor talks stall or unions push for higher terms, refiners including Marathon, Valero and others could face higher risk of disruption or margin pressure. What To Watch Next

From here, the key things to watch are union feedback on the four-year proposal, any contract revisions that affect industry wide costs, and how often Marathon pairs operational updates with new community or sustainability commitments. If you want to see how other investors are thinking about these moving parts and how they fit into the longer term story, take a look at the community narratives on Marathon Petroleum’s dedicated page.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com