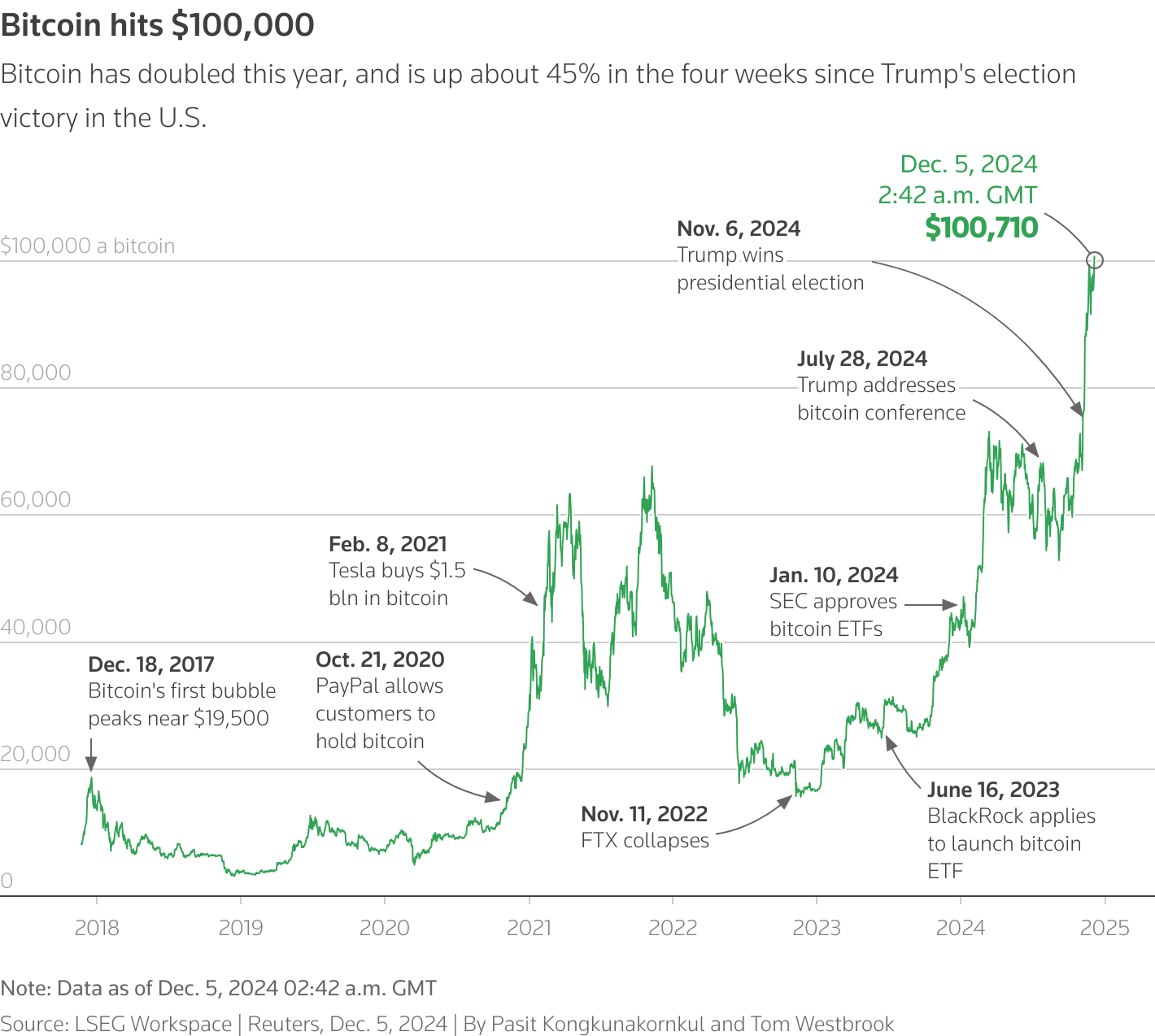

Bitcoin, the world’s best known cryptocurrency, has been on a tear since November on expectations that Donald Trump’s U.S. election win will usher in a friendly regulatory environment for cryptocurrencies.

“There’s reason to believe this thing could keep going,” said Kyle Rodda, senior financial market analyst at Capital.Com, stressing the friendlier regulatory environment.

This chart depicts the price of Bitcoin over time.

The euro managed to rise despite the uncertainty because the collapse of the government was already priced in, said Lee Hardman, senior currency analyst at MUFG.

“The contagion outside of French markets is fairly limited. If you look at the spreads between (German and) Italian and Spanish bonds they’ve actually been falling, so it’s not spilling over into European markets and that limits the implications for the European economy,” he said.

Traders are all but certain the European Central Bank will cut rates next week and are pricing in around 157 basis points of easing by the end of 2025.

YEN GAINS GROUND

In Asia, the Japanese yen strengthened over 0.3% to 150.80 per dollar as traders assessed whether the Bank of Japan will hike interest rates later this month.

Expectations had been growing that the BOJ will hike rates at its Dec. 18-19 meeting, buoyed by comments from Governor Kazuo Ueda. But media reports published on Wednesday suggested the BOJ may skip a rate hike this month, muddling those wagers.

The dollar index , which measures the U.S. currency against six rivals, was slightly lower at 106.18.

Sterling ticked up 0.15% to $1.2721, while the Australian dollar was flat at $0.6431 after dropping about 0.9% in the previous session on weak data.

The spotlight will be on Friday’s U.S. non-farm payrolls report for November, which is expected to show 200,000 jobs added in the month, according to a Reuters survey, after only 12,000 jobs were created in October, the lowest number since December 2020.

Sign up here.

Reporting by Ankur Banerjee in Singapore and Harry Robertson in London; Editing by Shri Navaratnam, Tom Hogue, Sherry Jacob-Phillips and Susan Fenton

Our Standards: The Thomson Reuters Trust Principles., opens new tab