(Bloomberg) — In the early hours of Friday, Germany’s Greens were given a choice: Would they veto a game-changing spending plan over grievances with chancellor-in-waiting Friedrich Merz, or back the radical shift they themselves had been demanding for months?

Most Read from Bloomberg

They were seven hours into talks at that point, following days of intense negotiations, and Foreign Minister Annalena Baerbock, a senior party figure, was in regular touch on the phone from Canada. With concessions from Merz’s conservative bloc such as extra climate protection funding, the Greens were in.

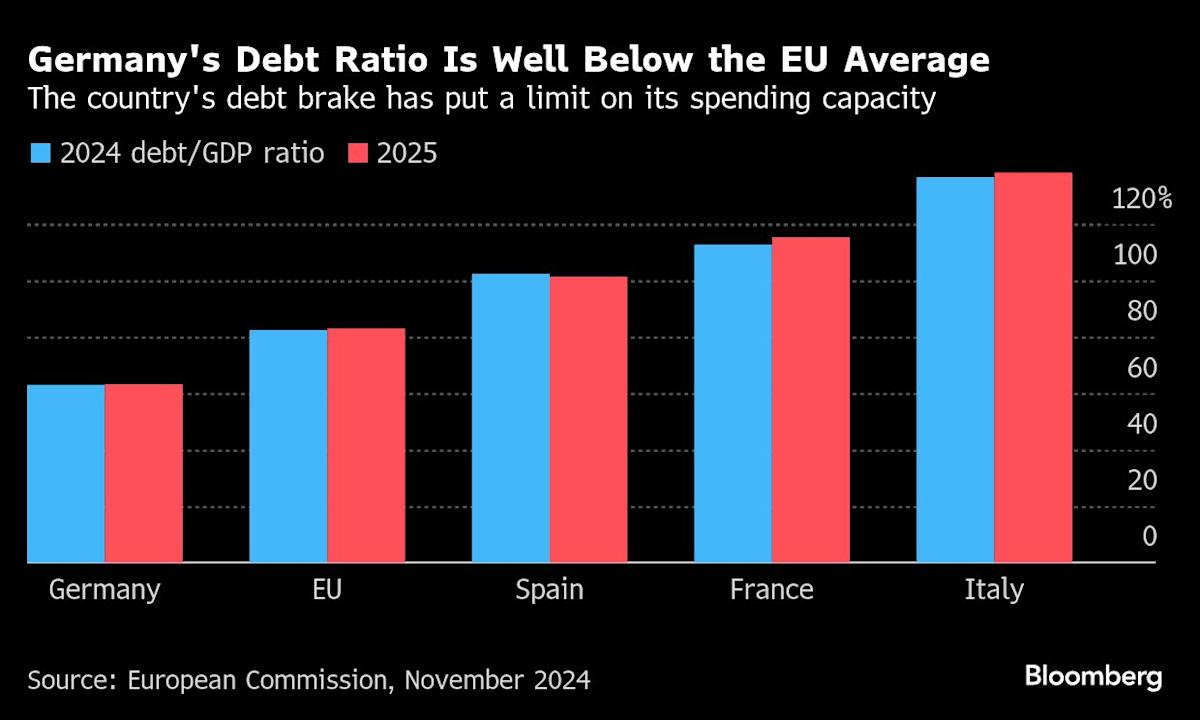

The decision to unleash the power of the federal balance sheet to transform Germany’s military and revamp its infrastructure is a watershed moment. It calls time on an era of budget restraint that’s hobbled the economy for years and could kickstart broader European resurgence.

But the path to this victory has been strewn with mistakes that highlight the 69-year-old’s personal flaws and raise questions about how Merz will manage once he seals the coalition deal he needs to take office. Before then, he still has to negotiate a formal vote in parliament on Tuesday to lock in his fiscal revolution.

This story is based on conversations with people within the main political parties and close to Merz and other senior politicians. They requested anonymity discussing internal matters.

Rapid Reaction

Merz was set up to become chancellor when his conservative CDU/CSU bloc won last month’s elections. But coalition talks in Berlin take months. And Donald Trump’s tariff offensive and the US retreat from European security mean that Germany didn’t have the time to wait.

Merz’s response was nothing less than seismic.

In lightning negotiations with his prospective coalition partners, the Social Democrats, he agreed on a 500 billion ($543 billion) infrastructure fund and an escape clause that takes defense spending outside of Germany’s tight constitutional restrictions on borrowing. The aim is to jumpstart the economy through more investment and get Europe ready to counter Russian threats and fill the gap left by the US.

The market reaction was dramatic, with a comprehensive repricing across the European financial system. German borrowing costs jumped, while the euro and German stocks rose.

Big Spender