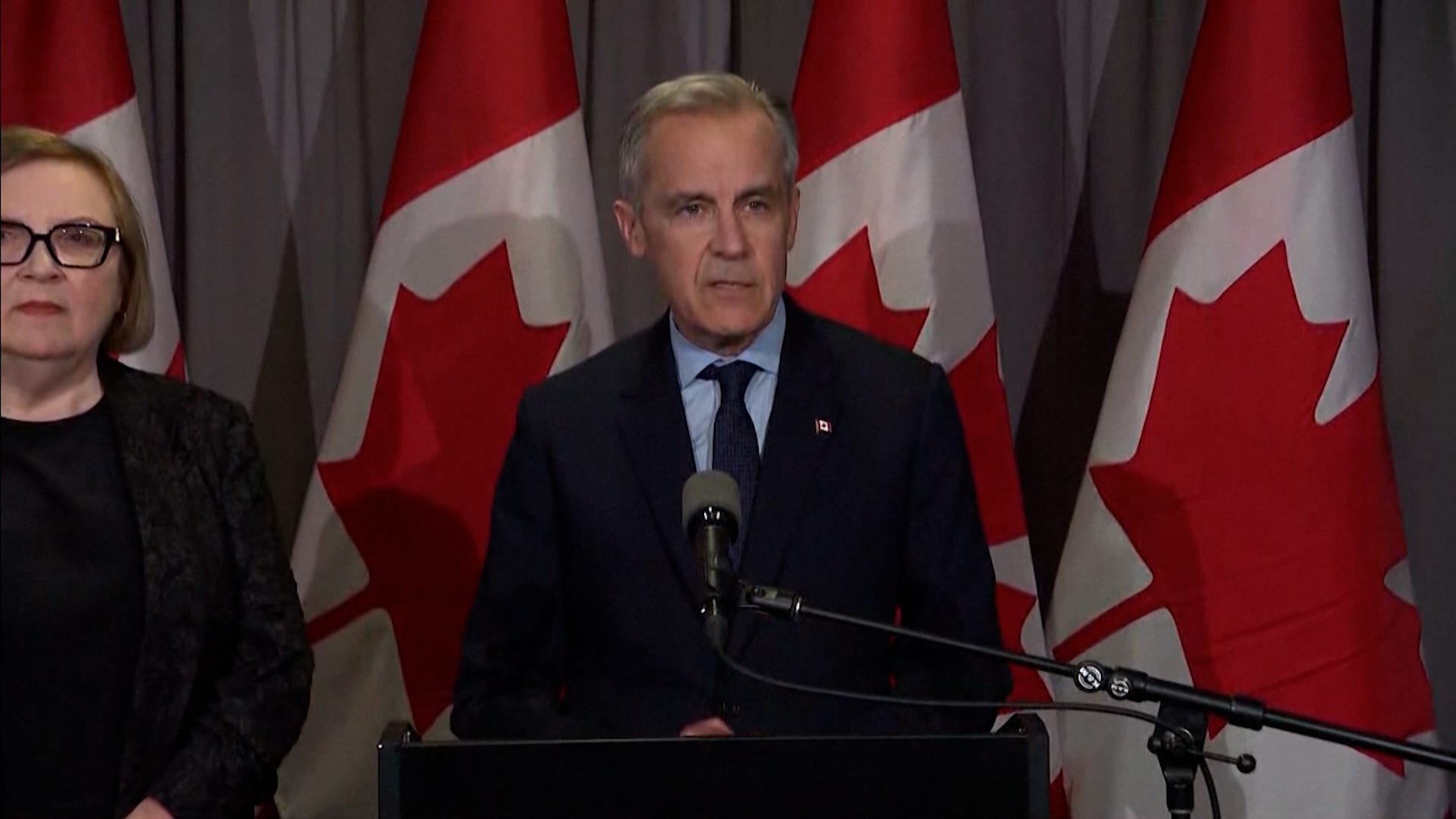

World leaders react to President Trump’s automobile tariffs

Canadian, South Korean, German and Japanese world leaders quickly reacted to President Trump’s tariffs on cars.

Uncertainty is expected to linger for months regarding the impact of tariffs on the auto industry.Trump once again brings up a plan to offer a new tax deduction for the interest consumers pay each year on car loans.

The Trump tariff experiment is unlike any economic policy we’ve seen in decades. Hence, all the jitters. But some are grasping onto some hope that Michigan ends up surviving better than expected.

Auto stocks, which have taken a hit over the past few weeks, fell again Thursday, which was the first day of trading after President Donald Trump announced that he would slap a 25% tariff on all cars and trucks sold here but built outside of the United States.

The U.S. will start collecting the higher tariffs on these auto imports April 3, which the White House estimates will raise $100 billion in revenue each year. Trump is set to announce more tariff news on April 2.

General Motors Co., which has major assembly operations outside of the U.S., saw the biggest drop Thursday of the Detroit Three. GM shares were down 6.65% or $3.39 cents a share to trade at $47.56 a share before 1 p.m. Thursday. GM stock closed at $47.20 a share, down $3.75 a share or 7.36%.

Ford Motor Co. shares were down 2.59% or 27 cents a share and trading at $10.03 a share before 1 p.m. Ford stock closed at $9.90 a share, down 40 cents or 3.88%.

Stellantis was down 1.96% or 23 cents a share to trade in the early afternoon at $11.73 a share. Stellantis stock closed at $11.81 a share, down 15 cents a share or 1.25%.

Make no mistake, the three big automakers already saw a brutal squeeze on stock prices as tariff talks shook Wall Street earlier this year.

Collectively, the three automakers have lost $12 billion in market value since Dec. 31 through Wednesday’s market close, according to David Sowerby, managing director and portfolio manager for Ancora Advisors in Bloomfield Hills. The collective market value for the three automakers is now a bit more than $146 billion.

Exactly how much car sales suffer from the higher prices that will follow added tariffs can be anyone’s guess at this point. But consumers can expect to see tighter supplies and higher prices overall on many vehicles.

“The auto uncertainty will linger for months on the true consumer cost of tariffs,” Sowerby said.

Trump raises hopes for new deduction on car loan interest

Where’s the hope? Trump once again brought up a plan Wednesday to offer a new tax deduction for the interest consumers pay each year on car loans — a deduction that would apply only to American-made cars and trucks.

Trump would need to get such a tax break passed by Congress, and the president said he is working with House Speaker Mike Johnson on creating such a tax deduction.

The idea of making car loan interest fully deductible was first raised by Trump at the Detroit Economic Club when he was on the campaign trail in October.

Trump proclaimed it’s the kind of idea where people might say, “Why the hell didn’t I think of that?”

It isn’t a new idea, though. Car loan interest payments — in fact, all interest expenses, including credit cards — were fully deductible prior to the Tax Reform Act of 1986. The 1986 act limited interest expense deductibility to mortgage interest, as well as interest on home equity loans.

Mark Luscombe, principal analyst for Wolters Kluwer Tax & Accounting in Riverwoods, Illinois, said Thursday that all tax proposals this year will be handled in Congress through the budget reconciliation process, which permits passage in the Senate through only a simple majority and avoids the filibuster rules.

Yet he noted that the proposed deduction on car loan interest rates isn’t a done deal, and could be at risk given a long list of other costly tax cuts being proposed, such as no tax on tips, no tax on overtime and no tax on Social Security benefits, as well as extending the expiring provisions of the Tax Cuts and Jobs Act that end in December.

“Although it is still being discussed, it seems to me that the car loan interest deduction could fall by the wayside in the face of all of these other conflicting priorities,” Luscombe said.

In addition, he said, there are discussions about reducing the mortgage interest deduction limit. Currently, you can deduct the mortgage interest you paid during the tax year on the first $750,000 of your mortgage. But some want Congress to cap that limit at $500,000 in the future.

“It seems to me to be a little unlikely that they would add a car loan interest deduction at the same time that they are reducing the mortgage interest deduction, except that they might want to try to squeeze in what Trump has proposed,” Luscombe said.

A key point to remember: About 90% of taxpayers claim the standard deduction and do not itemize deductions currently. So depending on how a deduction on car loan interest is handled, many taxpayers may see no benefit from the additional interest deduction.

Unless there is some sort of special line-item deduction for car loan interest ahead, you wouldn’t be able to claim a deduction on car loan interest unless you’re part of a small group of people who itemize several deductions.

Should we see a deduction for car loan interest, though, that might help motivate some buyers to deal with higher car and truck prices. It’s not a huge tax break, but borrowers who might qualify aren’t going to argue with it.

Winners and losers in struggle to revive manufacturing

Trump has been marketing tariffs as a way to bring back manufacturing jobs, nudging companies to start reshoring production in response to Trump’s trade policies.

In a visit to Bangor Township in Michigan in March, Vice President JD Vance promised a manufacturing renaissance.

“If you want to be rewarded, build in America. If you want to be penalized, build outside of America,” Vance was quoted in a Detroit Free Press story about the event.

Many fear that Trump’s aggressive shift in trade policy will quickly drive consumer prices higher and contribute to a slowdown in Michigan’s economy. But Vance defended Trump’s trade strategies as a way to protect workers here.

Yet there will be losers alongside the winners, too. Detroit’s trade relationship with Canada has been ongoing and growing longer than many people younger than age 60 have been alive.

“Detroit’s auto industry is deeply integrated with Canada, particularly Ontario, forming one of the most interconnected automotive supply chains globally. Together, Michigan and Ontario produce about 22% of North America’s vehicles,” according to a report by the Canadian Chamber of Commerce.

Smaller manufacturers in Michigan, some experts say, could benefit as tariffs drive other companies to shift production away from factories in other countries to facilities in the U.S. The goal will be to find more U.S. suppliers of components, parts and other goods.

“The energy right now is toward ‘What are my domestic options?’ ” said Brian Calley, former Michigan lieutenant governor and the current president and CEO of the Small Business Association of Michigan.

Calley said the infrastructure remains in place in Michigan, unlike many other states, to pick up business as many companies search for more domestic suppliers. Michigan is better suited than other states to benefit from reshoring, he said.

“This is where the capacity is,” Calley said. “Where else is it going to go?”

He acknowledged that the impact of tariffs won’t be the same for all industries, even in Michigan.

“If you’re a shop that lost work to China over the last 10 years, you probably look at this policy and say ‘Thank God,’ ” Calley said.

“But if you’re a shop that is assembling things that are largely made overseas and imported to assemble here, well, you’re probably pretty nervous about this.”

Contact personal finance columnist Susan Tompor: stompor@freepress.com. Follow her on X @tompor.