The ‘Wolf of Wall Street’ has defended Donald Trump against allegations that the US President was facilitating insider trading or engaging in market manipulation by doling out financial advice on social media before pausing trade tariffs.

Stocks were wavering between gains and losses on Wednesday morning after markets had tumbled following Trump’s unveiling of strict tariffs on dozens of countries.

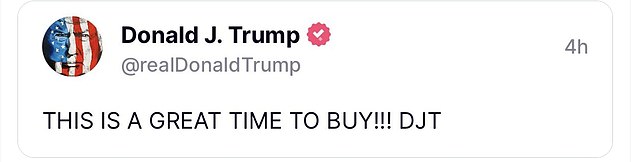

‘THIS IS A GREAT TIME TO BUY!!! DJT,’ he wrote on his social media platform Truth Social at 9.37am that day.

Less than four hours later, Trump announced a 90-day pause on nearly all his tariffs.

Stocks soared on the news with the S&P500 closing up 9.5%, while the market gained back about $4 trillion, or 70%, of the value it had lost over the previous four trading days.

Now, some Democratic lawmakers are calling for investigations into whether Trump’s policy reversal led to any market manipulation or insider trading.

Jordan Belfort – the former Wall Street trader whose infamous rise and fall was immortalised in the 2013 Martin Scorcese film ‘The Wolf of Wall Street’ starring Leonardo DiCaprio – said he wasn’t concerned by Trump’s behaviour.

Speaking on Sky News, Belfort said: ‘I personally don’t find it overly suspicious. Especially since he’s told it to everybody at once.

‘If he hadn’t said anything and told five of his best friends “I’m gonna ease this tariff situation – you should be buying”, that would be illegal.’

But law experts warned the US President could be straying into dangerous territory.

Democratic lawmakers are calling for investigations into whether Trump’s policy reversal led to any market manipulation or insider trading

‘THIS IS A GREAT TIME TO BUY!!! DJT,’ he wrote on his social media platform Truth Social at 9:37am. Less than four hours later, Trump announced a 90-day pause on nearly all his tariffs

Jordan Belfort – the former Wall Street trader whose infamous rise and fall was immortalised in the 2013 Martin Scorcese film ‘The Wolf of Wall Street’ starring Leonardo DiCaprio – said he wasn’t concerned by Trump’s behaviour

Betting on short-term market swings is common practice among traders.

Some market experts said that although they observed a record surge in trading volume on Wednesday, it came at a time of heightened volatility and fast-changing policies, making it hard to put a finger on suspicious trading.

‘There’s no way to know if that buyer at that moment just had lucky timing (or not),’ said Henry Schwartz, vice president of market intelligence at Cboe Global Markets.

‘I haven’t found any smoking gun,’ he said.

Belfort added that Trump’s Truth Social post was just reiterating what the President had already said publicly, and that buying when share prices plunge is a well-known investment move.

‘He had been saying that all along [to buy], it wasn’t the only time he’d said that,’ the former trader told Sky.

‘[Treasury] Secretary Bessent had been saying that too. It’s a really basic piece of advice.’

But Democrats are pushing for Trump to be placed under renewed scrutiny.

‘Did anyone buy or sell stocks, and profit at the public’s expense?’ Democratic Sen. Adam Schiff asked on social media, as Democratic Sen. Chris Murphy declared: ‘An insider trading scandal is brewing.’

US House of Representatives Democratic Leader Hakeem Jeffries said there are members of Congress who will be ‘aggressively demanding answers and transparency particularly as it relates to stock purchase decisions that may have occurred over the last few days’.

Trump critic and former White House ethics lawyer, Richard Painter said of Trump: ‘He’s loving this, this control over markets, but he better be careful.

‘The people who bought when they saw that post made a lot of money.’

US President Donald Trump, Secretary of Defense Pete Hegseth and Secretary of State Marco Rubio attend a cabinet meeting at the White House in Washington

Wall Street stocks rocketed to close solidly higher Wednesday, with dramatic advances on all three major indexes as US President Donald Trump delayed steep new tariffs

Besides the timing, another curiosity of Trump’s social media post was his signoff using his initials – DJT.

DJT is also the stock symbol for Trump Media and Technology Group, the parent company of the president’s social media platform Truth Social.

Trump includes ‘DJT’ on his posts intermittently, typically to emphasise that he has personally written the message.

But it’s not clear if Trump was saying buy stocks in general, or Trump Media in particular.

The ambiguity about what Trump meant didn’t stop people from pouring money into that stock.

Trump Media closed up 22.67%, soaring twice as much as the broader market, a stunning performance by a company that lost $400 million last year and is seemingly unaffected by whether tariffs would be imposed or paused.

Trump’s 53% ownership stake in the company, now in a trust controlled by his oldest son, Donald Trump Jr., rose by $415 million on the day.

Trump Media was bested, albeit by only two-hundreds of a percentage point, by another Trump administration stock pick – Elon Musk’s Tesla.

In an emailed statement, the White House did not directly address concerns about market manipulation.

White House spokesman Kush Desai said it is the president’s responsibility to reassure the markets and Americans about economic security in the ‘face of nonstop media fearmongering’.

The Securities and Exchange Commission, which in the past has taken action against insider trading involving options trading, declined to comment.