As European markets experience a period of optimism, with the pan-European STOXX Europe 600 Index rising by 3.44% amid easing tariff concerns and economic growth in the eurozone doubling its pace, small-cap stocks are gaining renewed interest from investors seeking opportunities in this dynamic landscape. In this environment, identifying stocks that demonstrate robust fundamentals and resilience to external pressures can be particularly rewarding for those looking to uncover hidden gems within Europe’s diverse market.

Top 10 Undiscovered Gems With Strong Fundamentals In EuropeNameDebt To EquityRevenue GrowthEarnings GrowthHealth RatingAB TractionNA3.81%3.66%★★★★★★Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative26.90%4.14%7.22%★★★★★★ABG Sundal Collier Holding8.55%-4.14%-12.38%★★★★★☆Decora20.76%12.61%12.54%★★★★★☆Dekpol73.04%15.36%16.35%★★★★★☆Alantra Partners3.79%-3.99%-23.83%★★★★★☆Viohalco91.31%12.25%17.37%★★★★☆☆Inversiones Doalca SOCIMI15.57%6.53%7.16%★★★★☆☆Grenobloise d’Electronique et d’Automatismes Société Anonyme0.01%5.17%-13.11%★★★★☆☆MCH Group124.09%12.40%43.58%★★★★☆☆

Below we spotlight a couple of our favorites from our exclusive screener.

Simply Wall St Value Rating: ★★★★★★

Overview: Polaris Media ASA is a media house and printing company operating in Norway and Sweden with a market cap of NOK 4.56 billion.

Operations: Polaris Media generates revenue primarily from its Media House operations in Norway and Sweden, with NOK 1.95 billion and NOK 1.06 billion respectively, alongside contributions from Print and Distribution segments in both countries. The company reports a net profit margin trend that reflects its operational efficiency across these diverse revenue streams.

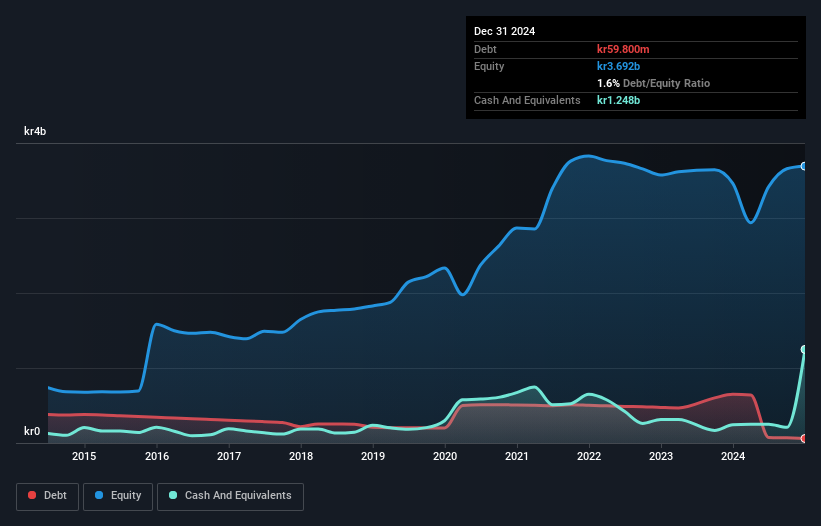

Polaris Media, a nimble player in the media sector, has shown promising financial health. The company’s price-to-earnings ratio of 6.7x is well below the Norwegian market average of 12x, suggesting potential undervaluation. It boasts more cash than its total debt and has reduced its debt-to-equity ratio significantly from 8.6 to 1.6 over five years, indicating prudent financial management. Polaris turned profitable this year with net income reaching NOK 678 million compared to a NOK 47 million loss previously, reflecting strong operational improvements and high-quality earnings that set it apart from industry peers.

OB:POL Debt to Equity as at May 2025

OB:POL Debt to Equity as at May 2025

Simply Wall St Value Rating: ★★★★★★

Overview: Huber+Suhner AG provides electrical and optical connectivity components and system solutions, with a market cap of CHF1.37 billion.

Operations: Huber+Suhner AG generates revenue from three primary segments: Communication (CHF353.57 million), Industry (CHF276.66 million), and Transportation (CHF263.65 million).

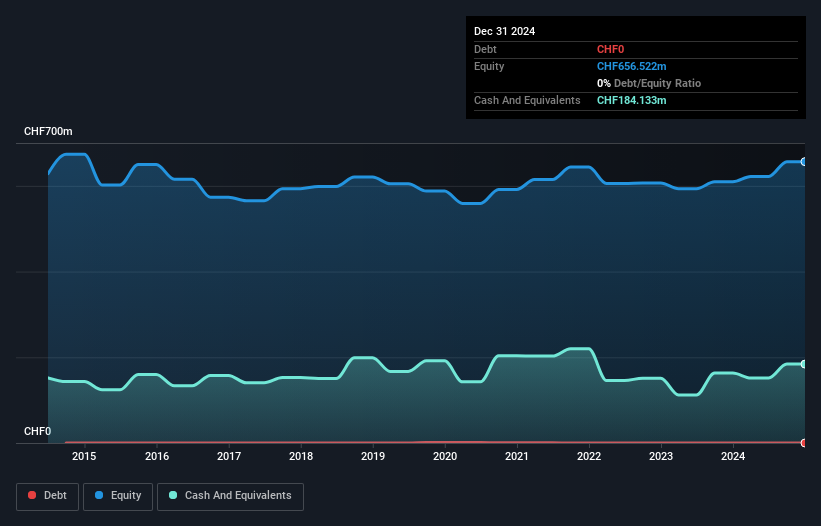

Positioned as a promising player in the European market, Huber+Suhner is currently trading at 34.1% below its estimated fair value, offering an intriguing opportunity for investors. The company has demonstrated consistent earnings growth of 4.2% annually over the past five years and remains debt-free, enhancing its financial stability. With net income rising to CHF 71 million from CHF 64 million year-over-year and basic earnings per share increasing to CHF 3.87 from CHF 3.48, it reflects robust financial health. Future prospects are bolstered by strategic expansions in India and advancements in EV charging technologies, though economic uncertainties pose potential challenges ahead.

SWX:HUBN Debt to Equity as at May 2025

SWX:HUBN Debt to Equity as at May 2025

Simply Wall St Value Rating: ★★★★★★

Overview: Lubawa S.A. is a Polish company that manufactures and sells products for the army, police, municipal police, border patrol, fire brigade, and special forces both domestically and internationally, with a market cap of PLN1.65 billion.

Operations: Lubawa’s primary revenue streams include Specialist Equipment – Retail (PLN264.99 million), Fabrics (PLN180.45 million), and Advertising Materials (PLN142.56 million).

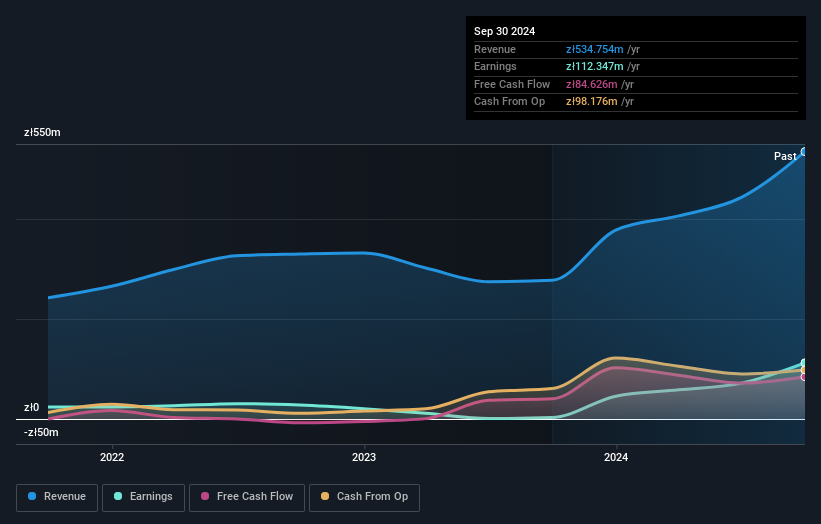

In the dynamic world of European stocks, LBW stands out with its impressive earnings growth of 3846.2% over the past year, far surpassing the Aerospace & Defense industry’s 33.5%. This debt-free company is trading at 44.2% below its estimated fair value, suggesting potential undervaluation in the market. Despite a highly volatile share price recently, LBW’s financial health appears robust with no debt compared to five years ago when its debt-to-equity ratio was 37.8%. The company’s high-quality earnings and positive free cash flow further underline its solid performance in a competitive sector.

WSE:LBW Earnings and Revenue Growth as at May 2025Make It HappenContemplating Other Strategies?

WSE:LBW Earnings and Revenue Growth as at May 2025Make It HappenContemplating Other Strategies?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

If you’re looking to trade Lubawa, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored Content

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com