Amid geopolitical upheaval and energy uncertainty, Europe and Germany face a pivotal moment – not just to adapt, but to lead. With innovation, policy ambition, and market moment on its side, the continent is once again poised to redefine the future of clean energy. How bold will Europe and Germany be pushing the boundaries of the energy transition?

Key highlights:

AI-powered trading: Hedge funds of the energy transition

Danish power traders using AI saw ROEs up to 260.8%, profiting from €500/MWh swings.

AI automates intraday decisions using satellite & weather data – light assets, high margins.

But: regulatory gaps + 4.4B trades monitored in 2022 raise systemic risk concerns.

Wind & solar: Booming but bottlenecked

Europe added a record 65.5 GW solar and 16 GW wind in 2024.

Germany’s offshore wind faces delays (only 27 of 30 GW expected by 2030).

Solar PPAs surged, but oversupply & grid congestion push for smarter infrastructure.

Petrol stations: From fuel pumps to energy hubs

EU petrol stations may drop -45% by 2050 as ICE vehicle sales decline.

Hydrogen, biofuels & EV chargers reshaping forecourts into multi-energy centers.

BP exiting Netherlands retail signals market consolidation & reinvention

EV charging: Speed, scale & smart integration

Ultra-fast chargers (≥150 kW) now every 60 km on major EU highways.

V2G, smart charging & battery buffers address grid strain from rising EV adoption.

M&A boom: legacy fuel retailers acquire charging networks to stay relevant.

Full market outlook:

Europe’s clean energy transition entered 2025 with significant momentum. In 2024, wind energy supplied roughly 20% of the continent’s electricity consumption, and solar PV additions soared to a record-breaking 60 GW. Investments in energy storage – essential for managing intermittent renewable generation – also climbed to an all-time high of $54 billion globally. These developments underscore growing investor confidence, especially as regulatory tailwinds strengthen across the EU. The REPowerEU initiative has accelerated permitting and raised 2030 renewable energy targets, while Germany, still the bloc’s industrial engine, has introduced new legislation aimed at achieving 80% renewable power by 2030.

Yet, this promising momentum now faces a more volatile global backdrop. In early 2025, renewed geopolitical tensions began reshaping the macroeconomic landscape. The re-election campaign of former U.S. President Donald Trump brought a wave of new tariffs, reigniting trade frictions with key global partners. Most notably, the escalating trade war between the United States and China – marked by tit-for-tat tariffs on clean tech components and rare earth materials – has raised concerns about the resilience of global supply chains, particularly for solar modules, batteries, and critical raw materials that underpin the energy transition.

Compounding these challenges, a massive power outage on April 28, 2025, plunged Spain and Portugal into darkness, with parts of southern France also affected. The blackout, one of Europe’s most severe in decades, disrupted transportation, communications, and essential services. Preliminary investigations suggest that the outage was triggered by a sudden imbalance in electricity generation and demand and limited interconnection capacity with neighboring grids. This incident has sparked a broader debate on the need for robust backup systems and grid stability measures to support the continent’s shift towards renewable energy.

Europe finds itself caught in this intensifying rivalry. While the EU remains committed to strategic autonomy and decarbonisation, it must now navigate a more fragmented global trade environment. Supply security, diversification, and local manufacturing have become not just buzzwords, but imperatives. This is particularly acute in Germany, where a new coalition government took power in early 2025 following months of political uncertainty. The new administration, while green-leaning and committed to the climate agenda, faces the dual challenge of accelerating the energy transition while restoring economic competitiveness in the face of inflationary pressures and an evolving geopolitical order.

For investors, the message is clear: clean energy in Europe is no longer a niche or thematic play — it’s becoming a mainstream asset class, albeit one shaped by geopolitical currents and evolving policy. As valuations remain attractive in select subsectors and capital flows into energy infrastructure accelerate, this is a pivotal moment to position in the market. At Carlsquare, we are actively supporting transactions across wind, solar, storage, and adjacent infrastructure – and we believe the current environment offers both urgency and upside for strategic and financial investors alike.

Sector spotlight – The rise of AI in power trading

AI is transforming European power trading from a traditional utility-driven business into one of the most dynamic frontiers in energy markets. Nowhere is this more evident than in Denmark, where firms like Danske Commodities, InCommodities, and Norlys Energy Trading are using algorithmic models and meteorological data to make intraday bets on weather-driven power fluctuations — and reaping extraordinary profits. InCommodities, for example, reported a return on equity of 260.8% in 2022, while Danske Commodities’ net profit surged to €1.47 billion. These traders, many of whom employ AI to respond automatically to satellite imagery and market shifts, are capitalizing on renewable intermittency, with price swings of up to €500/MWh becoming the norm in Nordic day-ahead markets.

For investors, this evolution presents both opportunities and risks. On one hand, the sector offers exceptional margins, fast scalability, and limited capital intensity — most firms don’t own generation assets. On the other, the rise of automated high-frequency trading introduces systemic risk, liquidity vulnerabilities, and regulatory lag. In 2022, the EU’s Agency for the Cooperation of Energy Regulators (ACER) monitored 4.4 billion energy transactions — about 139 trades per second — raising questions about oversight capacity. A pending update to REMIT (the EU’s market integrity regulation) and ongoing criminal investigations into alleged manipulation by some Danish firms underscore the need for caution.[1]

Still, with volatility here to stay and digitization accelerating, AI-powered trading desks are poised to be the hedge funds of the energy transition. For institutional capital and strategic acquirers, now is the time to build exposure — or risk being left behind.

M&A activity

Globally, renewable energy deal value hit a record $117 billion in 2024[2], with Europe accounting for a significant share and strong participation by private equity and infrastructure funds. Notable transactions include major offshore wind farm stakes sales in the North Sea (In Germany alone, rights to 7 GW of offshore capacity were auctioned for several billion dollars), several large battery portfolio acquisitions by utilities and PE investors, and oil & gas majors expanding into biofuels. In Germany and Europe, deals in the wind and solar space often involve “asset recycling”, as developers sell stakes in operational projects to recycle capital into new developments. Projects in the renewables and BESS domains are expected to dominate the 2025 energy M&A landscape.

Policy momentum and regulations

The EU’s Green Deal initiatives and REPowerEU plan have accelerated regulatory updates across Europe. In 2024 the EU formally raised its binding renewable energy target for 2030 to at least 42.5% of final energy[3]. To achieve this, the EU estimates a total installed wind and solar capacity to reach about 1,230 GW by 2030, up from 569 GW in 2024[4]. Although policies such as streamlined permitting rules, faster environmental assessments and incentives are being implemented, many EU countries have been slow to apply the new rules. Countries in the EU have been slow to apply the rules, speeding up permit approvals is crucial to hitting the 2030 targets.

Renewable energy outlook

Wind & solar energy: Driving Europe’s renewable revolution

Europe’s wind and solar energy sectors are expanding at record pace, but both must overcome permitting, grid and supply challenges to meet the ambitious 2030 targets. In 2024, the EU added 16

GW[5] of new wind capacity and a staggering 65.5 GW of solar – the largest annual solar addition ever[6]. Yet, both sectors face hurdles in scaling fast enough, questioning the EU’s renewable energy targets.

Offshore wind capacity is set to rise rapidly, with Germany targeting 30 GW by 2030 and 70 GW by 2045, but grid connection delays and limited transmission capacity could slow expansion. Germany might miss its 2030 offshore target due to delays (27 GW reached vs 30 GW goal)[7]. Meanwhile, onshore wind continues to struggle, with slow permitting, local opposition and rising turbine costs. Germany’s permitting reforms – such as dedicating 2% of land to wind – could set an example for others to follow, but delays remain a key bottleneck.

Solar energy continues to lead Europe’s renewable surge, doubling in deployment between 2021 and 2023. Falling solar module costs and energy security concerns have accelerated utility-scale and distributed solar investments across Europe. However, midday oversupply and grid congestion remain challenging, forcing curtailments in high-generation regions like Spain and Germany. To mitigate this, policymakers are promoting agrivoltaics (solar systems that allow land to be used for agricultural purposes), floating solar and smart grid integration to optimize land use and enhance grid flexibility.

The solar and wind expansion is supported by booming corporate power purchase agreements (PPAs). Alone in 2024, over 316 renewable energy PPAs were signed in Europe[8] – a 14% increase from the previous year – helping developers to stabilize their revenues. With solar PPA prices falling by roughly 13% in 2024[9], corporate demand for renewables is expected to remain strong throughout 2025.

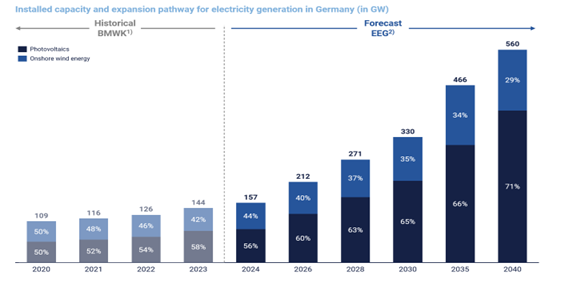

Click here to view the electricity generation in Germany chart

Notes: 1) Historical installed capacity based on data from the Federal Ministry for Economic Affairs and Climate Action (BMWK); 2) Forecast based on the Renewable Energy Sources Act (EEG 2023), § 4 Expansion Path

Energy storage, grid balancing & power trading

Energy storage systems, especially battery storage systems (BESS), moved to the forefront as a critical enabler of the energy transition. In Q1 2025, battery storage capacity in Europe is at 67 GW, with 913 operational projects and 147 under construction[10]. Developers are deploying utility-scale lithium-ion batteries (projects of 50-200 MW are becoming common) in markets like the UK, Germany or Spain, seeking to capture opportunities in frequency regulation, capacity markets and energy arbitrage.

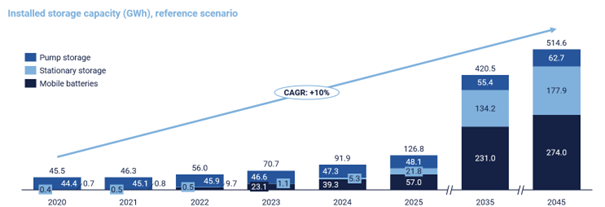

Click here to view the installed storage capacity chart

Source: Frauenhofer ISE 2025

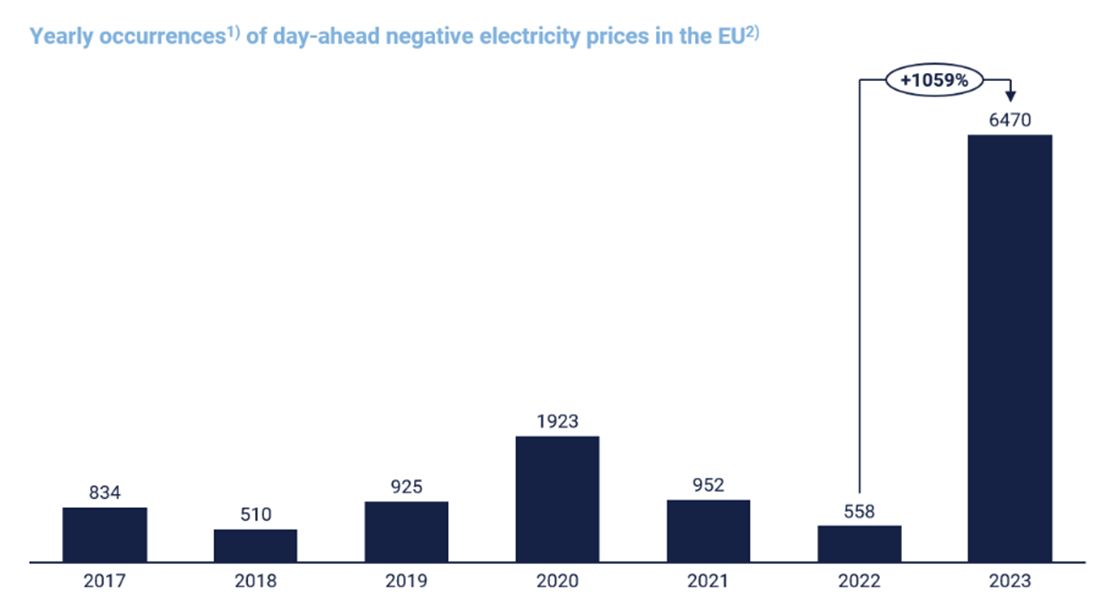

Europe’s power trading landscape is transforming, with intraday trading volumes surging over 40% in 2024[11]. Batteries play a growing role in stabilizing renewable-dominated grids by storing excess wind and solar power and selling it when demand peaks. The rise in negative power prices has further strengthened the business case for flexible storage solutions.

Price volatility will be driven by an increase in hours with zero or negative prices[12].

Click here to view the negative electricity prices chart

Source: European Union Agency for the Cooperation of Energy Regulators (ACER).

Notes: 1) One occurrence corresponds to one hour during which prices are negative; 2) EU + Norway and Switzerland

However, challenges such as grid bottlenecks remain. Many networks were not designed for high renewable penetration, leading to curtailments. Grid operators must upgrade transmission infrastructure and implement smart grid solutions, such as AI-driven demand response, vehicle-to-grid (V2G) integration and hydrogen-based long-term storage. Meanwhile, European regulators are overhauling grid fees and connection rules to better accommodate storage, ensuring BESS deployment keeps pace with Europe’s accelerating clean energy buildout.

Petrol stations

Europe’s petrol station retail market is at a crossroads, facing a long-term structural decline in fossil fuel demand while adapting to new consumer behaviours, vehicle electrification and evolving regulations. As of 2023, Europe had approximately 137,500[13] operational petrol stations, with Germany leading at around 21,700 stations – one of the densest networks on the continent. However, a study by Sia Partners forecasts that Europe’s petrol station count could shrink by 45% by 2050, mirroring an expected 63% decline in internal combustion engine vehicles from 260 million to 97 million[14]. In Germany where policymakers have set ambitious 2045 net-zero target, the transition is expected to accelerate, pushing operators to rethink their business models. Nonetheless, the question remains whether the ambitious EV adoption will be achieved.

There are still several hurdles regarding EVs. Consumer hesitancy due to concerns over driving range, charging infrastructure reliability and higher upfront costs; slow corporate adoption, with companies registering 60% of new cars[15], but lag behind private households in EV uptake; and industry challenges, as European automakers are grappling with producing affordable EVs while facing intense competition from China.

Contrary to the anticipated decline of ICE vehicles, advancements in alternative fuels are offering a lifeline. Even though it is still in early-stage development, innovations in hydrogen internal combustion engine vehicles present a pathway to utilize existing ICE technology with zero CO2 emissions. Companies like Toyota have demonstrated the viability of hydrogen-powered engines in motorsports, showcasing their potential for broader applications. Additionally, E-fuels, synthesized using captured CO2 and hydrogen from renewable sources, serve as carbon-neutral drop-in replacements for conventional fuels. They offer the advantage of computability with existing ICE infrastructure, potentially extending the relevance of ICE vehicles in a carbon-constrained future.

Given these developments, petrol stations in Europe and Germany are at a strategic inflection point. To remain viable, petrol stations are evolving into multi-energy service hubs, integrating ultra-fast EV chargers, hydrogen refuelling stations, and biofuels. Embracing technological advancements such as cashless transactions, mobile payments, and AI-driven inventory management enhances operational efficiency and customer experience.

Despite these adaptations, the industry faces significant challenges. Market consolidation is accelerating, as operators reassess their portfolios in response to falling fuel sales and rising investment requirements. BP’s planned sale of all 310 petrol stations in the Netherlands by 2025 underscores the shift, with similar trends expected in Germany as oil majors and independents restructure their asset base. The high cost of infrastructure upgrades, particularly for hydrogen refuelling and ultra-fast EV charging, poses another hurdle, requiring strategic partnerships and public-private investments to ensure financial viability.

Smart energy & digitalization

The energy transition isn’t just about hardware—it’s also about digital transformation. Across Europe, smart meters, AI-driven grid management, and digital energy platforms are reshaping the sector for greater efficiency and flexibility.

Germany, historically slow in smart meter adoption, is accelerating installations due to new regulations, with only 11% of households equipped by mid-2024 but rapid growth expected in 2025. Smart meters are crucial for real-time pricing, demand response, and better integration of solar and battery storage.

Beyond metering, AI and advanced analytics are improving demand forecasting and grid stability, while smart grid hubs and digital trading platforms are emerging to enhance energy market participation. Prosumer services are also expanding, with energy retailers offering apps for real-time consumption tracking and 24/7 renewable energy matching.

2025 is set to be a breakthrough year, with EU-backed funding supporting smart grid expansion, EV smart charging, and vehicle-to-grid (V2G) pilot projects in Germany. As cybersecurity becomes a growing concern, utilities are ramping up protections.

The digitalization of energy unlocks new business opportunities, from energy management software to data analytics and energy-as-a-service models. Markets like Germany, Scandinavia, and the Netherlands are leading this shift, moving smart energy solutions from pilot phase to mainstream adoption.

Alternative fuels sector

Hydrogen remains a key pillar of Europe’s energy transition, but high costs and infrastructure gaps continue to hinder large-scale adoption. The EU aims to produce 10+ million tons of renewable hydrogen annually by 2030, yet most projects depend on government subsidies or contracts for viability. Germany is advancing its Hydrogen Network Act, but a fully operational hydrogen pipeline system is unlikely before 2032, requiring interim solutions such as on-site hydrogen production and road transport. Green hydrogen remains 2–3 times more expensive than fossil-based alternatives, slowing adoption in industries where cost competitiveness is essential. Despite these challenges, investments in hydrogen-ready power plants, industrial decarbonization, and joint ventures between oil & gas majors are increasing, reflecting long-term confidence in hydrogen’s role in heavy industry, refining, and transport.

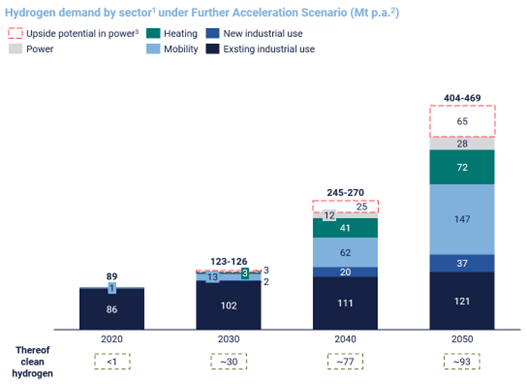

Click here to view the hydrogen demand by sector chart

Source: McKinsey 2023.

Notes: 1) Fading momentum scenario: Delayed uptake of fuel cell electric vehicles in road transport as well as uptake of alternative fuels in aviation drives lower hydrogen demand; 2) Net-zero commitments achieved by leading countries through purposeful policies with followers transitioning at slower pace; 3) Includes conventional fuels refining and biofuels hydrogeneration and refining

At the same time, biofuels and biomethane are gaining traction as viable alternatives for reducing emissions in hard-to-electrify sectors. Under REPowerEU, the EU aims to increase biomethane production to 35 bcm by 2030, a tenfold jump from 2020 levels, with auction schemes and feed-in premiums supporting this expansion. Germany, which already operates thousands of biogas plants, is shifting focus toward upgrading biogas into biomethane for direct grid injection, reducing reliance on natural gas imports. Meanwhile, cellulosic ethanol, renewable diesel, and waste-based biofuels are seeing rising investment as EU policies tighten restrictions on food-based biofuels. Germany is also considering a full transition to renewable gases in its gas grid by 2045, reinforcing biomethane’s role in industrial heating, power generation, and transport.

With increasing regulatory support and investor interest, both hydrogen and biofuels present significant opportunities, from scaling biomethane infrastructure to forming hydrogen supply chain partnerships. As Europe phases out fossil fuels, alternative fuels will remain critical for industries where direct electrification is not feasible.

EV charging infrastructure

Europe’s EV charging network is expanding rapidly, with ultra-fast chargers being deployed along highways and in urban areas. By Q1 2025, nearly all major European highways are set to have fast chargers (≥150 kW) every 60 km, mandated by EU regulations, ensuring long-distance travel is viable. This has driven strong public and private investment, with operators like Ionity, Fastned, EnBW, and TotalEnergies significantly expanding their networks.

Despite this growth, utilization remains uneven, with high-traffic corridors thriving while some rural stations struggle. This has financial implications—Numbat’s 2024 bankruptcy highlighted the challenges of sustaining early-phase charging startups. Larger, diversified players like BP Pulse and Shell Recharge are better positioned, leading to increased consolidation and partnerships in 2025, particularly in fleet charging for logistics and delivery companies.

Technological advancements are improving, charging speed and efficiency. Ultra-fast (350 kW) chargers are becoming standard, adding ~300 km of range in 10 minutes, while megawatt charging for trucks and buses is being piloted. Payment systems are also evolving—EU rules now require card payment and ad-hoc access, enhancing convenience.

Looking ahead, focus is shifting from expanding charger count to optimizing grid integration. Utilities are investing in smart charging solutions, battery storage, and vehicle-to-grid (V2G) technologies to manage demand efficiently. As EV adoption rises, charging infrastructure is becoming a more stable, attractive investment, with M&A activity increasing as larger players acquire smaller networks and fuel retailers expand into electric charging assets.

2025 M&A outlook and conclusion

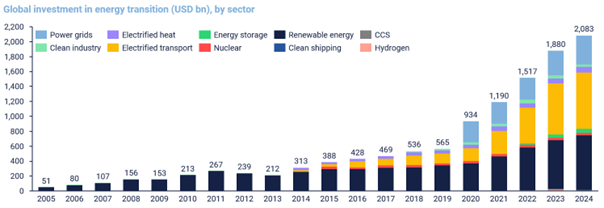

The European energy sector remains one of the most active M&A markets, driven by strong capital flows into renewables, storage, and grid infrastructure. In 2024, global energy transition investments exceeded $2 trillion, with Europe playing a key role. Private equity and infrastructure funds continue to dominate transactions, targeting renewable platforms, battery storage assets, and offshore wind developments.

Click here to view the global investment in energy transition chart

Source: BloombergNEF, Energy Transition Investment Trends 2025.

Notes: Start year differs but all sectors are present from 2020 onwards. Most notably, nuclear figures start in 2015 and power grids in 2020. CCS refers to carbon capture and storage.

Key M&A trends include consolidation among mid-sized developers, large-scale platform acquisitions, and growing interest in storage and hydrogen projects. Oil majors and utilities are restructuring portfolios to accelerate their shift into clean energy, while cross-border transactions remain strong, with North American investors particularly active in European renewables. Integrated energy infrastructure deals, bundling generation, storage, and grid assets, are also rising as investors seek diversified revenue streams.

Looking ahead, offshore wind, battery storage, and grids will remain M&A hotspots, with investor demand for stable, long-term assets. Risks such as high interest rates, policy execution delays, and supply chain constraints could slow down activity, but favourable regulatory frameworks continue to drive dealmaking.

As Q1 2025 concludes, momentum in Europe’s energy transition remains strong, with renewables, storage, and hydrogen leading investment activity. Wind and solar are set for record growth, while energy storage moves from pilot to mainstream, supporting grid flexibility. Hydrogen investment is ramping up, though commercialization challenges persist.

M&A activity will remain robust, particularly in offshore wind, battery storage, and integrated energy solutions. While policy execution and supply chain risks require careful navigation, investor appetite for energy infrastructure remains high. With strategic partnerships and targeted acquisitions, Europe’s clean energy transition offers compelling opportunities for dealmakers in 2025 and beyond.

[1] Blas, J. (2024, January 18). You switched the lights on. Traders made billions of dollars. Bloomberg Opinion.

[2] Enerdatics. (2024). Here’s Your Exclusive Access to Enerdatics’ Annual M&A Report: A breakdown of energy transition M&A trends in 2023 and key insights for 2024. Energy Central.

[3] European Commission. (2024, May 13). REPowerEU – 2 years on. Directorate-General for Energy.

[4] Rosslowe, C., & Petrovich, B. (2025, January 23). Five years of progress – European Electricity Review 2025. Ember.

[5] Roy, S. R. C. (2025, February 27). WindEurope: Europe added 16.4 GW of new wind energy capacity in 2024. WindInsider.

[6] Review Energy. (2024, December 17). EU solar market hits record 65.5 GW in 2024, but growth slows down.

[7] Wettengel, J. (2024, July 17). Germany set to miss 2030 offshore wind expansion target – industry. Clean Energy Wire.

[8] reNews. (2025, February 17). 2024 saw surge in corporate PPA signings.

[9] Norman, W. (2025, January 30). EU PPA market defined by falling prices, corporate demand and political shifts. PV Tech.

[10] European Commission, Joint Research Centre. (n.d.). European Energy Storage Inventory. JRC Smart Electricity Systems.

[11] European Energy Exchange (2024 January 14).

[12] McKinsey & Company. (2024, September). Global Energy Perspective 2024. Energy Solutions, Global Energy & Materials Practice.

[13] FuelsEurope. (2023). Vision 2050: A pathway for the evolution of the refining industry and liquid fuels.

[14] Sia Partners. (2024). Energy Stations of the Future: How fuel distribution networks will have to reshape their businesses by 2050.

[15] EVBoosters. (2024, January 23). Corporate EV adoption in EU lags behind private households, raising concerns