To accelerate economic growth, he recommended implementing “quick win” measures within 3–6 months to swiftly restore investor confidence, attract foreign investment, and revitalise the capital market.

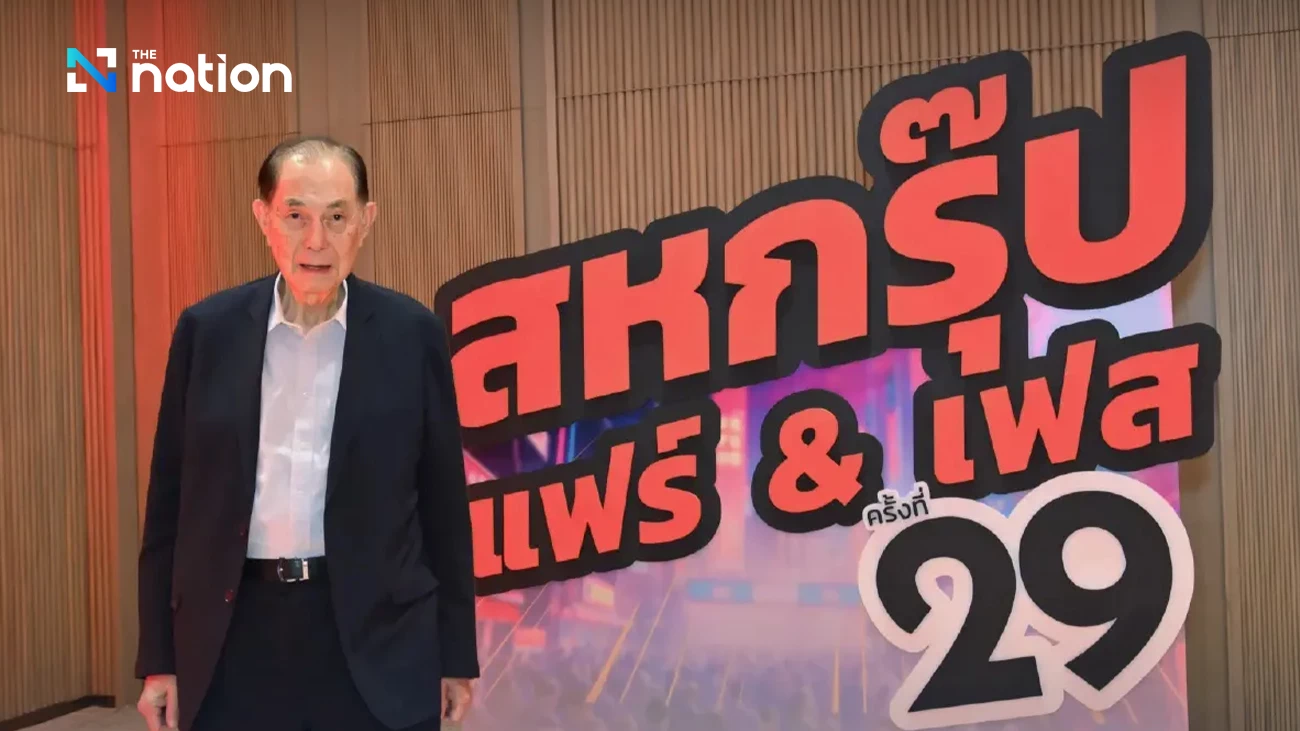

He explained that Saha Group has strengthened partnerships with Japanese businesses to operate in Thailand, reaffirming that Japanese investors continue to trust the Thai market despite economic struggles in Japan.

“When the economy is strong, consumer purchasing power rises. Quick win policies must instil confidence in investors. Many countries wish to invest in Thailand, but our measures are slow to be enacted,” he said.

For medium- to long-term strategies, Boonsithi urged the government to push forward large-scale investment projects, including the expansion of the Eastern Economic Corridor (EEC), development of a southern land bridge, and reconsideration of the Kra Isthmus canal project to improve Thailand’s logistics network, facilitating direct exports to Europe without bypassing the Malacca Strait, while also fostering trade with Taiwan and Japan.

“With the EEC, we need a complementary southern corridor. The land bridge is crucial—akin to having economic zones on both the left and right. The EEC itself should be expanded. Most importantly, the Kra Isthmus should be developed,” he said.

“These initiatives will bolster Thailand’s economy, but currently, no action is being taken—just discussions without execution. Bold decisions are needed, even if some nations hold differing views.”

However, he dismissed direct cash handout measures, arguing that they do not contribute to real economic growth but are merely political campaigning tools.

“There are numerous measures that could stimulate the economy. National development projects foster genuine growth, whereas cash giveaways are absent from economic textbooks—they belong in electioneering manuals,” he remarked.

Boonsithi reiterated that Saha Group’s investment strategy aligns with natural market trends, adjusting speed accordingly and prioritising global partnerships. He outlined the company’s focus on high-growth industries such as food, real estate, and services, while noting that fashion, clothing, and textiles are currently facing downturns.

“Saha Group has weathered numerous economic fluctuations. When the economy thrives, we grow; when it declines, we still expand, albeit at a slower rate. Some may perceive us as lagging behind others, but all our growth stems from solid foundations,” he said.

“Additionally, our business prioritises stability, risk management, and financial security, avoiding excessive reliance on loans or foreign debt,” he concluded.