What’s going on here?

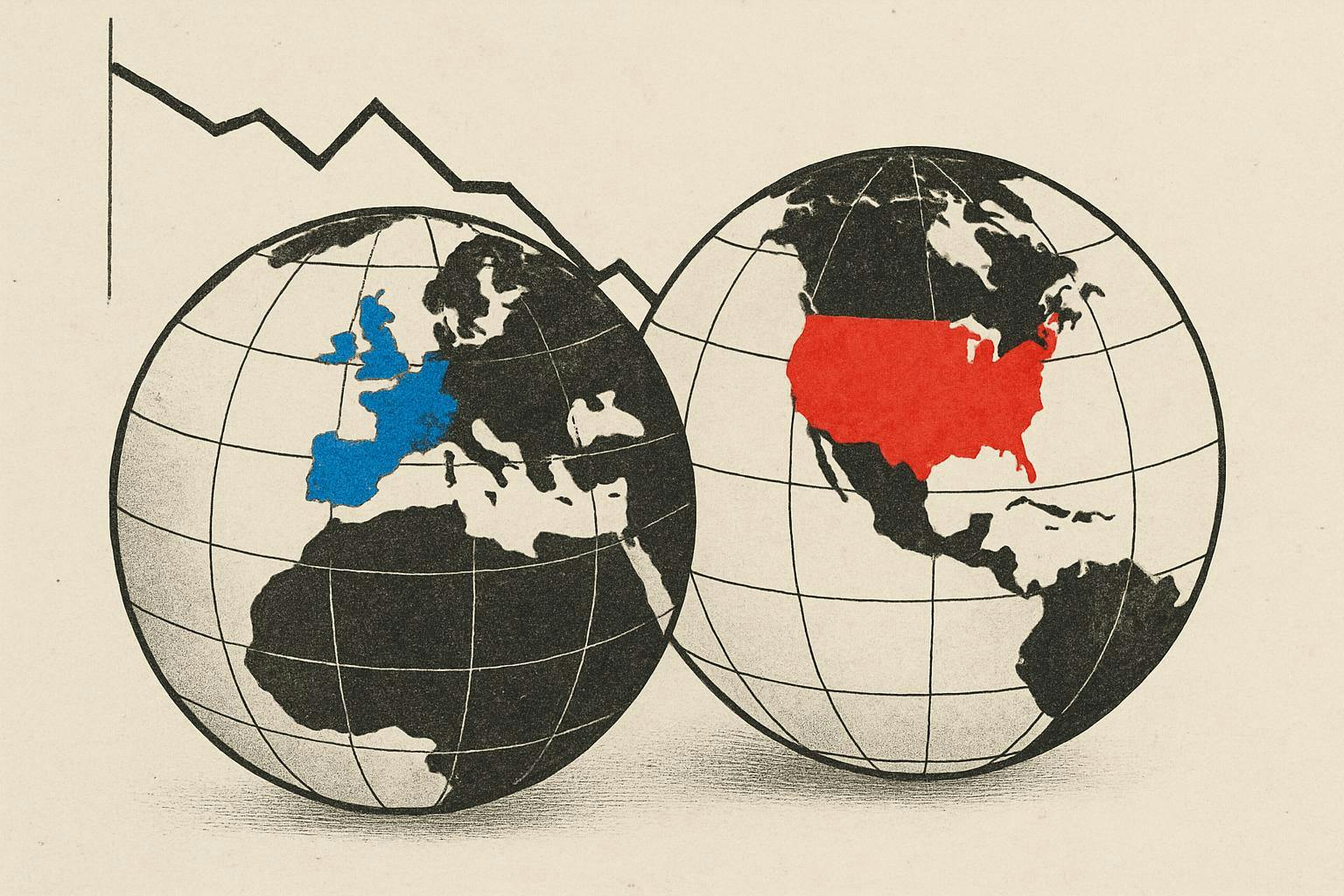

European markets took a downturn with major indices sliding, just as the US and UK announced a big trade deal at the G7 Summit.

What does this mean?

The Stoxx Europe 600 dropped by 0.80%, Germany’s DAX fell 1.1%, France’s CAC 40 dipped 0.76%, and the FTSE 100 decreased by 0.46%. These declines came amid mixed signals, like Germany’s ZEW economic sentiment indicator rising to 47.5 points, hinting at potential recovery. The new US-UK trade deal could boost exports like beef and ethanol, enhancing transatlantic ties. Meanwhile, stocks like Ferrari fell due to delayed luxury EV plans, and Unilever shares slipped slightly amid changes in its ice cream sector leadership. On the upside, TotalEnergies gained 2% after securing a 25-year offshore wind concession in the North Sea.

Why should I care?

For markets: Cautious steps in a shifting landscape.

European market dips reflect ongoing challenges, from fluctuating demand for luxury goods like Ferrari’s EVs to strategic shifts at Unilever. Yet, opportunities like TotalEnergies’ wind project present positive paths in renewable energy investments.

The bigger picture: Global partnerships reshape alliances.

The US-UK trade agreement marks shifting international dynamics, offering new trade opportunities amid evolving geopolitical alliances. Such deals could impact global economic strategies and business decisions worldwide.