What’s going on here?

US markets took a hit as oil prices climbed and geopolitical tensions in the Middle East heightened investor worries.

What does this mean?

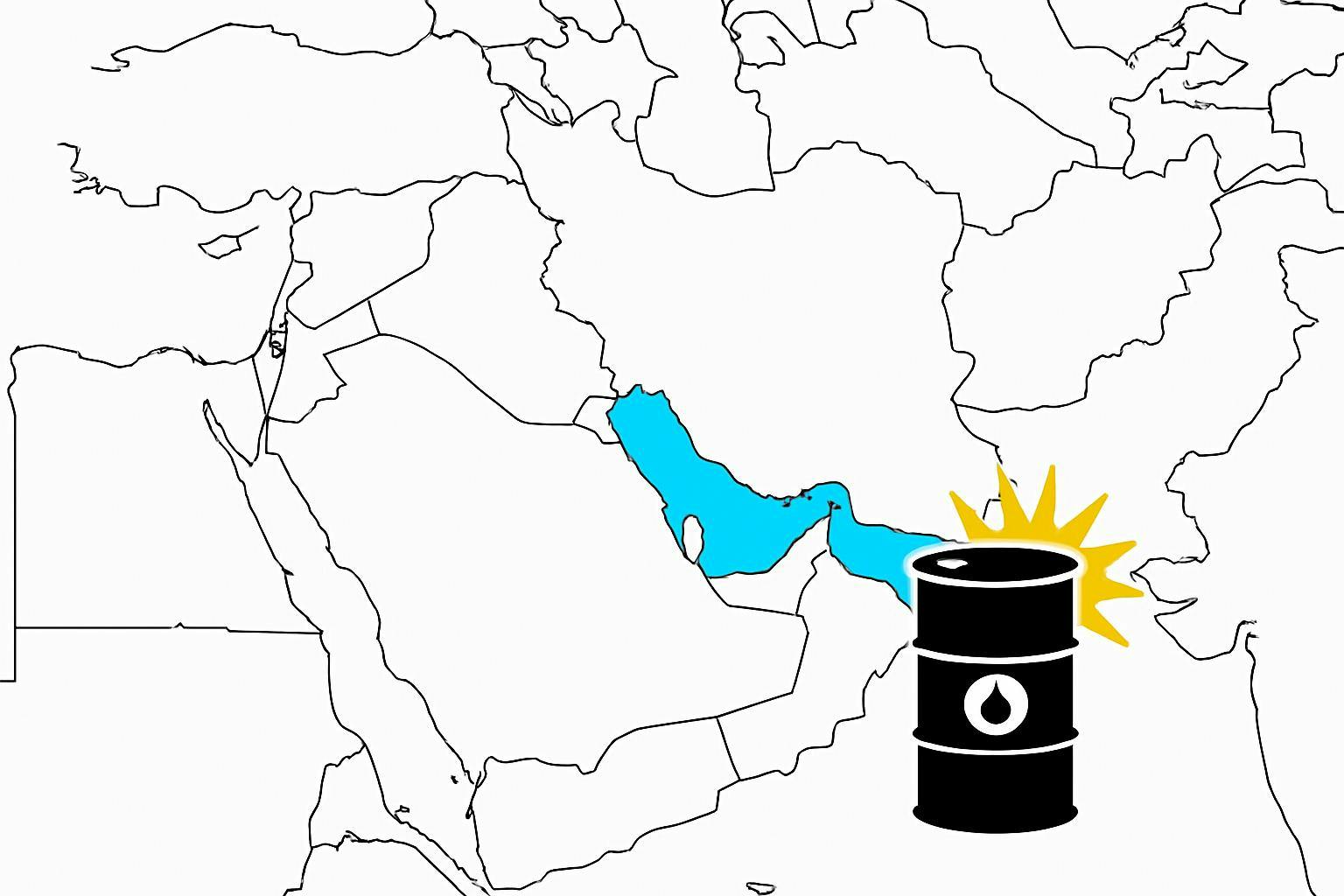

US indexes, including the Nasdaq, S&P 500, and Dow, dipped noticeably due to rising oil costs and escalating tensions involving Iran. West Texas Intermediate crude jumped 3.5% to $72.71 a barrel, with concerns over the Strait of Hormuz playing a central role. These developments, along with weaker-than-expected retail sales and industrial production, have cast a shadow over market sentiment. Consumer spending fell more than anticipated in May, and US industrial output also lagged. The plummet in solar stocks followed a Senate proposal to phase out clean energy tax incentives gradually.

Why should I care?

For markets: Oil and turmoil shake investor confidence.

The correlation between oil price hikes and investor unease is clear, as markets react to geopolitical factors and economic indicators. As Treasury yields fell, hinting at a shift toward safer investments, the energy sector’s struggles may signal challenges ahead.

The bigger picture: Global tensions mold economic landscapes.

The situation underscores how international relations reshape economic strategies. With retail and industrial data revealing vulnerabilities, stakeholders must consider how global shifts and energy dependencies could redefine economic and policy frameworks.