Intelligence on natural gas market fundamentals presented by NGI’s data and price analysts

Expand

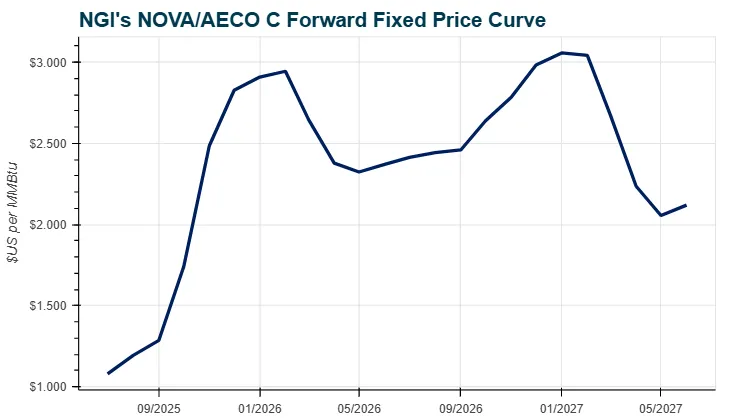

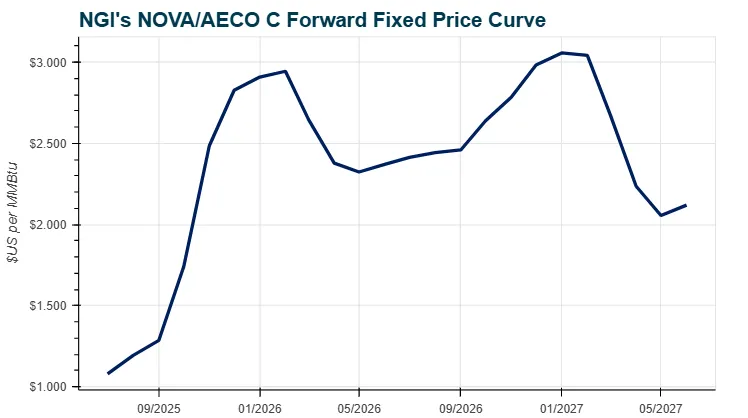

LNG Canada in British Columbia (BC) has confirmed it has achieved first production of LNG for export over the weekend. When fully operational next year, LNG Canada will have an export capacity of 14 million tons/year (~2.0 Bcf/d).Daily prices in Western Canada were mixed on Monday, with Westcoast Station 2 up C28.0 cents to an average of C41.0 cents/GJ and other locations nearly flat or lower. This compared to U.S. benchmark Henry Hub prices that averaged US$3.515/MMBtu and Asia’s Japan Korea Marker prices that averaged close to $14.50.Coastal GasLink pipeline, the intrastate feed gas pipeline, reported zero receipts from the Willow Valley connection near Dawson Creek, BC, according to Wood Mackenzie data. Nevertheless, there are three LNG tankers slated to take on LNG from LNG Canada: the Gaslog Glasgow arriving Wednesday, the Peteri Seijinang set to arrive July 6 and the Diamond Gas Crystal scheduled for August 14. All have a carrying capacity of around 2.5 Bcf.Now that LNG Canada is in service, there could be increased trading of Western Canadian natural gas and the potential for new markets to emerge. At the same time, Canada natural gas exports to the Lower 48 could also decrease over time because of the new premium outlet for Canada natural gas.Both of these scenarios would likely prop up prices for natural gas in the Western U.S. market. On Monday, the western United States/Rockies imported a net 3.13 Bcf of gas from Canada, while flows into the Midcontinent region were 3.62 Bcf. Prices, meanwhile, were generally in the $2.000-3.000 range.