Hey everyone,

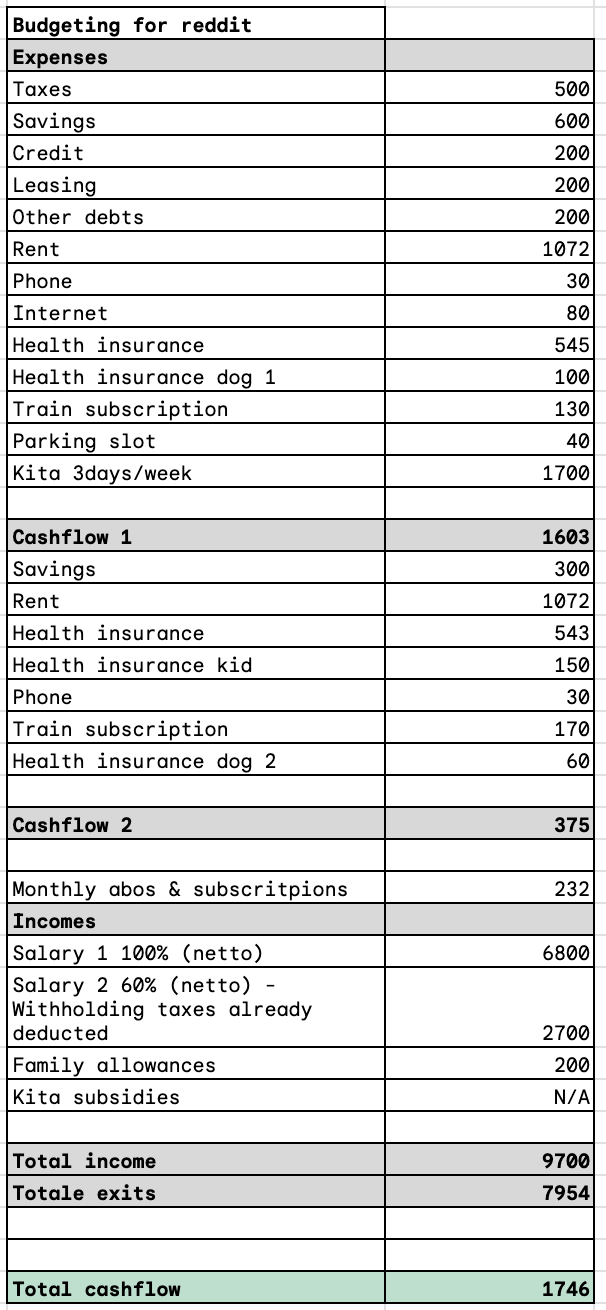

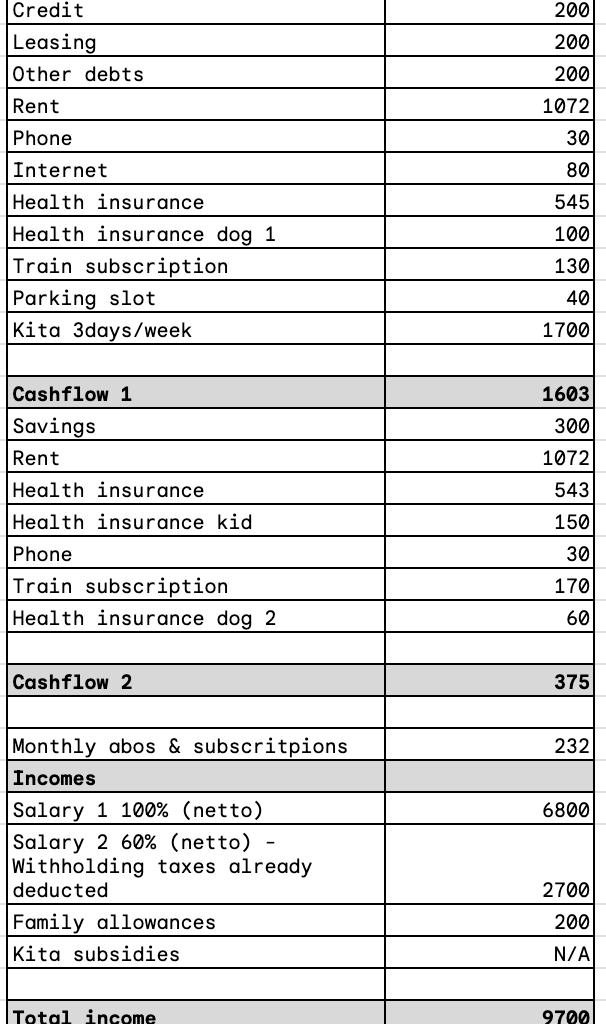

My partner and I are expecting our first child in 2026 and I’ve started planning our family budget well in advance. We’re both employed (one at 100%, the other will be at 60%) and live in a municipality in Canton Zurich.

Our municipality only grants Kita subsidies for families with an annual (taxable) income below CHF 105’000/year, which we exceeded this year — so we’ll only qualify from 2027 onward (based on 2026 income).

We’re planning 3 days of Kita per week, and without subsidies it will cost us ca. CHF 1’700/month 😵💫. I’ve shared our detailed budget below (fixed expenses, two salaries, insurance, etc.). Despite everything, our monthly cashflow is still around CHF 1’700 positive, which is comforting, but not bulletproof considering that food, pampers, clothes, exits, trips ecc. are not included.

Is annoying to know that without the cost of the kita we could affort trips, restaurants etc. and in general a way better lifestyle than with it. I mean, is very expensive. The first 4 months of maternity leave will be quite comfortable, considering we don't have to pay it. Note: we don't have grandparents nearby, so this is not an option.

What do you think? Any suggestions?

by Existing-Complex964

5 comments

Your rent is crazy low for an appartment that offers enough space for 3 people and 2 dogs. How did you do that? And family allowance was increases to 213 as of 2025, not life changing, but better than nothing 😉

Regarding Kita, thats why we did not send our kids there, just too expensive and it didn‘t make sense in the end.

Clothes, toys, stroller and other necesities should also be accounted. Depending on your preferences and quality, these can vary a lot pricewise.

Then pampers, wipes, formula etc.

Also, where is the groceries counted?

You might need to rethink it entirely.

You should post this on r/SwissPersonalFinance

But anyway, yeah having a child is expensive and you loose on opportunities to travel, go out etc. I think that you manage do to pretty nice, you still end up with a comfortable positive cash flow. Maybe you can already start putting aside money for him/her? Let this grow over the years through investments in etfs

I personally don’t consider Kita as being part of the cashflow, but as a down payment of 36-48 times the monthly fee. That way the money is gone, and the budget looks balanced.

It’s a bit like buying a (very) expensive car.

So we learn that less cashflow will total in more cashflow?

FYI. A certain amount of daycare costs can be deducted from taxable income.

You cannot do much and need to get through. As long as you don’t want to reduce working percentage or work differente shifts.

General „family advice“. I recommend the father to spend at least one day a week alone with the children. So he is also able to manage it alone and can connect to his kids.

Comments are closed.