Passengers on the SS Wall Street spent much of last week rushing from the fear-side of the ship to the greed-side scooping up risk as they scurried across the poop deck.

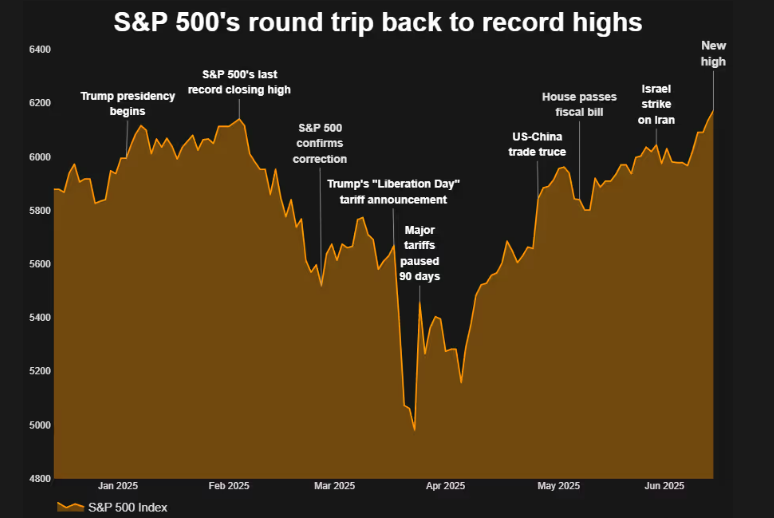

By Friday’s close, the S&P 500 closed at a new record high at 6,173 points after gaining 0.5% across the day and 3.4% over the week.

The tech-centric Nasdaq also closed at a record high, up 0.4%, while the blue-chip Dow put on 1%.

The ASX, however, looks stuck in the doldrums today with futures trading pointing to a gain of less than 0.1% on opening.

The S&P 500’s recovery since its April low has been impressive, rebounding 24%.

The 89 trading days since its previous record back in February makes it the fastest recovery following a 15% or more drop in Wall Street history.

S&P 500 this year (Reuters, Datastream)

S&P 500 this year (Reuters, Datastream)

The buying has been spurred on by the perception that various crises have been averted.

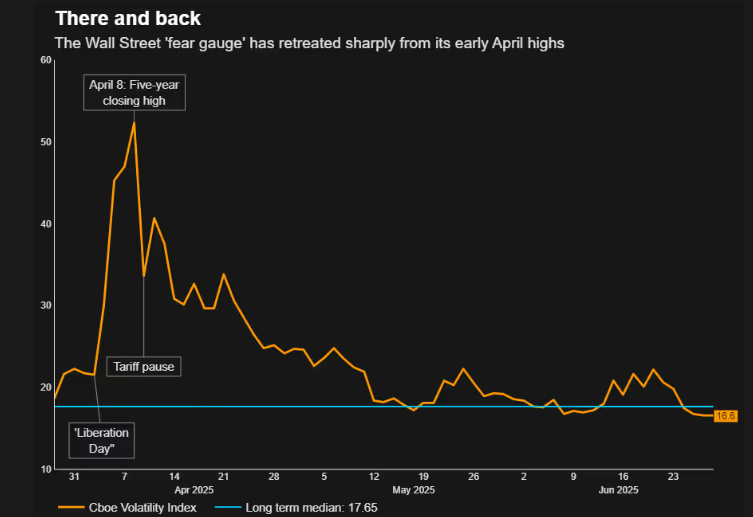

The so-call “fear gauge”, the Chicago Board Options Exchange Vix Index, having spiked in April just after the “liberation day” tariff announcement, has slid back to its long-term average.

The Vix “fear” index (CBOE, Reuters, Datastream)

The Vix “fear” index (CBOE, Reuters, Datastream)

Fears about the impact of President Trump’s tariff and tax policies have receded, hope that rate cuts are on their way have risen, while corporate profits have been much stronger than expected.

According to LSEG IBES first-quarter earnings season for S&P 500 companies rose 13.7% from a year earlier, compared to an expected 8% gain back in April.

“This was one of the most furious comebacks ever from a near bear market, as trade worries were overblown, but so were all the recession calls,” Carson Group chief market strategist, Ryan Detrick, told Reuters.

“The economy is hanging in there and overall, first-quarter earnings were quite solid, sparking the huge rally.”

The return of the so-called “Magnificent Seven” mega-cap tech and growth stocks to favour have been a very large part of the rebound.

That group, which includes Microsoft, Nvidia and Amazon has jumped about 37% against a 24% rise for the S&P 500.

The US dollar was little changed, although the Australian dollar lost a bit of ground after a rally last week.

US Treasuries were modestly higher, although they eased late in the session on expectations the Fed was a fair bit closer to resuming rate cuts than previously anticipated.

Oil recovered some composure after shedding around 12% last week.

The price cratered after traders saw little prospect of a major supply disruption in the Middle East.

Gold also lost a little shine (-1.7%) in the investor race to re-embrace risk.