Intelligence on natural gas market fundamentals presented by NGI’s data and price analysts

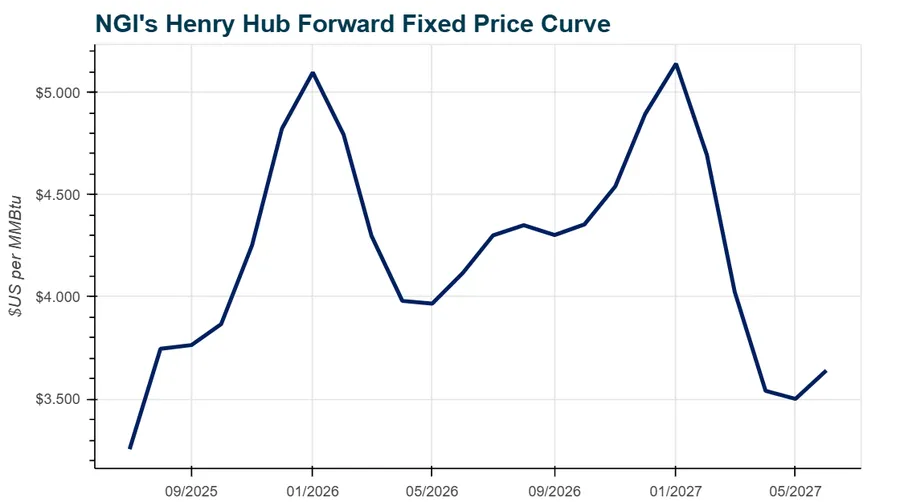

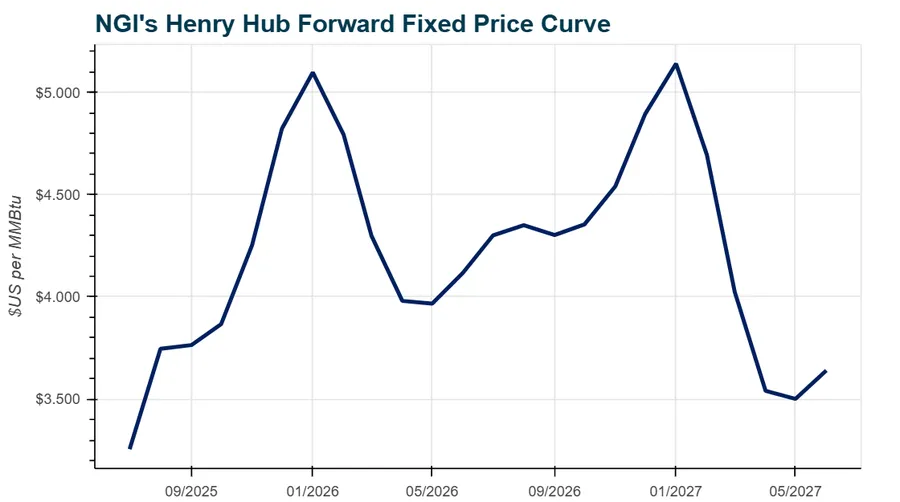

In its own version of “easy come, easy go,” the August Nymex Henry Hub futures contract rallied from the bottom to the middle of its 20-day Bollinger Band at $3.750/MMBtu on Friday, only to see an about face back toward the bottom of that band to start the week. August opened Monday at $3.735 but then dipped below $3.600 in early trading.If the prompt month is able to take out $3.500, which is a fairly important support level on its own based on five failed tests of that level since mid-May, the contract faces secondary support at $3.465, the bottom of the Bollinger Band.$3.465 is all the more important of a support level from a purely technical standpoint. There is not much in terms of technical patterns or previous reactionary lows that could potentially slow a march toward the $2.974 low the August contract posted on Nov. 4, 2024.But slow stochastics are starting to reach oversold status, and that could help August defend a move below $3.465. Moreover, spot market prices should serve as something of a moving support level for August futures as well. NGI’s Daily Henry Hub index averaged $3.225 on Friday.If August were to rally, it would first need to break above its 200-day simple moving average of $3.712, followed by another test of the middle of its 20-day Bollinger Band, which now sits at $3.745. From there, the top of the 20-day Bollinger Band comes into play at $4.027.