Friday, July 4, 2025

In May 2025, Greece led the pack in European hotel growth with the top revenues and occupancy gains, while Spain, Portugal, Italy, and Switzerland achieved healthy gains as well, reinforcing the dominance of Southern Europe in the European hospitality market. Greece achieved an extraordinary fourteen point nine percent revenue spike and nine point eight percentage point occupancy increase that could not be topped, but its neighbors achieved competitive averages—reinforcing a larger regional pattern of continued tourist demand, smart pricing, and seasonal savvy.

In May 2025, Greece emerged as the leading European country in hotel performance, outpacing long-established tourist destinations such as Spain, Portugal, Italy, and Switzerland. New data indicates a notable increase in both revenue and occupancy rates for Greek hotels, reflecting the nation’s growing appeal and strategic pricing. While other southern European countries also posted solid gains, it was Greece that set a new continental benchmark. The figures highlight how shifting travel demand and competitive positioning are reshaping the hospitality landscape across Europe.

Greece Tops the Continent in Hotel Growth

Greece reported the most substantial growth in hotel sector performance among sixteen European countries, driven by a remarkable fourteen point nine percent year-on-year rise in revenue per available room and a nine point eight percentage point increase in occupancy rates for May 2025. These surges not only placed Greece at the top of the rankings for growth but also pushed its average hotel revenue to one hundred fifty-four euros and seventy cents—making it the second-highest in Europe, just behind Italy.

Despite maintaining near-constant pricing strategies, as reflected in a slight zero point three percent dip in average daily rates, Greek hoteliers successfully attracted more guests without sacrificing profitability. This strategic approach helped Greece combine affordability with appeal, solidifying its position as a leading destination.

Italy Maintains High Average Revenue Levels

While Greece led in growth, Italy retained the top spot in terms of absolute hotel revenue. Italian hotels recorded an average of one hundred sixty-two euros in room revenue for May 2025. This performance illustrates Italy’s continued dominance in attracting high-spending tourists, largely thanks to its enduring global appeal and diversified tourism offering—from cultural cities to coastal escapes.

Although Italy didn’t experience the highest growth rate, its stable revenue base confirms the country’s resilience and ongoing popularity in a competitive travel market.

Switzerland and Portugal Post Competitive Revenue Numbers

Switzerland secured a position just behind Greece, with hotel revenues averaging one hundred forty-one euros, reflecting its firmly established presence within Europe’s competitive hospitality landscape. The high figure likely reflects Switzerland’s consistent performance in the premium travel segment, bolstered by its reputation for alpine destinations, wellness tourism, and upscale experiences.

Portugal also held a strong position with average hotel revenue reaching one hundred thirty-four euros and fifty cents. Though not achieving the same growth momentum as Greece, Portugal’s solid revenue figures highlight its stable and well-managed hospitality market.

Spain Continues Positive Momentum Amid Strong Seasonal Demand

Spain recorded average hotel revenue of one hundred twenty-nine euros and fifty cents, driven by a favorable climate and strategic event scheduling. A reported eight percent increase in room rates helped the country capitalize on strong demand, with warm weather drawing travelers across the Iberian Peninsula during the late spring shoulder season.

Though Spain did not reach the upper tier in terms of growth percentages, its continued upward trend reflects sustained popularity and effective market adaptation.

Wider European Trends Reveal Mixed Performance

Across Europe, hotel performance varied considerably. The overall continental market registered a four point seven percent increase in revenue per available room. This growth stemmed from a combination of rising average daily rates, which went up by two point four percent, and a one point six percentage point boost in occupancy levels.

Nevertheless, hotel performance varied significantly across different European markets. While some countries posted strong gains, others recorded flat or negative results, underscoring the uneven recovery and competitiveness of the European hospitality sector.

Latvia, Austria, Poland, and Germany Join the Fast-Growing League

Outside of southern Europe, several underdog markets showed impressive year-on-year growth in hotel revenue. Latvia led the broader European cohort with a seventeen point nine percent rise in performance, followed closely by Austria at fourteen point eight percent, Poland at thirteen point two percent, and Germany at eleven point nine percent.

Germany’s boost in revenue was partially attributed to hosting the UEFA Champions League final, which significantly drove demand in key cities. These sharp increases highlight the shifting dynamics of European travel, where emerging and mid-size markets are gaining ground against traditional leaders.

UK Registers the Only Decline Among Major Markets

The United Kingdom was the sole major European market to report a decline in hotel performance for May 2025. Revenue fell by one point eight percent, with both occupancy and average daily rates remaining stagnant. This underperformance places the UK in contrast to most of Europe, where moderate to high growth was the norm. The results signal potential challenges in competitiveness, pricing, or international perception.

Growth Driven by Mid-Range and Luxury Segments

Analyzing the performance by segment, mid-range and luxury hotels were the primary contributors to Europe’s overall hotel growth in May 2025. Mid-range properties recorded a five point one percent increase in revenue, while luxury hotels posted a six point two percent rise. Occupancy levels in both segments also grew by over two percentage points, indicating rising consumer confidence and spending power in premium travel.

This trend suggests that travelers are seeking enhanced comfort and value, with many willing to invest in upgraded accommodations, particularly in top leisure destinations like Greece, Italy, and Switzerland.

Price Strategy Proves Critical in Competitive Markets

The findings also highlight the importance of effective pricing strategies in maintaining competitiveness. Greece’s deliberate move to keep average daily rates stable, while maximizing occupancy, paid off with the highest growth in Europe. In contrast, other countries that relied too heavily on pricing increases without boosting demand—such as the UK—saw weaker or negative returns.

These outcomes emphasize the need for balance between rate optimization and market attractiveness, particularly during seasonal transitions like spring and early summer.

Southern Europe Reinforces Its Tourism Strength

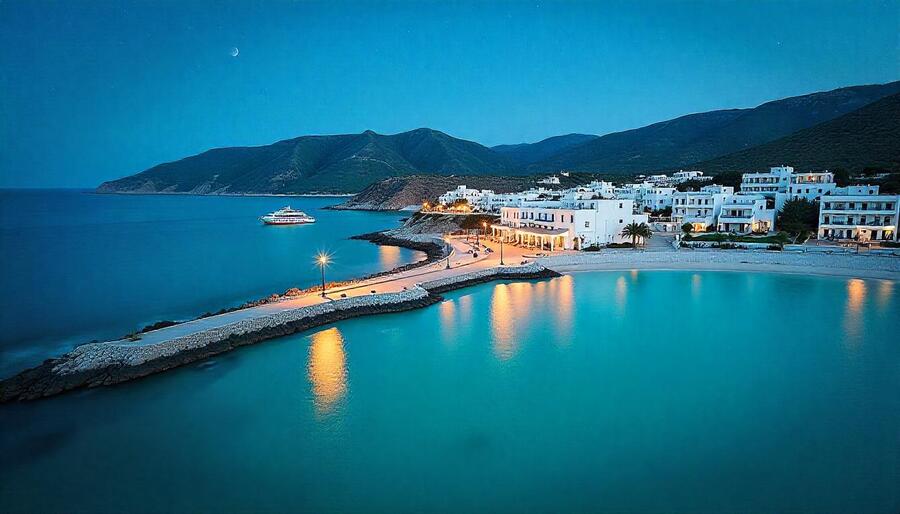

With Greece, Italy, Spain, Portugal, and Switzerland all ranking high in terms of revenue and performance, southern Europe reaffirmed its status as the continent’s tourism powerhouse. This region consistently delivers strong returns due to its rich cultural offerings, favorable climates, and well-developed infrastructure.

The robust numbers from these nations suggest that travelers are prioritizing well-known, scenic destinations with a blend of affordability, access, and amenities.

Seasonal Events and Weather Patterns Influence Travel Flows

Event-driven tourism and favorable weather conditions were pivotal in shaping May’s results. Germany’s performance spike from sports events and Spain’s advantage from sunny weather demonstrate how external factors can impact hotel occupancy and revenue. For destinations aiming to replicate this success, coordinated scheduling of major events and leveraging seasonal trends could be key drivers of future gains.

As the European hotel market continues to evolve, the performance of Spain, Portugal, Italy, and Switzerland demonstrates solid momentum, especially within the context of a competitive and dynamic tourism sector. Yet, it was Greece that led the charge in May 2025, setting new benchmarks in revenue growth and occupancy rates while maintaining stable prices.

Greece topped Europe’s hotels industry in May 2025 with the strongest revenue and occupancy growth, while Spain, Portugal, Italy, and Switzerland also turned in healthy results that solidify Southern Europe as the tourism powerhouse of the continent.

This combination of strategic pricing, growing demand, and improved infrastructure positions Greece as a model of how tourism economies can balance value with volume. Meanwhile, the strong showings from its southern European neighbors underscore the continued resilience and allure of the region in attracting global travelers. As summer progresses, all eyes will be on whether these trends can sustain or accelerate in the months ahead.

«Enjoyed this post? Never miss out on future posts by following us»