The killing of Russian Major General Mikhail Gudkov in July 2025—a key architect of naval combat operations—and the U.S. pause in military aid to Ukraine have created a volatile new chapter in the Russia-Ukraine war. These twin developments have intensified conflict dynamics, reshaped strategic priorities, and opened critical investment opportunities in defense and energy sectors. For investors, the interplay of geopolitical risk and technological innovation is now a primary driver of returns in these spaces.

Defense Sector: The Air Defense Arms Race

The U.S. suspension of Patriot missile shipments to Ukraine has exposed a glaring vulnerability in Kyiv’s ability to counter Russia’s drone and missile onslaughts. With Russian attacks hitting record levels—over 5,438 drones launched in June 2025 alone—demand for air defense systems is surging globally. This creates a structural tailwind for companies like Raytheon Technologies (RTN), which manufactures the Patriot system, and Lockheed Martin (LMT), a leader in radar and missile defense.

The PRXY ETF, which tracks defense and aerospace companies, has outperformed the S&P 500 by 22% since 2023, reflecting growing geopolitical anxiety. Investors should also consider BAE Systems (BAESY), a UK firm with expertise in naval defense, as European nations ramp up spending to offset U.S. aid gaps.

Cybersecurity: With Russia’s cyberattacks on energy grids and defense networks intensifying, firms like Palo Alto Networks (PANW) and CrowdStrike (CRWD)—specializing in threat detection and infrastructure protection—are poised for growth. The conflict’s digital dimension is a multiplier for these sectors.

Energy Sector: Supply Chain Disruptions and Renewable Plays

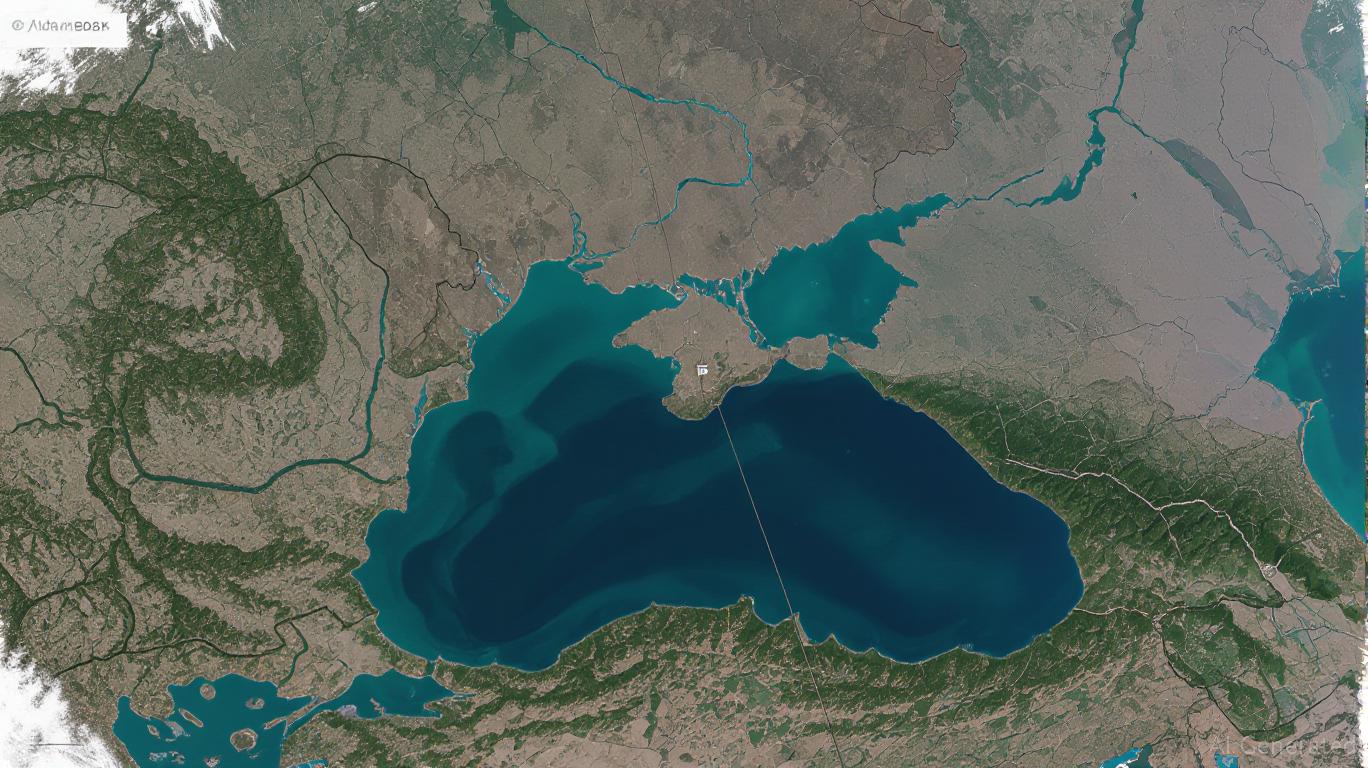

The war has become a pressure test for global energy markets. Russia’s partial reliance on Ukrainian ports for grain exports and Ukraine’s control over critical Black Sea energy routes have created chokepoints. Investors should focus on three areas:

Oil and Gas Infrastructure: Companies like Chevron (CVX) and ExxonMobil (XOM), which are expanding LNG terminals in the Mediterranean and Caspian Sea to bypass Russian pipelines, are critical to diversifying supply chains. Renewables and Energy Independence: The conflict has accelerated Europe’s pivot to renewables. Stocks like NextEra Energy (NEE) and Vestas Wind Systems (VWDRF), which dominate offshore wind and solar, will benefit from EU’s REPowerEU plan to reduce Russian gas reliance. Critical Minerals: Ukraine’s lithium and rare-earth reserves—now a U.S. bargaining chip for aid—add geopolitical value to mining stocks like Lithium Americas (LAC) and Albemarle (ALB).

Despite current dips, volatility remains high. A prolonged war could send gas prices back above €100/MWh, benefiting energy producers with hedged positions.

Risks and Investment Strategy

The conflict’s trajectory remains unpredictable. A Russian territorial gain or a U.S.-brokered ceasefire could shift market dynamics overnight. Investors should:

– Diversify: Pair long positions in defense and energy with short bets on Russian equities (e.g., Gazprom (GAZP.ME)).

– Focus on Liquidity: Prioritize large-cap firms with global supply chains, like Schlumberger (SLB) in energy services or Northrop Grumman (NOC) in defense tech.

– Monitor Geopolitical Triggers: Watch for U.S. aid resumption signals or Russian advances in the Donbas, which could amplify sector volatility.

Conclusion: A Geopolitical Hedge for Portfolios

The Ukraine-Russia conflict is now a permanent feature of global markets, with defense and energy sectors serving as both beneficiaries and barometers of instability. Investors ignoring this reality risk being blindsided by supply chain shocks or defense spending booms. For now, the playbook is clear: allocate to resilient defense tech, bet on energy diversification, and keep a wary eye on the Black Sea horizon.

Avi Salzman

June 19, 2025