Europe’s IPO market remains in a precarious position as a combination of geopolitical turmoil, trade tensions, and valuation mismatches continue to spook investors and delay high-profile listings. While global equity markets have largely rebounded from the initial shock of President Donald Trump’s sweeping tariff announcements earlier this year, the aftershocks are still being felt in capital markets, particularly in Europe. Volatility has eased as the VIX index has dropped about 67 per cent from its post-tariff peak, and fund flows into European equities have reached their second-highest level this century.

However, investor appetite for initial public offerings remains subdued. Advisers point to lingering concerns over geopolitical flashpoints, especially the brief but intense Israel-Iran conflict, and the weak aftermarket performance of recent IPOs such as German retailer Douglas, whose shares fell over 12 per cent on debut and subsequently cut guidance.

Major listings postponed or scrapped

Several companies have shelved or postponed planned listings, citing geopolitical uncertainties and market dynamics. Among the most notable was Brainlab, a German med-tech firm specialising in AI-driven surgical solutions, which pulled its Frankfurt debut just two days before pricing. The offering, which aimed to raise €160 million ($188.44 million) in new capital, would have valued the company at €1.7 billion ($2 billion) but was ultimately shelved due to shareholder concerns over the quality of the investor order book.

Other delayed listings include pharmaceutical company Stada and car parts seller Autodoc, both of which have cited either market volatility or weak demand. Even Cobalt Holdings, backed by Glencore and billed as London’s largest IPO of the year, failed to drum up sufficient interest.

Adding to the pressure is the trend of large London-listed firms exiting the exchange in favour of US markets. Companies like AstraZeneca and Wise Plc are considering or have already shifted listings to New York, citing greater liquidity and investor depth. More than $100 billion in market value has already moved across the Atlantic in recent years, further eroding confidence in the City of London as a viable IPO venue.

What are Su-57 Jets and the S-500 Air Defence System—Why did India say no to Russia?

KYC for ITR 2025: New rules, guidelines, and what every taxpayer must know

6 scientific reasons to doubt Ryo Tatsuki’s 2025 prophecy

Nankai Trough ‘megaquake’ could kill 300,000 people: Japan acknowledges risk, ramps up measures

List of prophecies by Ryo Tatsuki, Japan’s Baba Vanga: A famous death, a virus and more

Microsoft exits Pakistan after 25 years, country’s ex-president warns of economic fallout

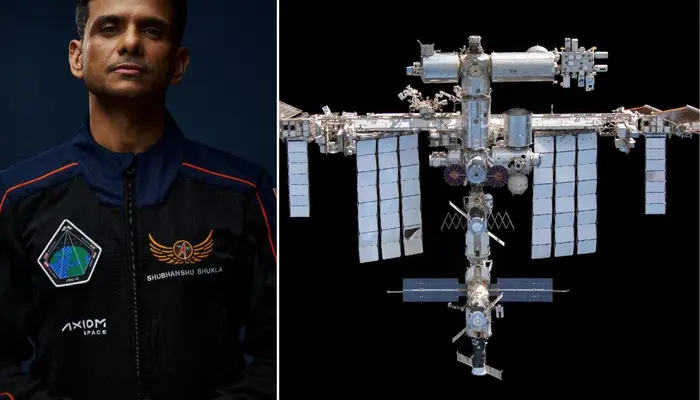

‘No signal, no antennas’: How did Indian astronaut communicate with Earth from space?

Japan braces for Manga’s apocalyptic date | Japan Earthquake

Fantastic Four actor Julian McMahon dies at 56, wife issues statement

‘Signed. Sealed. Delivered’: Donald Trump signs ‘Big Beautiful Bill’ into law

Hope for a post-summer recovery

Despite IPO volumes across EMEA (Europe, the Middle East and Africa) falling to 44 from 59 a year earlier and proceeds plummeting from $14.1 billion to $5.5 billion in the first half, some bankers remain cautiously optimistic. Advisers say that a slew of delayed but high-quality listings may return after the summer, provided market conditions stabilise.

Firms like Ottobock, ISS Stoxx, and the Swiss Marketplace Group are reportedly in the pipeline, while Visma, a €19 billion ($22.37 billion) software firm backed by Hg Capital, could be London’s marquee IPO in 2026. Spain’s Cirsa, a casino operator owned by Blackstone, is also expected to proceed with its €2.5 billion ($2.94 billion) float in the coming days, despite market jitters.

Until the broader geopolitical landscape stabilises and investor confidence returns, Europe’s IPO market appears stuck in a holding pattern, with hopes now pinned on a much-needed post-summer reset.