Cognizant Technology Solutions (NASDAQ: CTSH) trades at $80.15 as of June 19, 2025, yet its valuation remains deeply undervalued relative to its growth trajectory and strategic momentum. Despite sector-wide macroeconomic headwinds, CTSH’s AI-driven innovation, recent acquisitions, and sector-specific dominance in financial services and healthcare present a compelling risk-reward opportunity. With a 25.7% discount to its estimated fair value and analyst consensus targeting $90+, now is the time to position for upside.

AI-Driven Innovation and Sector-Specific Momentum

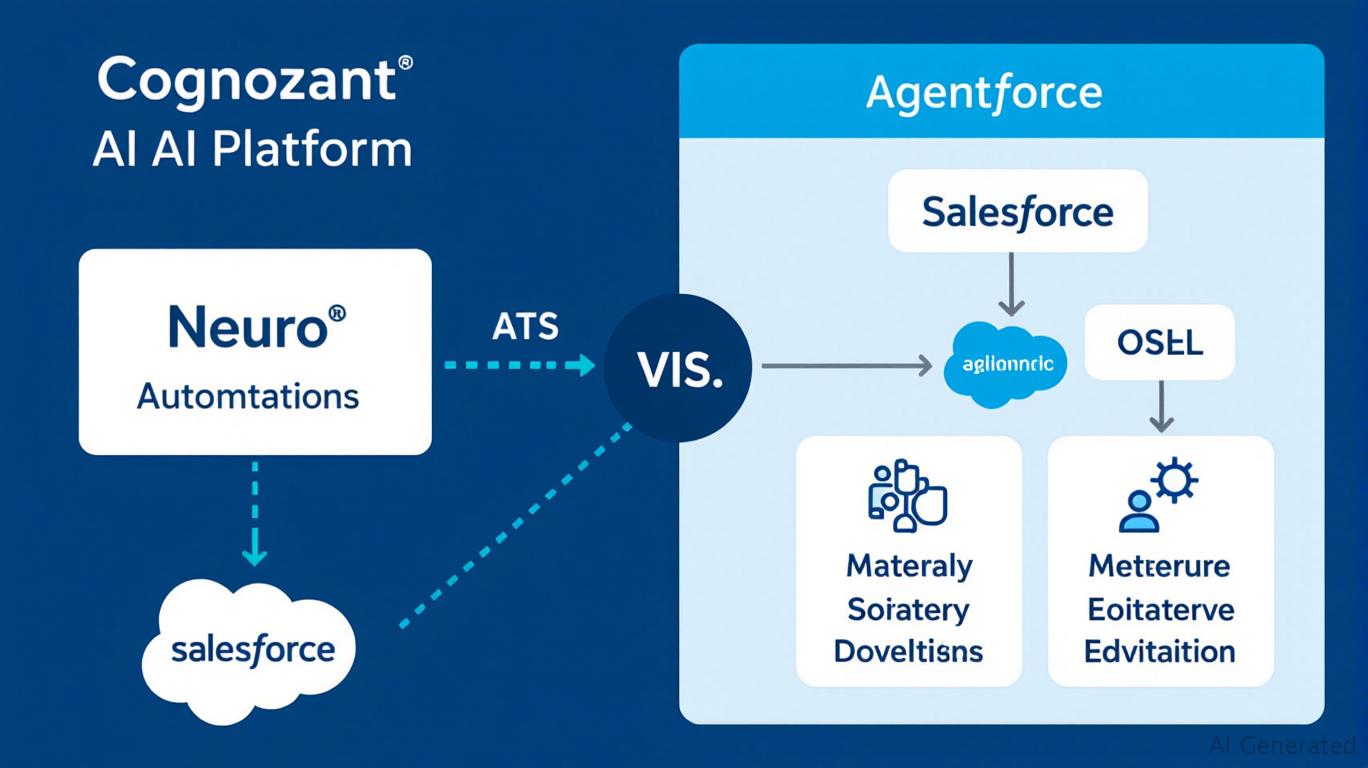

CTSH’s Neuro® AI Multi-Agent Accelerator is at the core of its differentiation, enabling clients to automate complex workflows and reduce costs. Recent partnerships, such as its June 2025 expansion with Salesforce’s Agentforce, underscore its ability to monetize AI solutions in high-growth enterprise software markets.

The company’s Financial Services and Health Sciences segments are key growth engines:

– Financial Services: Revenue growth accelerated to 10% in Q1 2025, driven by demand for digital lending, fraud detection, and cloud-based payment solutions. The $1B+ UnitedHealth partnership in June 2025 exemplifies its traction in healthcare payers.

– Health Sciences: A 12.7% year-on-year revenue surge reflects strong demand for AI-driven clinical development and claims processing solutions.

The Belcan Acquisition: A Catalyst for Engineering Synergies

CTSH’s $1.3B acquisition of Belcan (completed in August 2024) is a strategic masterstroke. Belcan’s 6,500 engineers and expertise in aerospace & defense (A&D) engineering research and development (ER&D) directly align with CTSH’s AI and digital engineering strengths.

Key benefits include:

– Revenue Synergies: Over $100M annually within three years, driven by cross-selling ER&D services to CTSH’s blue-chip client base.

– EPS Impact: Neutral in 2025 but accretive by 2026, as integration costs are offset by cost savings and higher margins.

The combination positions CTSH to capture the $190B ER&D market, growing at over 10% CAGR, while reducing reliance on commoditized IT services.

Valuation: Undervalued with Upside Potential

Despite its growth catalysts, CTSH trades at a forward P/E of 15.64—below its 5-year average of 16.47—and at a 25.7% discount to its fair value per Snowflake analysis. Analysts’ 12-month price target of $88.93 (range: $79–$98) suggests significant upside.

Financial health reinforces this case:

– Strong Balance Sheet: $2.7B cash reserves and a debt-to-equity ratio of 4.0%, ensuring flexibility to weather macro uncertainty.

– Free Cash Flow: Consistently robust at $2.1B annually, supporting a 1.2% dividend yield and buybacks.

Risk Considerations and Margin of Safety

Near-term risks include U.S.-India trade tensions, margin pressures from wage inflation, and slowing enterprise spending. However, CTSH’s large-deal momentum ($1B+ bookings in Q1 2025) and 11.73% net profit margin suggest resilience.

The dividend yield and low leverage provide a margin of safety. Even if revenue growth moderates, the stock’s $80 price represents a 10% discount to its 200-day moving average—a level that historically has been a buy signal.

Investment Thesis: Buy Dips Toward $80, Target $90+

CTSH’s AI and ER&D plays are undervalued and underappreciated. Analyst upgrades (JPMorgan raised its target to $98 in May 2025) and strategic execution argue for patience.

Action Items:

– Buy on dips below $80, targeting $90+ by year-end 2025.

– Hold for the long term: The $100+ target by 2026 (per synergies) justifies a multiyear horizon.

Conclusion

Cognizant’s valuation discount, AI-driven innovation, and Belcan’s engineering synergies position it to outperform peers amid sector volatility. With a robust financial profile and a backlog of high-margin deals, CTSH offers a rare combination of growth and safety. Investors ignoring near-term noise and focusing on its structural advantages stand to benefit handsomely.

Final Note: Monitor Q3 2025 earnings (guidance: $4.95–5.02B revenue) for validation of execution quality.