Dublin, July 07, 2025 (GLOBE NEWSWIRE) — The “South Korea Recommerce Market Intelligence Databook – 60+ KPIs, Market Size, Share & Forecast by Channel, Category & Consumer Segment – Q2 2025 Update” report has been added to ResearchAndMarkets.com’s offering.

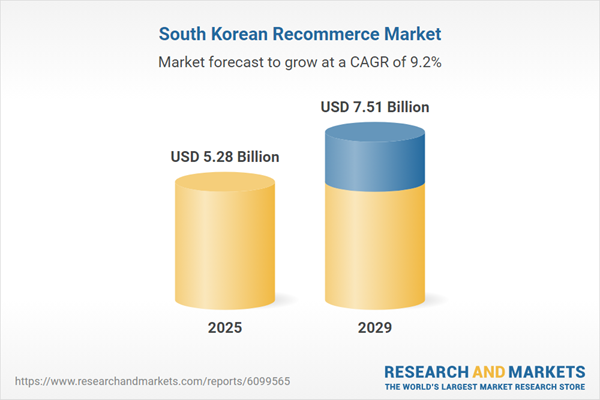

The South Korean recommerce market is poised for significant growth, with expectations to reach USD 5.28 billion by 2025, marking an annual growth rate of 11.0%. From 2025 to 2029, the market is projected to grow at a CAGR of 9.2%, culminating in an estimated USD 7.51 billion by the end of 2029. This growth is bolstered by a consistently increasing CAGR of 13.3% from 2020 to 2024.

This report provides a detailed data-centric analysis of the recommerce market in South Korea, covering market opportunities and risks across consumer segments (peer-to-peer and business-led resale); product categories; sales channels; and resale formats. With over 60+ KPIs at the country level, this report provides a comprehensive understanding of recommerce market dynamics.

It offers a comprehensive analysis of market dynamics in the recommerce market, segmented by recommerce channels (C2C, B2C, trade-in programs), sales models (resale, rental, refurbishment), platform types (generalist and vertical-specific), digital engagement (app, website, social media), and retail categories (electronics, apparel, home goods, and more). In addition, it provides a snapshot of consumer behaviour, device usage, payment preferences, and city-level penetration across Tier 1 to Tier 3 cities.

Recommerce in South Korea Is Growing Through Platform Integration, Tech-Enabled Fashion Resale, and Regulatory Circularity Goals

South Korea’s recommerce market is shifting from peer-based secondhand transactions to structured, tech-enabled resale ecosystems. Fashion and electronics remain leading verticals, supported by digital platforms, logistics infrastructure, and national policies linked to circular economy goals.

Fashion and electronics resale are formalizing through digital platforms, OEM partnerships, and ESG-aligned business models. Over the next 2-4 years, Korea’s recommerce market is expected to consolidate into professionally managed, compliance-driven ecosystems across key consumer categories.

Fashion Recommerce Is Scaling Through Brand-Led Resale and Online Platforms

Fashion resale in South Korea is being driven by platforms like KREAM (sneakers, streetwear), Bunjang, and Karrot. Department stores and fashion brands are also experimenting with resale offerings.High smartphone penetration, a strong online resale culture, and millennial/Gen Z fashion consciousness are key drivers. Limited-edition sneaker resale has gained legitimacy through verification services and branded storefronts.Expect further verticalization in resale platforms – e.g., more segmented fashion, sportswear, or luxury resale sites – and increased integration with e-commerce and logistics platforms.

Electronics Recommerce Is Expanding Through OEM-Backed and Carrier Trade-In Programs

Samsung and LG operate structured trade-in and refurbishment programs in partnership with telecom providers like SK Telecom and KT. Local platform Aladin also sells certified pre-owned electronics.Consumer price sensitivity, frequent upgrade cycles, and growing e-waste volumes are driving demand for structured electronics resale.With growing institutional focus, electronics trade-in and resale programs will expand across online and offline channels. Platforms offering diagnostics and certification will grow in relevance.

Livestream and Community-Driven Recommerce Is Influencing Purchase Behavior

Platforms like Karrot and Danggeun Market are popular for local, peer-to-peer resale. Features such as in-app messaging, real-time listings, and community reviews are widely used.Urban density, mobile-first digital behavior, and trust-based community dynamics make local resale convenient and low-friction.Livestream resale and social validation will continue to grow, especially for low-ticket categories. These models may coexist with formal platforms for high-value goods.

Circular Economy Policies Are Influencing Corporate Reuse and Recycling Models

South Korea’s Resource Circulation Framework Act mandates waste reduction, encouraging OEMs and retailers to engage in resale, take-back, and recycling.Extended Producer Responsibility regulations and climate targets under the 2050 Carbon Neutral Strategy are incentivizing corporate circularity initiatives.ESG-linked reuse operations and impact tracking will expand across consumer sectors. More brands will formalize recommerce as part of sustainability reporting.

Logistics and Fulfilment Innovation Is Supporting Growth of Structured Recommerce

Startups and logistics providers are enabling resale flows by offering diagnostics, grading, packaging, and delivery services. This includes last-mile and reverse logistics.South Korea’s advanced delivery infrastructure supports fast resale cycles. Marketplaces are embedding logistics to drive customer trust and convenience.Logistics-backed recommerce will become essential for scale, especially in electronics and apparel. New startups are likely to emerge to serve this value chain.

Competitive Landscape in South Korea Is Defined by Specialized Platforms, OEM Participation, and Policy-Aligned Retail Pilots

South Korea’s recommerce landscape is maturing with differentiated platforms in fashion and electronics, along with growing institutional focus on circularity. Competitive dynamics are shaped by platform features, resale legitimacy, and regulatory alignment. The competitive landscape in South Korea is increasingly defined by platform specialization, regulatory support, and high consumer expectations around trust and speed. Strategic success will depend on integration of verification, logistics, and sustainability metrics into recommerce operations.

Specialized vertical platforms are likely to expand in luxury, kidswear, and refurbished electronics.Policy incentives and ESG reporting pressure will drive more brands to internalize resale.Logistics partnerships will support scale and trust in both peer-to-peer and structured resale models.

Fashion Recommerce Is Driven by Vertical Platforms and Authenticity Infrastructure

KREAM specializes in sneaker and streetwear resale, offering price tracking and product verification. It is backed by Naver and has emerged as the dominant vertical platform.Bunjang and Danggeun Market (Karrot) support broader secondhand transactions with large user bases and in-app transaction tools. Their influence extends beyond fashion into general goods.Platforms emphasize verification, escrow payments, and user ratings to build trust.

Electronics Recommerce Is Anchored by Samsung, LG, and Telecom Resale Programs

Samsung and LG operate formal trade-in programs in partnership with carriers like SK Telecom and KT. Devices are refurbished and resold via official retail or online channels.Aladin, an online bookstore, has expanded into certified used electronics through buy-back programs.Electronics recommerce is often bundled with upgrade plans or loyalty incentives through telco platforms.

Community Platforms Maintain Scale in Peer-to-Peer Resale

Karrot (Danggeun Market) continues to lead in local resale, enabling neighborhood-level transactions in metro areas like Seoul.Trust is built through proximity, user verification, and active community moderation.While informal, these platforms account for high transaction volumes across apparel, gadgets, and household items.

Retailers and Brands Are Launching Pilot Circular Programs in Response to Policy

Brands and retail conglomerates are experimenting with resale, particularly in fashion and electronics, as part of their ESG strategy.Some department stores are piloting resale counters or partnering with online platforms.These initiatives are often linked to compliance with the Resource Circulation Framework and EPR mandates.

Company Coverage:

KREAMBunjangKarrot / Danggeun MarketSamsungLGSK TelecomKTAladinNaver

Key Attributes:

Report AttributeDetailsNo. of Pages83Forecast Period2025 – 2029Estimated Market Value (USD) in 2025$5.28 BillionForecasted Market Value (USD) by 2029$7.51 BillionCompound Annual Growth Rate9.2%Regions CoveredSouth Korea

Report Scope

This report offers a comprehensive, data-centric analysis of the recommerce market in South Korea, supported by 40+ tables and 55+ charts. The databook provides detailed forecasts and key performance indicators across transaction value, volume, and market share trends from 2020 to 2029.

Below is a summary of the key market segments covered:

South Korea Recommerce Market Size and Growth Dynamics

Gross Merchandise Value (GMV) Trend AnalysisAverage Transaction Value Trend AnalysisTransaction Volume Trend Analysis

South Korea Recommerce Market Size and Forecast by Sector

Retail ShoppingHome ImprovementOther Sectors

South Korea Recommerce Market Size and Forecast by Retail Category

Apparel & AccessoriesConsumer ElectronicsHome AppliancesHome Decor & EssentialsBooks, Toys & HobbiesAutomotive Parts & AccessoriesSports & Fitness EquipmentOther Product Categories

South Korea Recommerce by Channel

Consumer-to-Consumer (C2C)Business-to-Consumer (B2C)Retailer Trade-In & Buyback Programs

South Korea Recommerce by Sales Model

ResaleRentalRefurbishment & Certified Pre-Owned

South Korea Recommerce by Digital Engagement Channel

Website-Based ResaleApp-Based ResaleSocial Media Driven Resale

South Korea Recommerce by Platform Type

Generalist MarketplacesVertical-Specific Platforms

South Korea Recommerce by Device and OS

Mobile vs DesktopAndroid, iOS

South Korea Recommerce by City Tier

Tier 1 CitiesTier 2 CitiesTier 3 Cities

South Korea Recommerce by Payment Instrument

Credit CardDebit CardBank TransferPrepaid CardDigital & Mobile WalletsOther Digital PaymentsCash

South Korea Recommerce Market Share Analysis

Market Share by Key PlayersCompetitive Landscape Overview

South Korea Recommerce by Consumer Demographics

Market Share by Age GroupMarket Share by Income LevelMarket Share by Gender

For more information about this report visit https://www.researchandmarkets.com/r/p7ud1p

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

South Korean Recommerce Market