While Australia’s economy faces short-term pressures, its structural strength remains a solid foundation for long-term prosperity. Stephen Koukoulas reports.

IN AUSTRALIA, it is often difficult to have a considered and sober debate about the economy and economic policy.

This is because much of the debate is often muddied by an understanding (or misunderstanding) of what is important to make the economy stronger and fairer in a sustainable way.

This boils down to misguided suggestions and debate on what are cyclical pressures on the economy versus the structural fabric of the economy.

This is evident now, where there are many ideas on what the economy needs and many noisy vested interests poised to lobby against changes that are good for the economy as a whole, but bad for them as largesse is scaled back. The debate over the reforms to superannuation is a case in point.

In terms of some basics on the economy, as things stand, the cyclical side of the Australian economy is weak, while the structural side is amongst the world’s best.

Some definitions

The cyclical side: Every economy will experience a business cycle. That is, the economy will at various stages experience a cyclical upswing — periods with strong growth, higher than acceptable inflation, buoyant consumer and business activity and full employment.

Due to policy decisions and the unsustainability of these conditions, there will follow a cyclical downswing with weak growth, low inflation, pessimistic tones for consumer and business activity and rising unemployment. When this happens, policy will be eased, which will spark an upswing in the business cycle.

And so the cycle goes on and on, up and down, over many decades.

The structural side: The structural underpinnings of an economy are usually more complex and difficult to identify, although there are a series of basic tests for the structural strength of an economy.

The structure of the economy relates to:

the efficiency of the tax system;

the skills and education of the population;

the soundness and sustainability of public finances;

the level of infrastructure;

the level of business investment and ease of doing business;

the legal system; and

the credibility of central agencies (the central bank, for example), to name a few.

Where is the Australian economy now?

On the cyclical side, conditions are currently weak. We are in a cyclical downturn driven by extreme restrictiveness of monetary policy, with interest rates too high for too long; Australia’s terms of trade have fallen sharply, dampening export returns; and global economic conditions are subdued, which is impacting business sentiment and investment plans.

The good news is that this cyclical downturn can be arrested, and with further interest rate cuts, for example, which are cheap and easy. Indeed, given the significant extent of high interest rates on the current cyclical downturn, materially lower interest rates by the end of 2025 will be a critical factor underpinning a cyclical upswing.

The structural side of the economy is heavily influenced by government policy. This is where the Government’s Productivity Round Table in August is important in framing many issues that, if implemented correctly, will enhance the structural strength of the economy over the longer term and almost regardless of the cyclical side of the economy.

While the inevitable reforms that will flow from the Roundtable will be of significant long-run benefit, the Australian economy is currently in a structurally sound position, albeit with a possible concern about productivity.

Australia has a low tax burden and is broadly in the middle of international comparisons for tax to GDP ratios . Some reform of the tax system, mainly for fairness and equity reasons rather than for the structural improvement of the economy will be delivered.

At the same time, government finances are in good shape with net government debt very low and only small deficits factored in over the forward estimates. The government has the scope to provide quality services whilst maintaining sound fiscal settings.

While the skill and education level of Australian workers can be enhanced and will need to be improved to match trends in technological and artificial intelligence over the years ahead, the current low unemployment rate and skewing of the immigration intake to those with skills is helping to support the structure of the economy. This is vital for the structural integrity of the economy.

The weak level of private sector business investment, which has been evident for more than a decade, is the main area of structural weakness that is undermining the structural integrity of the economy.

To some extent, lower interest rates will help support a lift in business investment, but this is only a small part of the solution to the extended period of underinvestment.

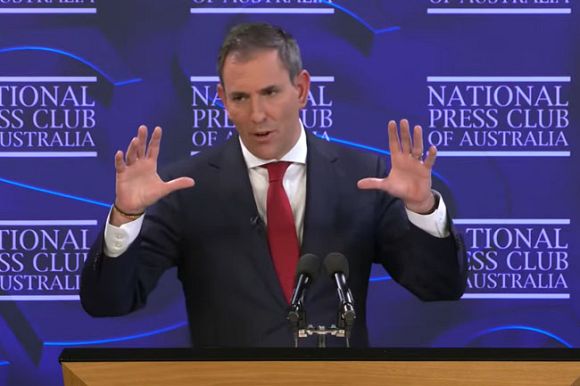

Removing marginal legislative and regulatory restrictions on business is part of the solution. Treasurer Jim Chalmers has signalled his objective of cutting unnecessary “red tape”. This can be in the form of the costly (for business) duplication of rules from federal, state and local government, the simplification of tax rules, greater simplicity in wage and labour market obligations, among others.

The outlook

Suffice it to say, the outlook is positive for Australia and the economy.

Cyclically, lower interest rates will boost economic activity and help maintain full employment. Structurally, the Government is alert to what is needed to maintain and even enhance the foundations of the economy.

The next six to 18 months will be fascinating for economic policy.

Lower interest rates will kick-start growth in private sector demand. A constructive reform agenda from the Government will set up the economy for medium-term growth.

If it all goes well – which it should – Australia can enhance its position as a world-best economy for many years to come.

Stephen Koukoulas is one of Australia’s most respected economists, a past chief economist of Citibank and senior economic advisor to an Australian Prime Minister. You can follow Stephen on Twitter/X @TheKouk.

Support independent journalism Subscribe to IA.

Related Articles