You need to be scrappy to survive as a private producer on the small side of the spectrum. But if you can keep that grit, hold the line on cost and set a sharp eye on the competition, you can spot the opportunities.

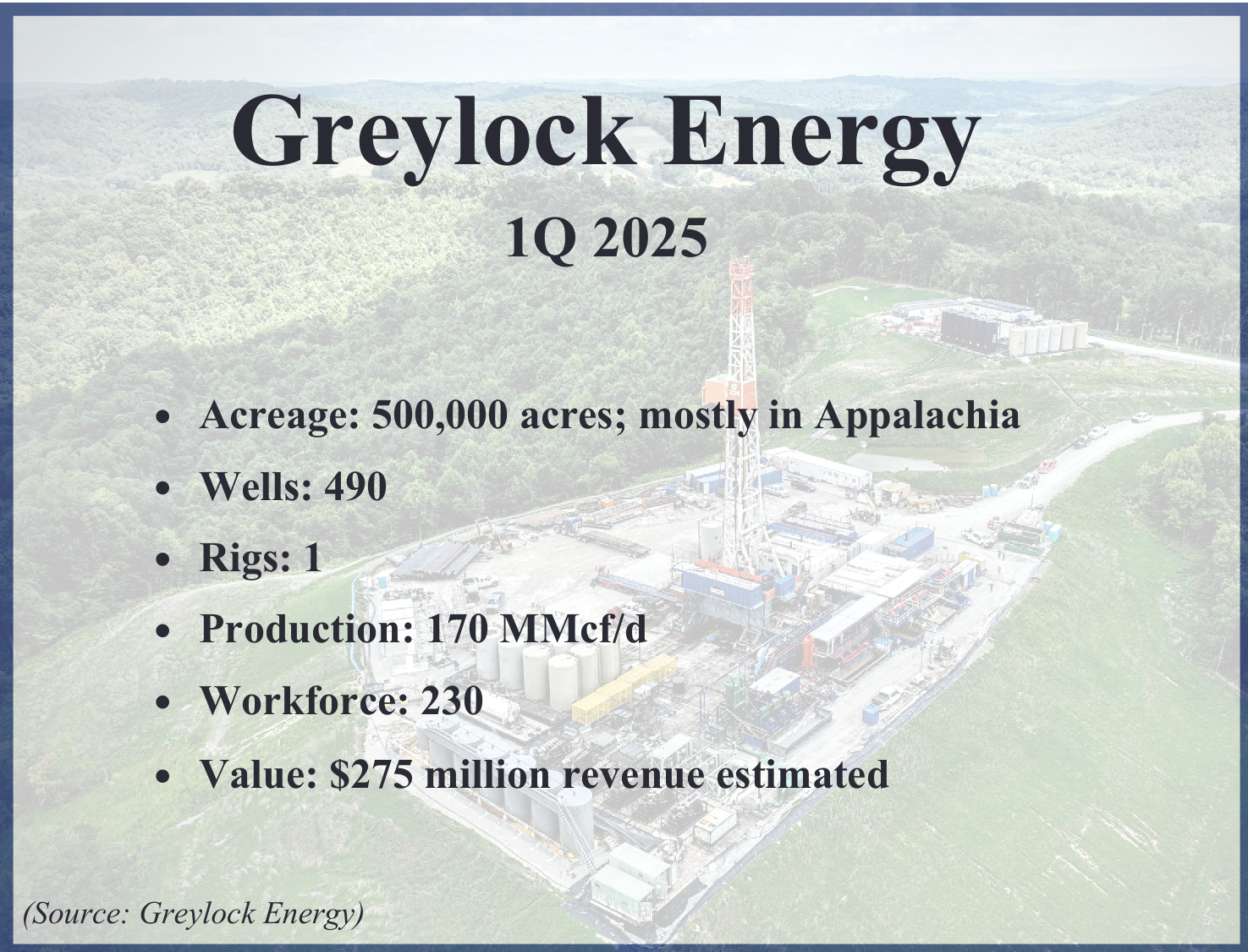

Kyle Mork, president and CEO, Greylock Energy. (Source: Greylock Energy)

Kyle Mork, president and CEO, Greylock Energy. (Source: Greylock Energy)

“That’s the fun part, but it’s certainly a challenge,” Greylock Energy CEO Kyle Mork told Hart Energy.

Greylock has grown the company by expanding in multiple directions: acquisitions, the drill bit and diversification.

Much of its leadership team worked together originally at Energy Corp. of America. In 2017, the Greylock team coalesced with backing from Boston-based private equity firm Arclight Capital and some 3,500 conventional wells in Appalachia, which the company still operates.

The next step was taking a position in Greene County, Pennsylvania, with unconventional acreage in the dry gas Marcellus play, and also some midstream assets.

“In the first several years of Greylock, we were really about growing via the drill bit in the Marcellus position in Greene County,” Mork said.

“The entire time we’ve existed, we’ve looked at opportunities to acquire new assets. Initially, we were primarily focused on other Appalachian assets and then as time went on, we started looking at other basins. In 2022, we closed a big deal to buy assets in the Rockies in both Utah and Wyoming from a public producer.”

That deal allowed Greylock “to really take an asset that was very non-core for the seller and [create] very much a core asset for us. We’ve increased production without drilling any new wells—just being able to get a lot of wells back online and working over wells.

“We’ve continued to develop, drill new wells and bring wells online in the east and are preparing for our first new activity in the Rockies in the next 12 months or so.”

Standing out

On a production basis, Greylock’s footprint is two-thirds in Appalachia and one-third in the Rockies. But two key aspects set it apart, Mork said.

Augmenting its upstream production is Greylock’s midstream business, which builds out projects for third parties.

“We’re starting to see a lot of traction and get deals done with what we call ‘demand-driven’ projects. For instance, we have two projects with a big steel producer here in Appalachia that consumes a good amount of gas as a part of the process, so we built pipelines for them. And we’re talking to data centers, like everyone else on Earth, and other big consumers of gas on the midstream side,” Mork said.

Next is the technical team in place that packs a one-two punch of expertise: the firm can develop, drill, complete and bring online new unconventional resources in multiple places, as well as workover conventional assets and optimize them.

“We’re comfortable with both operating and producing fairly complex producing assets and also doing the latest and greatest unconventional development,” he said.

The top eastern U.S. private producers in 2024. (Source: Enverus)Expanding development

The top eastern U.S. private producers in 2024. (Source: Enverus)Expanding development

Greylock is always looking for its next add-on, Mork said. In any given year, the firm is examining different packages and bidding on assets.

“As we think about the next 12 to 24 months, I think we will be looking to expand development in our Utica play, potentially a little more in the Marcellus and then definitely, get our first development activity going in the Rockies, but we will also be looking for outside opportunities.

“We’re pretty basin agnostic. We want to look at everything that comes to market in Appalachia and in the Western Rockies as well, but we’re open to other basins and we’ve looked at assets in a lot of other basins as well.”

The firm’s entrance into the Rockies wasn’t necessarily premeditated, he said.

“We just really liked the asset as we started to look at it and thought there were some unique things about being in that basin with their gas pricing, and we picked up some liquids with it.

“But yes, we will definitely be looking at potential acquisitions this year.”

Rocking the resource

Greylock is a gas-weighted producer, a position that is coming into its own this year as Henry Hub prices have shown stability while crude oil is rocked by market volatility, tariffs and trade turmoil. A drop in Henry Hub prices below $3/MMBtu—or a pop above $5, for that matter—might trigger a reconsideration of activity levels. As such, the firm hasn’t needed to revisit its guidance, a step many of its peers took during the first quarter.

“Our real focus in the second half of the year is our next batch of wells in our Utica position in northern Pennsylvania,” Mork said. “That’s really unchanged.”

Greylock is targeting a three- to five-well program, which isn’t a ton of wells, he said. But drilling deep, 10,000-plus ft laterals in the Utica is an expensive proposition that also promises significant volume. Year-over-year production growth by the end of 2025 could be as much as 15%, he said. Production growth is in a 10% to 15% year-over-year range.

“For us, turning in three, four, five wells a year, we can achieve steady growth with respect to new wells and total company production,” he said. “Like a lot of producers now, we’re not looking to grow dramatically and outspend cash flow to do so. We’re really looking to grow at a steady pace and be able to do it within our existing cashflow.”