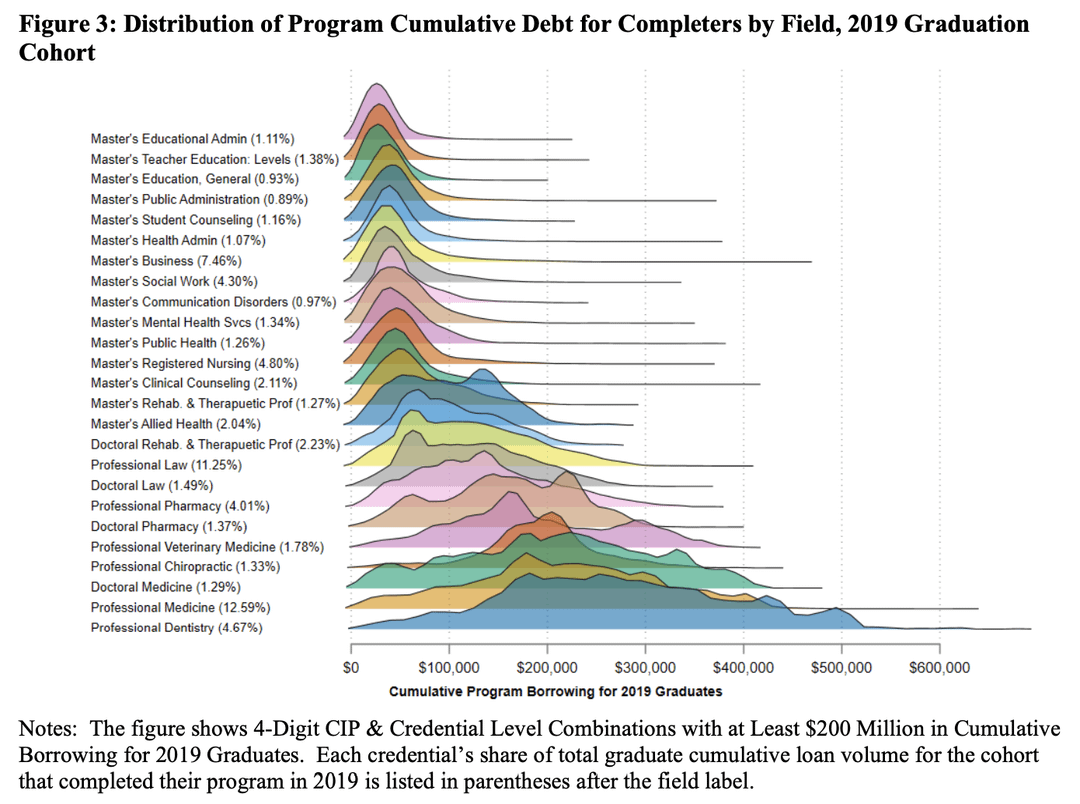

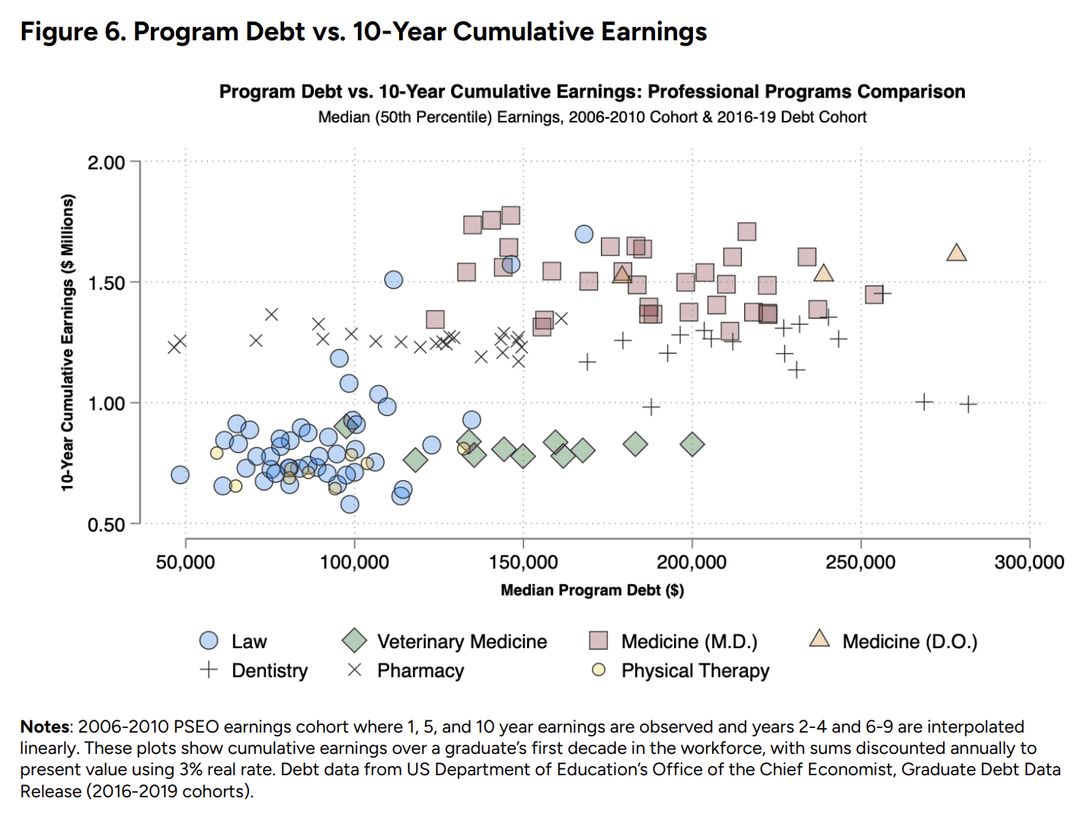

Just wanted to share some data from a report I co-wrote for the US Department of Education at the end of the Biden administration. Thought folks here might find the patterns in these ridgeline plots to be of interest. The second plot comes from a second report a co-author and I just released through Census Bureau's PSEO Coalition and helps to put these debt amounts into perspective using the earnings data available for a select group of professional school programs. You can see that over just the first 10 years of employment after finishing school, graduate students earn about 10x the amount they borrowed for their program.

Posted by clibassi

12 comments

Why was education included on the first but not the second?

Personally I think it’s great that all of our doctors and lawyers start their careers in massive amounts of debt. I’m sure that won’t have any long-term consequences for our society 🙄

Sources of data: Administrative data from the US Department of Education and public aggregate data from PSEO, part of LEHD at the US Census Bureau

Tool: Stata

Interesting.

A lot of Ph.D. programs are funded and pay you. So thats obviously not reflected here.

“Professional” Chiropractic

I really like this framing. I think top left is where you want to be from a financial perspective and bottom right to avoid.

Looks like implications are some pharmacists are doing very well, with the higher earning MD’s being in a better place longer term. Any other insights?

For law firms it seems the high earners are the ones that took on more debt, whereas for most other fields earning was not impacted by the cost (quality?) of school.

Might be worth mentioning that these appear to be professional graduate degrees, not academic degrees preparing you for a life of research or industry.

Alright, whose the Denist with over one million in Student Debt? Is this why they gouge our wallets like the Brits gouge their teeth?

10 year cumulative earnings – for docs is this post fellowship/residency? Because that seems disingenuous.

That’s 3-8 years of time earning much less than median.

Do students of Engineering not go into debt?! If true, is this because of subsidies and stipends funded by industry? I obtained an MS in EE from a state school thanks to fully paid tuition and stipends from the school’s foundation/trust funds that were supported by industry/corporations. Most of my cohorts were supported the same way.

There are many baby-boomer dentists and doctors about to retire. If they are independent practitioners with no other licensed staff, college students in those fields should initiate a discussion about how they could partner with a soon-to-retire professional. Is there a way to arrange tuition funding in exchange for the student working and supporting the clinic? All while maintaining a long-term goal of joining and assuming the practice.

Food for thought.

Id want to see the graph show average debt $$ with # of years after completing being x axis. Showing which degrees pay themselves off and at what rate.

Finally, something I’m on the far end of the bell curve for!

Comments are closed.