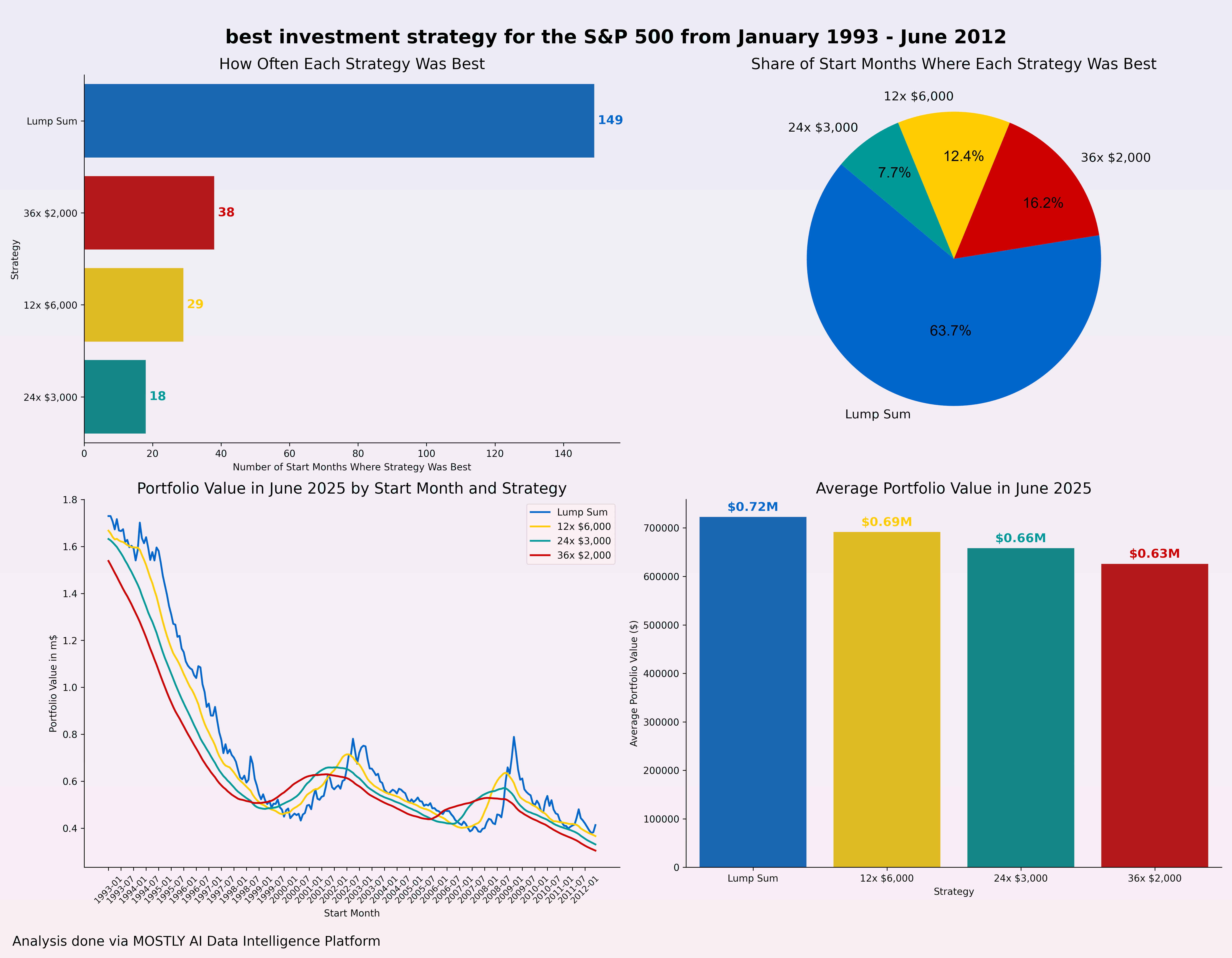

Conditions:

- Investing in S&P500 (SPY)

- 234 scenarios, starting from January 1993 – June 2012 (I selected 2012, so that every investment has at least a 10 year time span)

- All scenarios ending in June 2025

- 4 investment strategies, always $72,000:

- Lump sum: $72,000

- 12 installments: $6,000

- 24 installments: $3,000

- 36 installments: $2,000

Conclusion:

- 63.7% of the time lump sum was the best strategy (149 out of the 234 cases) and the highest expected value: $720k

- 16.2% of the time splitting into 36 investments was the best strategy (38 times), but it has the lowest expected value $630k

- The line chart shows the portfolio value for all 4 strategies, with the different starting dates on the x axis

- For example: 2002-07 shows the values of the portfolios at June 2025 with all 4 strategies starting from July 2002.

- Only around the dot com crash (2000 – 2002) and the financial crisis (2007 – 2008), lump sum wasn't the best strategy

- Even with the worst strategy (36 investments from Jun 2012 to May 2015), you would have quadrupled

Analysis done via MOSTLY AI Data Intelligence Platform

Source yfinance API

Posted by PrinceTrickster

![[OC] Should you invest all at once or splitting your investment? S&P 500 (SPY) from Jan 1993 - Jun 2012. 234 scenarios. In 64% of cases, lump sum was the best strategy.](https://www.europesays.com/wp-content/uploads/2025/07/dxrkoxfhw9df1-1920x1024.png)

11 comments

It isn’t clear how the installments are distributed. Over a year? A decade? Two decades?

Good example of “time in the market beats timing the market”, especially given the lower left plot. However, cutting that y-axis almost feels criminal… (minor typo there: this is not milli$ (m$), but millions (M$), I hope)

Also, what does the “average portfolio value” refer to?

Dropping 72k into an investment would be over 2 years based off of my last year W2 pre tax 🥲

This is a good start. Now you need to factor in the risks of the various strategies to determine how much to apportion to each.

Like you determined 1/6 of the time you roll a 3 on a six-sided die. But now you need to determine how much to invest in the 3-outcome given that 5/6 of the time it won’t come up.

To put it briefly, though lump sum was the best 60% of the time, that doesn’t suggest you should just go with the lump sum strategy. You need to hedge against the risk of that 40% of the time when it doesn’t turn out the best. And then you need to do that for all the other strategies to determine the one, optimal investment strategy!

Sorry, it’s been a while since I studied statistics formally, so I don’t have the language anymore. But let me know if that makes sense.

If I understand correctly, the ‘lump sum’ strategy almost always wins mostly because…most of the money in this strategy is in the market for longer.

For a market that generally trends upwards over time, getting 10 years of returns is almost always better than getting 7, 8, or 9. (Or an average of all of those.)

When investing, it turns out to be better to have 72k now, than to have 72k over the next three years. Money now is worth more than money later.

Use rolling times periods and calculate CAGR. Also, $10,000 is a common industry standard for an initial investment, not $72,000. Also also, the S&P 500 is older than the SPY ETF. Use the ticker ^GSPC in yahoo finance to get older S&P 500 data if you want.

For lump sum was it invested on Jan 1? Then you’re just giving it an unrealistic time advantage. In what scenario is someone sitting on 72k cash they plan to invest and going to wait and put it in the market throughout the year?

A realistic scenario would be to model if someone invested every paycheck, every month, every quarter, annual lump sum.

Over time the portfolio performances would be almost the same, just offset by a year’s worth of market earnings, but looking at monthly/yearly returns would differ since the closer to lump sum you get, the more cash you’re holding.

You should extend this to 2024. Interesting times!

Does lump sum outperform because more money is in the market for longer (lump sum up front vs spread out payments?). If so this only helps someone sitting on a pile of cash today trying to decide if they throw it all in now vs over time.

I’d like to see the outcome of the opposite scenario. I save $x per paycheck. Is it better to continuously invest each payday, or wait for a large all in purchase. If the spread out small buys end up outperforming lump sum buy, then it gives more credibility to time in the market

Kind of a bad example to be honest. Most people do not have $72K laying around. So, to invest long term, they are forced to do it in installments. In reality I think you’ll end up with a combination of both. Initially start with a lump sump and then continu with monthly installments.

You need to include interest on the cash that is not invested during DCA.

Comments are closed.