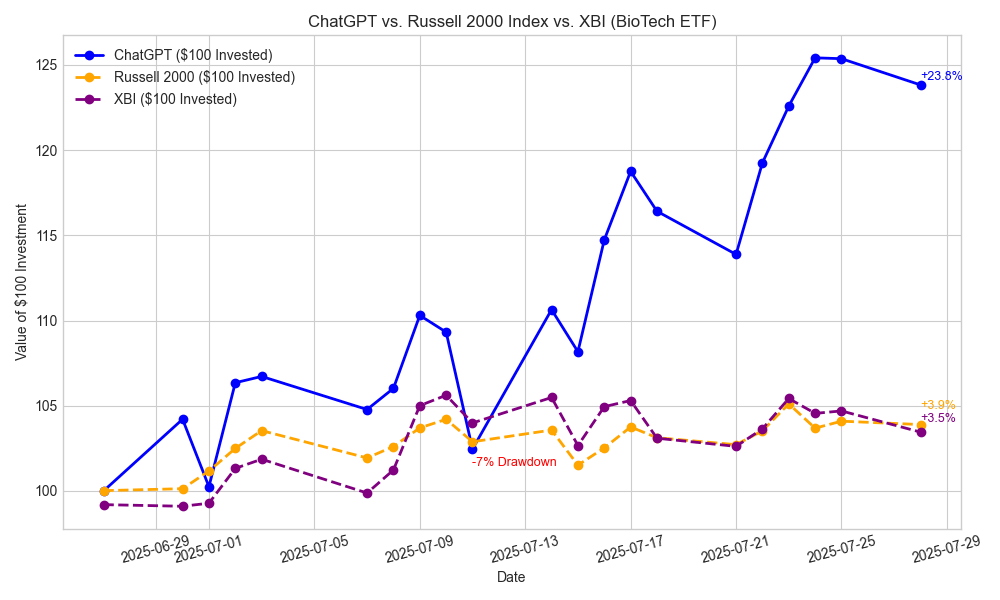

This is part of a 6-month experiment to see how a language model performs in picking small, undercovered stocks with only a $100 budget.

If your curious, the GitHub for everything is: https://github.com/LuckyOne7777/ChatGPT-Micro-Cap-Experiment

I also post about it weekly on my blog: https://nathanbsmith729.substack.com/publish/home?utm_source=menu

Disclaimer: None of this is financial advice or me trying to sell something, just a cool little experiment I wanted to show off.

Thanks for reading!

Posted by OpenArcher7341

29 comments

Data for Russell 2000 Index and XBI: Pulled using Yahoo Finance API in Python.

Data for ChatGPT’s Equity curve: ChatGPT picked stocks via weekly unbiased Deep Research. I then executed orders and simulated the same trades and calculations in Python using basic libraries (Pandas, NumPy). Data was then put in CSV files and visualized via MatPlotLib.

Edit:

Hey guys, sorry for being so vague. This is my first post ever and I really only got into working with data over the summer. To clarify, the model is only allowed to pick micro caps, so I figured R2K and and XBI would kinda be fitting but yeah that is bias.

My original prompt was “ You are a professional-grade portfolio strategist. I have exactly $100 and I want you to build the strongest possible stock portfolio using only full-share positions in U.S.-listed micro-cap stocks (market cap under $300M). Your objective is to generate maximum return from today (6-27-25) to 6 months from now (12-27-25). This is your timeframe, you may not make any decisions after the end date. Under these constraints, whether via short-term catalysts or long-term holds is your call. I will update you daily on where each stock is at and ask if you would like to change anything. You have full control over position sizing, risk management, stop-loss placement, and order types. You may concentrate or diversify at will. Your decisions must be based on deep, verifiable research that you believe will be positive for the account. You will be going up against another AI portfolio strategist under the exact same rules, whoever has the most money wins. Now, use deep research and create your portfolio.” (I originally wanted to test DeepSeek but it sucked to due outdated data, so I dropped it).

By feeding it live data meant I just inputted close price, volume, and the benchmark comparisons, things easily accessible on YF. Also, the model (o4) is only allowed to use DeepResearch 1 time a week. By no means was this a brag or to be a genuine attempt at trying to make money. I just wanted to throw some money at the wall and see what happens.

Thank you guys for all the questions and criticism, I will definitely try to be more accurate next time. Also, apparently the Substack link is paywalled, I thought I turned that off but this should be the real thing: [https://open.substack.com/pub/nathanbsmith729?r=4ccvwd&utm_medium=ios ](https://open.substack.com/pub/nathanbsmith729?r=4ccvwd&utm_medium=ios%C2%A0) thanks again!

Happens every time some of the time!

nice, I’m gonna put my $39,000 in life savings into whatever ChatGPT tells me to. Thanks for the tip

Stop posting this crap without risk-adjusting returns!

Why would you benchmark Russell 2K and Biotech? I think you need to give more detail on what your prompt truly is to be able to judge its performance.

Also is this before or after fees, taxes, etc? When doing a comparison like this – the specifications are the most important detail.

Oh boy, if more people start to do this, there will be a HUGE bubble.

“I provide it data on stocks in its portofolio” Can you elaborate on this part?

Nice now do every 4-week period for the last 40 years

It’s easy when the entire stock market is going up. What about earlier in the year?

your substack link is private

Not sure what this tells you. Quant funds have been using ML for many, many years and they don’t earn consistent returns. It just shows that you happened to get lucky.

Are there examples of your queries to CGPT? I couldn’t find any in your repo. Super interesting experiment though.

I’m trying something similar. Just getting started with it (started beginning of July). Had a good start and then a bumpy patch as I was trying to make some improvements… and also primarily caused by some user error where I accidentally sold something I didn’t mean to, panicked, did something else and lost a bit.

Started off with $200. Before my “user error” moment, I was up about $125 or so ($325 value) now back down to about $225.

We’ll see how it goes. The goal is to fast-track to “*I’m rich I tell you! Rich!!”* lol

I used Deep Research to do some, well… deep research on “how to make money on Wall Street, fast” essentially and then use that research to write GPT instructions to try to reach those goals. It’s set up to never use margins/credit so that “we” don’t go in debt and keep losses to a minimum.

It’s *definitely* not a *serious* investment plan. It’s partially so I can teach myself more of the technical side and quirks of using ChatGPT and also just kind of a game for entertainment purposes. It’s a minimal amount of money at play so if I “lose it all” it’s not that big of a deal. If it wins… cool!

I’ll definitely take a looks at your links u/OpenArcher7341. I’m curious to see what you’re doing! Thanks!!

Absolutely nothing can possibly go wrong if a bunch of people use an AI model to all make trades based off the same information.

/S, obviously

I have a few questions: what is the input, the data that ChatGPT is using to make decisions? Is it natural-language text, which LLMs are uniquely good at, or numerical data? If it’s numerical data, why use an LLM, since you could skip the tokenizer, which obscures numerical relationships expressed in text?

I got partial answers from your GitHub (Substack is behind a paywall):

> I provide it trading data on the stocks in it’s portfolio.

>

> Strict stop-loss rules apply.

>

> Everyweek I allow it to use deep research to reevaluate it’s account.

By “deep research,” I assume you mean the reasoning models like o3. That would be different from a more direct approach with a purely numerical neural network, in that the LLM talks to itself and runs code on putative answers (code that would handle the numerical data appropriately). But if that’s the case, the LLM must be generating explanations for the code it’s writing and running to make stock predictions. Reading those intermediate messages would tell you if it’s doing something sensible or just getting lucky.

I mean, it’s not a great experiment for the reasons stated elsewhere. But, it is thought provoking.

Why do we need Vanguard any more if an AI can just manage your stocks to an index and engage in optimal tax loss harvesting for you?

I get some people will always want a person picking investments for them, but with enough time and market acceptance of AI traded portfolios I suspect that will be a very small share of the market. But with indexing though, why even have people involved at all? You could have one AI generating trade orders, and another performing all the investment risk functions on top of it (investment guideline compliance, etc.). I feel like 90% of Vanguard’s costs are its people. Do we need them anymore?

The implications for all of this are insane. What a terrible time to be alive!

former equity researcher, from a statistical standpoint i’m curious how this fares vs the “market” portfolio. would love to see the GPT’s portfolio beta and sharp (sortino and treynor for other risk adjust measures) vs the s&p as a floor.

plus as your information develops u can ask gpt to model its possible performance via a monte carlo simulation.

Seems like this is probably just like all the other examples of amateurs beating experts. Dumb luck. Not that expert opinion is worth a whole lot either. Index funds are usually your best option. Personally, i invest in a few stocks I really believe in. My RocketLab has been going gang busters ever since starships started exploding.

try that again in a bear market

Yeah but is it doing better than trade like Pelosi?

And this is exactly my I get my investment advice from chatgpt

ChatGPT caught $OPEN last Monday

Ok, now do it 100x with 10 dollars each. The volatility here makes a single trial completely worthless. And in a data sub lol. This is an anecdote.

Call me when it outperforms SPY over a course of several years. Testing over 6 months is a waste of everyones time

throwback to the michael reeves video where he made a goldfish trade stocks and it made money

Very cool stuff!

The URL to the blog should just be [https://nathanbsmith729.substack.com/](https://nathanbsmith729.substack.com/)

I actually saw someone on the bus today to work asking chatgpt if ETH was a buy or sell today….. I believe that is a cryptocurrency or something.

Bonkers how people don’t understand how financial markets work, putting to one side crypto generally.

Chatgpt is a language model, meaning it is trained to reproduce stuff it’s learnt reading the Internet, encyclopedias, books, journals, newspaper articles, textbooks etc. It does have amazing generalisation to tasks other than regurgitating information, however stocks will never be it. Why? How is it good at everything else but not stocks? The economic rule is called “efficient market hypothesis” and essentially if the tool exists to predict stock prices then everyone will use it until prices move instantly, meaning no one or only the people operating at light speed near exchanges will make any money. There is no financial market for Wikipedia knowledge so chatgpt will be capable of maintaining knowledge of that stuff.

What you need to predict prices is a model no one else knows about, or know something about the stock no one else knows about. It has been done before and is probably going on right now in certain investment banks, however it’s the kinda thing you need a PhD in maths from Harvard to compete in…..or be the son of an executive of a public company and know something others do not.

Why are you comparing to these indices and not an S&P 500 fund?

Would be very interesting to see on a broader scale. Newer AI models already outperform in the vending machine experiment, outperforming stock trading and portfolio management shouldn’t be far away.

Comments are closed.