Find companies with promising cash flow potential yet trading below their fair value.

Patterson-UTI Energy Investment Narrative Recap

To be a Patterson-UTI Energy shareholder today, you need to believe in the company’s ability to weather ongoing industry headwinds, including declining revenue forecasts and sustained net losses. The recent second quarter net loss and muted revenue outlook may dampen enthusiasm for a near-term turnaround, but they do not appear to disrupt the company’s core operational catalysts based on long-term customer partnerships and scale. The biggest risk remains commodity price volatility, which directly affects drilling activity and profitability, this factor remains unchanged following the recent update.

Of the latest announcements, the completed buyback of over 87 million shares stands out as most relevant, reflecting Patterson-UTI’s ongoing commitment to returning cash to shareholders even during unprofitable periods. These capital returns support shareholder value, but are set against a backdrop of shrinking sales and losses, highlighting the importance of sustainable future earnings generation for supporting buybacks and dividends over time. However, investors should be conscious that…

Read the full narrative on Patterson-UTI Energy (it’s free!)

Patterson-UTI Energy is projected to reach $4.9 billion in revenue and $351.5 million in earnings by 2028. This outlook is based on an annual revenue decline of 1.7% and an earnings increase of $1.35 billion from current earnings of -$1.0 billion.

Uncover how Patterson-UTI Energy’s forecasts yield a $8.05 fair value, a 29% upside to its current price.

Exploring Other Perspectives PTEN Community Fair Values as at Jul 2025

PTEN Community Fair Values as at Jul 2025

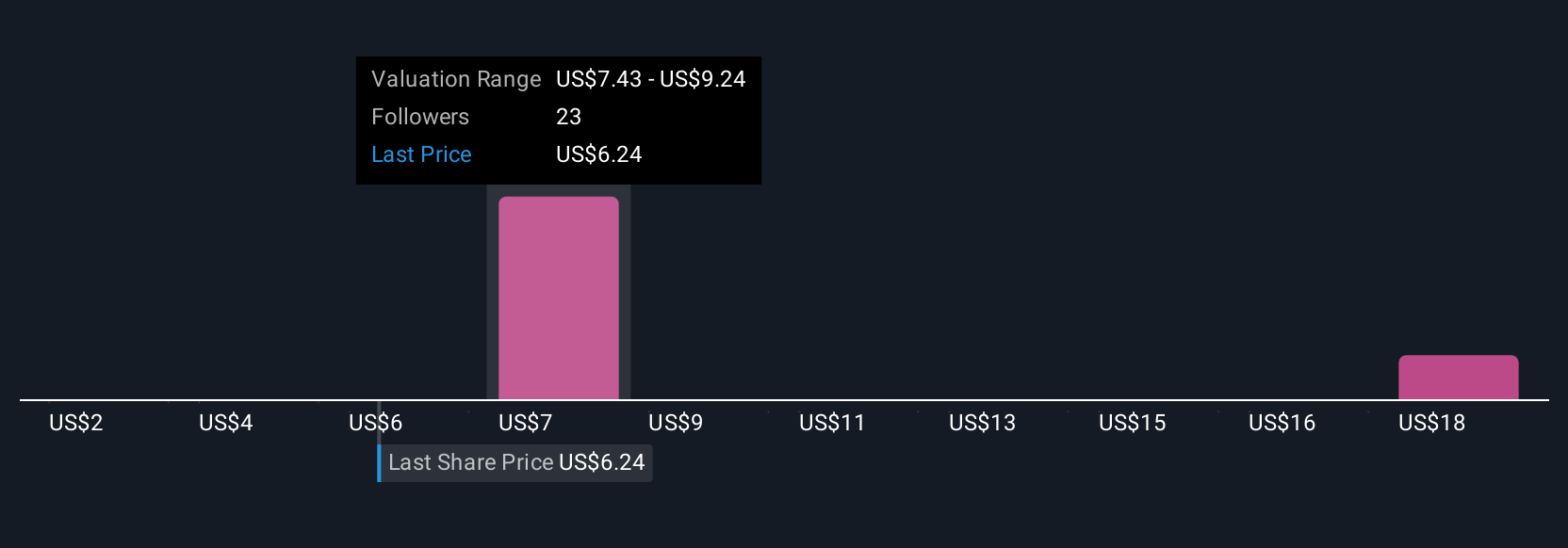

The Simply Wall St Community produced four personal fair value estimates for Patterson-UTI Energy, ranging from US$2.00 to US$20.10 per share. While many see room for higher valuation, persistent oil market volatility could weigh on revenues and margins, shaping differing outlooks on the company’s future potential.

Explore 4 other fair value estimates on Patterson-UTI Energy – why the stock might be worth less than half the current price!

Build Your Own Patterson-UTI Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don’t miss this chance:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com