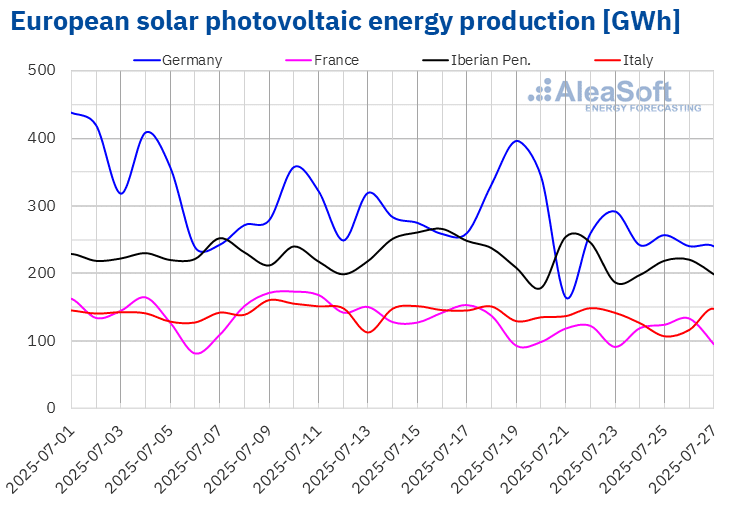

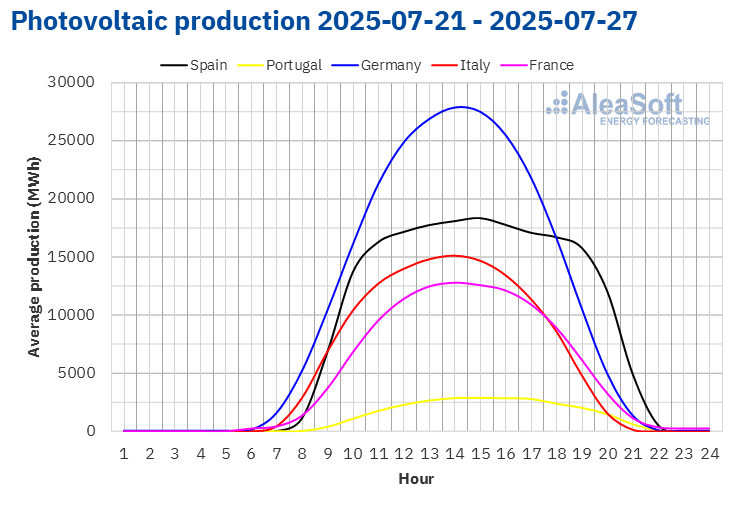

During the week of July 21, solar photovoltaic energy production declined in the main European electricity markets compared to the previous week. The German market registered the largest drop, at 21%, while Portugal registered the smallest decrease, at 2.0%. The Italian, Spanish, and French markets saw declines of 8.1%, 8.5%, and 8.6%, respectively. Both France and Italy continued their downward trend for the second consecutive week.

For the week of July 28, according to solar energy forecasts from AleaSoft Energy Forecasting, solar photovoltaic energy production will increase in the German and Spanish markets. In Italy, however, production will continue to decrease.

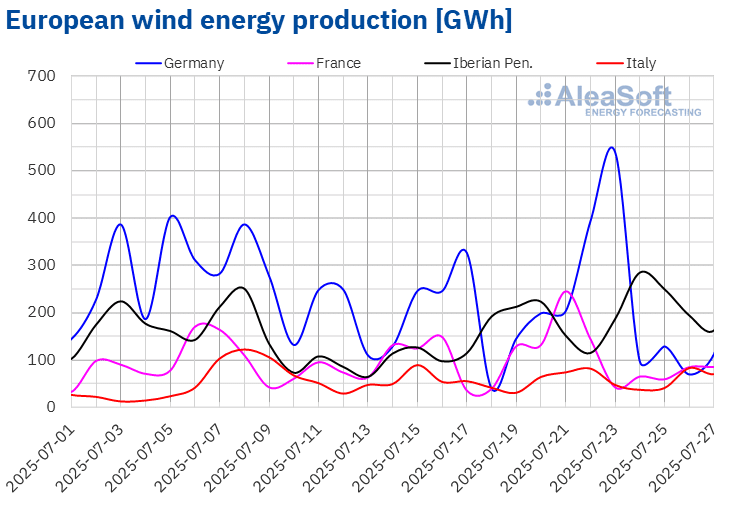

In the fourth week of July, wind energy production increased in most major European electricity markets compared to the previous week. The Iberian Peninsula maintained its upward trend for the second consecutive week. Spain registered the largest increase, at 30%, while Portugal registered the smallest, at 8.3%. The Italian and German markets also registered increases of 13% and 16%, respectively, reversing the downward trend of the previous week. France was the exception, with wind energy production falling by 1.8% after five consecutive weeks of growth.

Despite the decline in France, on July 21 the market set a new daily wind energy production record for the month of July, reaching 245 GWh. Additionally, on July 24, the Spanish market produced 228 GWh of wind energy, a level not seen since mid‑April.

For the week of July 28, according to AleaSoft Energy Forecasting’s wind energy forecasts, production will increase in the Iberian Peninsula and Germany, while it will decrease in the French and Italian markets.

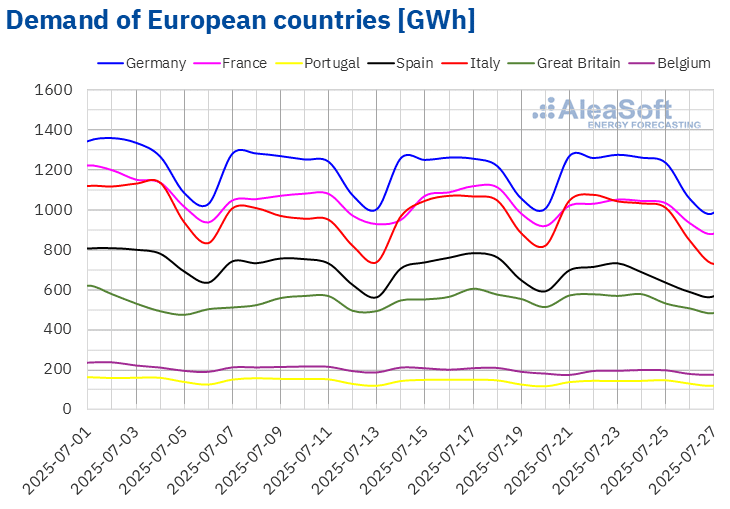

Electricity demand

During the week of July 21, electricity demand decreased in most of the main European electricity markets compared to the previous week. The Spanish and Belgian markets registered the largest drops, at 7.3% and 6.7%, respectively. The Portuguese and Italian markets showed the smallest reductions, at 1.6% and 1.7%, respectively. Demand fell by 2.4% in Great Britain and 3.4% in France. The Belgian and Portuguese markets continued their downward trend for the third consecutive week. In contrast, Spain, Italy, France, and Great Britain reversed the previous week’s upward trend, registering declines in demand. Germany was the exception, with demand increasing by 0.4% after two weeks of declines.

Lower average temperatures helped reduce demand across most of the analyzed markets. The decreases ranged from 0.3°C in Italy to 2.0°C in Spain. In addition, Belgium’s National Day on July 21 also contributed to lower demand in that market.

For the week of July 28, according to AleaSoft Energy Forecasting’s demand forecasts, demand will increase in the Belgian, Spanish, French, and Portuguese markets. In contrast, it will decrease in the Italian, German, and British markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.European electricity markets

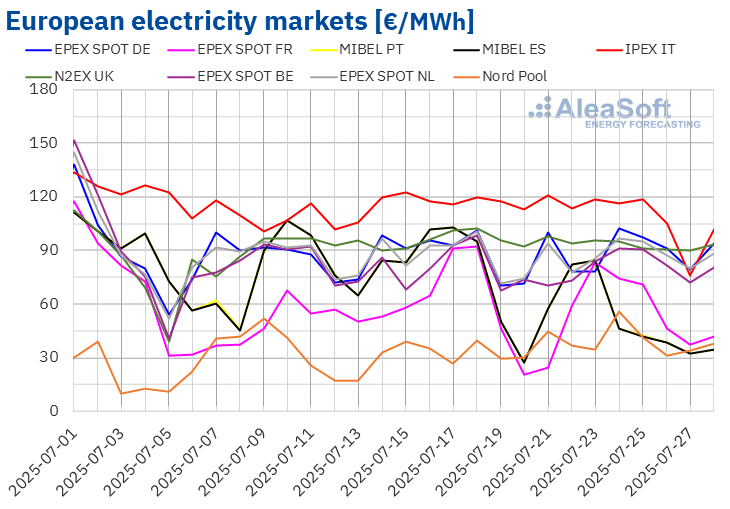

In the fourth week of July, average prices in most of the main European electricity markets fell compared to the previous week. The EPEX SPOT markets of the Netherlands and Germany, along with the Nord Pool market of the Nordic countries, were the exceptions, with increases of 0.9%, 1.2%, and 20%, respectively. The MIBEL markets of Spain and Portugal registered the largest percentage drops, with declines of 30%. On the other hand, the EPEX SPOT market in Belgium saw the smallest decrease, at 0.8%. In the other markets analyzed at AleaSoft Energy Forecasting, prices fell between 2.2% in the N2EX market of the United Kingdom and 7.2% in the EPEX SPOT market of France.

During the week of July 21, most European electricity markets’ weekly averages were above €55/MWh. The exceptions were the MIBEL markets of Spain and Portugal, which registered averages of €54.70/MWh and €54.73/MWh, respectively, along with the Nordic market, which registered an average of €39.59/MWh. The IPEX market of Italy registered the highest weekly average, at €109.81/MWh. Among the remaining markets analyzed at AleaSoft Energy Forecasting, prices ranged from €56.50/MWh in the French market to €93.38/MWh in the British market.

As for daily prices, on Monday, July 21, the French market registered the lowest daily average among the analyzed markets, at €24.34/MWh. On the same day, the Italian market reached the highest daily average of the week, at €120.80/MWh. In Italy, daily prices remained above €110/MWh throughout the entire week.

Regarding hourly prices, negative values were registered in some hours in the Spanish and Portuguese electricity markets during the fourth week of July. On Sunday, July 27, between 16:00 and 17:00, the Iberian market reached the lowest hourly price of the week, at ‑€0.60/MWh.

During the week of July 21, the decline in electricity demand across much of the analyzed markets, along with increased wind energy production in most of them, contributed to the drop in electricity prices in European markets.

Price forecasts from AleaSoft Energy Forecasting indicate that in the final week of July, prices will fall in most major European electricity markets, influenced by lower demand and increased wind energy production in some of these markets.

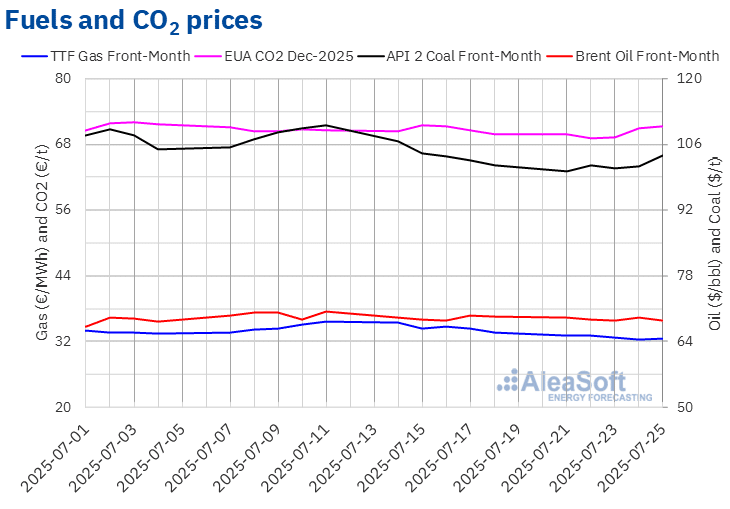

Brent, fuels and CO2

Brent oil futures for the Front‑Month on the ICE market declined in most sessions of the fourth week of July, marking the second consecutive week of losses. The exception was Thursday, July 24, when the settlement price rose by 1.0% compared to the previous day. On Monday, July 21, the futures reached their weekly maximum settlement price of $69.21/bbl, while on Friday, July 25, they registered their weekly minimum settlement price of $68.44/bbl. According to data analyzed by AleaSoft Energy Forecasting, this settlement price was 1.2% lower than that of the previous Friday.

During the fourth week of July, the decline in Brent oil futures was mainly driven by increased global supply and signs of weakening demand. Confirmation that OPEC+ would proceed with its plan to increase production starting in August strengthened the expectations of a more supplied market, exerting downward pressure on prices. At the same time, trade tensions between the United States and the European Union, amid the possibility of new tariffs, intensified fears of an economic slowdown and its impact on global energy consumption. Additionally, the prospect of increased oil exports from Venezuela, following diplomatic progress with the United States, reinforced short‑term oversupply concerns.

As for TTF gas futures for the Front‑Month on the ICE market, the weekly maximum settlement price was reached on Monday, July 21, at €33.16/MWh. Prices then declined steadily throughout the week, except for Friday, July 25, when they rose by 0.4% compared to the previous day. The weekly minimum settlement price was registered on Thursday, July 24, at €32.36/MWh. On Friday, July 25, the settlement price was €32.50/MWh, which was 3.3% lower than the previous Friday, according to data at AleaSoft Energy Forecasting. The weekly average price fell by 5.1% compared to the previous week.

The increase in liquefied natural gas supply in Europe, driven by higher imports and moderate demand in Asia, contributed to the decline in TTF gas futures prices during the week of July 21. This downward trend was reinforced by the abundance of available supply, within a context of high storage levels across Europe and no immediate signs of market stress. Additionally, spot LNG prices in Asia fell to their lowest levels in over two months, easing competitive pressure on European purchases and further contributing to the drop in TTF gas futures prices during the same week.

On the EEX market, CO₂ emission allowance futures for the December 2025 reference contract started the week with a settlement price 0.1% lower than the previous Friday. The downward trend continued through July 22, when futures reached their weekly minimum settlement price of €69.82/t. On Friday, July 25, the price rose by 0.6% from the previous day, reaching the weekly maximum settlement price of €71.35/ton. According to data at AleaSoft Energy Forecasting, this price was 2.1% higher than the previous Friday’s settlement price.