The United States-European Union trade deal ensures that euro area and EU growth will remain relatively resilient even though effective US tariffs on EU exports increase by around 16pps in aggregate this year.

The EU economies most exposed to the 15% US levies on imports agreed at the weekend are those with an elevated trade surplus and/or significant trade with the US, such as Germany and Ireland. The effects of the higher tariffs this year are also being felt indirectly through their effects on global value chains.

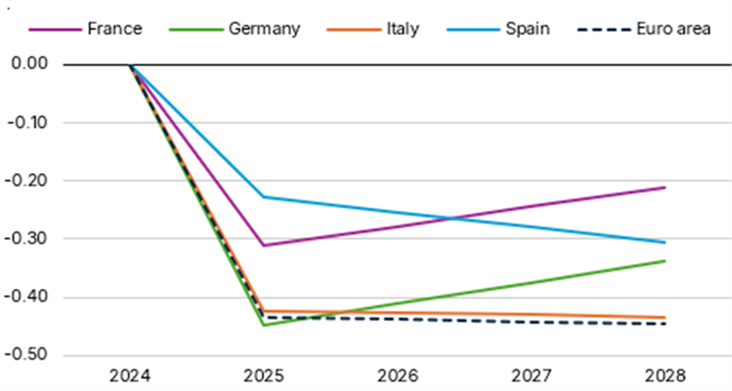

Among the EU’s four largest economies (Germany, France, Italy and Spain), Germany and Italy are the most vulnerable, each facing an estimated short-term output loss of 0.4pps from the trade levies this year. The higher tariffs may reduce Spain’s output by a moderate 0.3pps in the medium run. France is expected to experience a more-modest cumulative reduction in output of 0.2pps in the medium term.

Trade tensions adversely affect euro area growth, which Scope Ratings estimates at just 1.2% in 2025 though Scope expects growth to improve to 1.5% by next year, lifted by fiscal stimulus in Germany and higher defence spending across the EU.

US tariff rises set back growth in the largest EU economies

Cumulative impact on real output (percentage-point change) assuming the 15% levy on EU exports

Note: this scenario for the impact of US levies on the EU is based on the measures already in force or announced by the US since the start of Donald Trump’s second administration and the countermeasures from trading partners, including the agreements announced between the US and its trading partners and a 15% rate assumed on EU exports to the US. Source: Scope Ratings.

The preliminary agreement will likely contain many caveats and carve-outs, demonstrating limited enforceability, serving only to avert a worst-case escalation and acting as the starting point for further negotiations.

(Arne Platteau, analyst in credit policy at Scope Ratings, contributed to this research)