The is set to announce its decision today at 9:00 PM Riyadh time. This comes at a time when inflation continues to decelerate gradually, but structural pressures and geopolitical uncertainties persist. While the markets strongly expect the Fed to keep rates unchanged, all attention is focused on Fed Chair Jerome Powell’s remarks, which will be crucial in shaping expectations for the future path of monetary policy.

Most Likely Scenario: Holding Rates at 5.25%–5.50%

Markets are estimating a 96–97% probability that the Fed will maintain the federal funds rate at its current range of 5.25% to 5.50%. This consensus reflects investor confidence that the central bank will stay on hold during this meeting.

Why This Scenario Makes Sense?

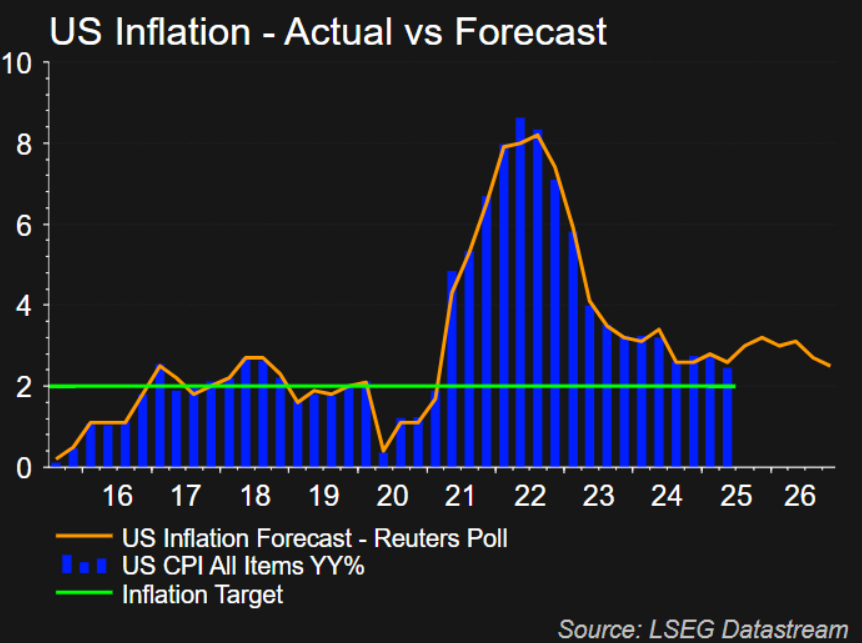

First, core inflation remains above the Fed’s 2% target. As of June, the Core Consumer Price Index (Core CPI) stood at 2.7% year-over-year. While this marks a significant decline from its 2022 peak, it is still not low enough to fully reassure policymakers, especially given the resilience in the labor market.

Second, global trade tensions, particularly between the U.S. and its major trading partners, pose additional inflationary risks. Any escalation in tariffs or disruptions to global supply chains could push commodity prices higher, undermining price stability.

Third, the U.S. economy remains surprisingly resilient. The unemployment rate stands at just 4.0%, job creation continues at a healthy pace, and Q2 GDP growth surpassed expectations at 2.3% year-on-year. These factors allow the Fed to adopt a cautious stance without rushing into rate cuts.

Fourth, although some voices are calling for policy easing in light of declining inflation, especially President Trump, the Fed is cautious of prematurely declaring victory over inflation. Policymakers remain mindful of the 1970s experience, when early rate cuts led to a revival in inflation and a painful policy reversal. With concerns about stagflation, a scenario of slowing growth and stubborn inflation, still in play, the Fed is likely to maintain a hawkish tilt until it is fully confident that inflation is sustainably under control.

What to Expect from Powell’s Speech

If rates are held steady as expected, Powell’s press conference will be the main market-moving event. He is expected to insist in delivering a careful balance between maintaining the Fed’s credibility in fighting inflation and calming market fears over excessive tightening. His key messages will likely include:

Acknowledging Progress Without Declaring Victory: Powell will likely recognize the improvement in inflation metrics, especially the retreat from 2022 highs. However, he will emphasize that inflation remains above target, warranting a continued restrictive stance.

Reaffirming the Data-Dependent Approach: Powell is expected to reiterate that future policy decisions will be driven entirely by incoming economic data, especially inflation and labor market reports, and not by preset timelines or political pressure. This gives the Fed flexibility to either hold rates higher for longer or pivot to cuts if conditions permit.

Warning Against Premature Rate Cuts: The Chair will likely caution that cutting rates too soon risks reigniting inflationary pressures, a mistake the Fed is determined to avoid. He may indirectly downplay market expectations of a rate cut in September, even as current pricing shows over a 60% chance of such a move.

Expressing Confidence in U.S. Economic Strength: Powell will probably highlight the underlying strength of the U.S. economy and job market, noting that the slowdown remains limited and that the U.S. is not in a recession. This narrative justifies the Fed’s cautious stance.

Highlighting Global Risks: He may address external risks such as rising global bond yields, trade disputes, and China’s economic slowdown, emphasizing that the Fed is closely monitoring these factors for their potential spillover effects.

Asserting the Fed’s Political Independence: Amid growing political scrutiny, particularly from Donald Trump, who has hinted at replacing Powell or pressuring the Fed toward easier policy, Powell is likely to stress the importance of central bank independence. He might be expected to repeat his trademark statement: “We don’t respond to political pressures; we respond to economic data and our dual mandate of price stability and maximum employment.”

This defense of the Fed’s autonomy is critical at a time when political interference could damage its credibility. Powell may even reference examples from other countries where central bank independence was undermined, resulting in soaring inflation and collapsing investor confidence.

Michel Saliby.

Senior Market Analyst at FxPro.