Hey

I finally want to get around to finish my tax declarations for 2024 in Winterhur (Zürich). I've extended the deadline early enough to end of November, as that's the maximum possible (in normal ways; it's been acknowledged and so that's taken care of).

So… The normal Swiss stuff is easy and I've done. However where I struggle is the following: In '24 my father died; let's say it was the 4 July 2024 (it was not). He lived in Germany; I live in Winterthur. I inherited it all, ie. some investment fonds.

What do I need to fill in…?

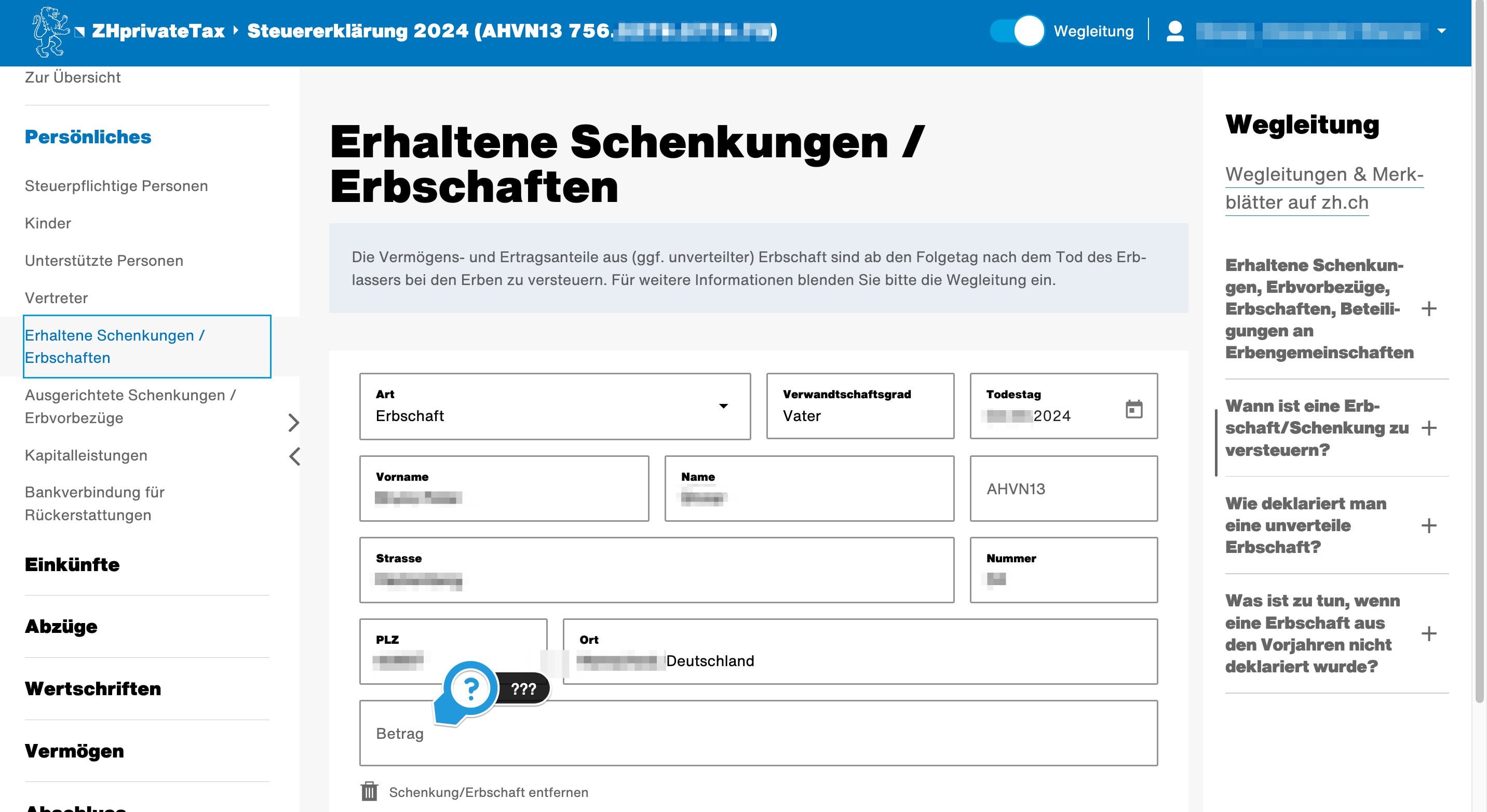

Specifically at "Erhaltene Schenkungen / Erbschaften" ("Gifts / inheritances received") (see also screenshot), what's the Betrag ("amount")? Would I need to contact the bank where he invested and have them tell me, the total sum of the investment fond accounts as of 5 July '24 (1 day after his death)?

Wouldn't the Steueramt ("tax office") also like to know how the values of the investments developed until 31 December 2024? Should I get this information also from the bank in Germany in a form of a Kontoauszug ("bank statement") or such? Where to enter this then?

In the Wertschriftenverzeichnis ("securities register") (screenshot)? One entry per fonds?

That's how?

Thanks.

by alexs77

2 comments

Call a professional… You really don’t wanna f up on taxes ..

call them and ask, they are helpful and will answer your questions.

Comments are closed.