Adnoc Gas has signed a 10-year preliminary agreement with Hindustan Petroleum Corporation (HPCL) to supply liquefied natural gas to the Indian fuel retailer, as demand for low-carbon fuel remains strong amid decarbonisation efforts.

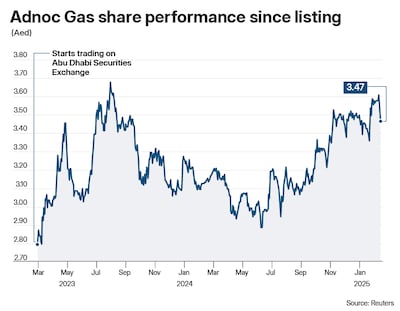

The company, estimated to have the seventh largest natural gas reserves globally, will supply 500,000 metric tonnes of LNG per annum to HPCL, Adnoc Gas said in a statement on Monday to the Abu Dhabi Securities Exchange, where its shares are traded. The total value of the deal was not disclosed.

The gas will be supplied from Adnoc Gas’ Das Island liquefaction facility, which has a production capacity of 6 mmtpa, the company said, adding that the Das Island LNG plant has shipped more than 3,500 LNG cargoes globally since starting operations.

“This milestone underscores Adnoc Gas’s ability to reliably meet rising global demand for LNG and support India’s ambition to increase natural gas to 15 per cent of its primary energy mix by 2030,” said Fatema Al Nuaimi, chief executive of Adnoc Gas.

The long-term agreement with HPCL is Adnoc Gas’s third with Indian companies in the past year, reflects the “robust energy partnership” between the UAE and India, she added.

The latest agreement contract strengthens Adnoc Gas’ partnership with significant Indian players as it builds on recent agreements with Indian Oil Corporation and GAIL India and underscores its global footprint across the high-demand Asian LNG market.

India is aiming to have natural gas make up a 15 per cent share of its total energy mix by 2030.

Growth strategy

The latest agreement builds on Adnoc’s strategy to build its customer base after a series of LNG agreements in the past two years.

In February, Adnoc Gas signed a 14-year deal to supply up to 1.2 million tonnes per annum of LNG to state-backed Indian Oil. The agreement is valued between $7 billion and $9 billion, Adnoc Gas said at the time, adding that Indian Oil is set to become the largest buyer of LNG from Adnoc by 2029.

The Abu Dhabi-based signed another contract with Indian Oil in September last year, in which it signed a preliminary 15-year agreement with the company to supply 1 million tonnes a year of LNG to India.

Adnoc also signed a 10-year agreement to supply LNG to state-owned energy corporation Gail India in January last year, without disclosing the total value of that agreement.

In June 2023, Adnoc Distribution, the UAE’s largest fuel and convenience retailer, signed an agreement with Hindustan Petroleum to explore opportunities for expanding their lubricants and allied products businesses in the UAE, India and other markets.

Adnoc Gas, which has access to 95 per cent of the UAE’s natural gas reserves, is looking to boost exports of products such as LNG, liquefied petroleum gas and naphtha. Alongside other Adnoc units, Adnoc Gas has been boosting investments to expand its geographical and operational reach. The company supplies approximately 60 per cent of the UAE’s sales gas needs and supplies end-customers in more than 20 countries.

In February, Adnoc signed a sales and purchase agreement with Japan’s Osaka Gas for the supply of up to 800,000 tonnes per annum of LNG from its Ruwais LNG project in Abu Dhabi, marking the first long-term LNG sales agreement between Adnoc and the Japanese utility.

Adnoc Gas is a key player in Adnoc’s strategy to enhance its natural gas production capacity and expand global LNG exports.

In April last year, Adnoc Gas said it plans to invest more than $13 billion until 2029 to pursue domestic and international growth opportunities as it aims to expand its LNG production capacity.

The company aims to more than double its LNG output capacity by 2028 through the strategic acquisition of the new Ruwais LNG plant from parent company Adnoc and potentially target assets in Europe, India, China and South-East Asia, it said at the time.

In May this year, Adnoc Gas reported a 7 per cent year-on-year increase in net income to $1.27 billion, driven by strong domestic demand for gas and continued economic growth in the UAE. The company is expected to announce its third-quarter financial results on Tuesday.

Shell’s 2025 LNG Outlook forecasts a 60 per cent increase in global demand for the fuel by 2040, driven by Asian economic growth, emissions reductions in industry and transport, and the rise of artificial intelligence. The consumption of the fuel – considered a cleaner alternative to coal and crude oil – is expected to reach 630 million tonnes to 718 million tonnes a year by 2040, compared with 407 million tonnes last year, according to Shell.