The world is witnessing a seismic shift in geopolitical alliances and economic dynamics as the U.S. imposes tariff threats on India for its continued purchases of Russian oil. This tension, rooted in divergent strategic priorities, underscores the fragility of global supply chains and the volatility of equity markets in Asia. For investors, the interplay between geopolitical risk, energy security, and trade policy demands a nuanced understanding of how emerging markets are recalibrating their positions in a fractured global order.

The Geopolitical Calculus: U.S. Pressure and Indian Resilience

The U.S. has long positioned itself as a gatekeeper of global energy markets, leveraging sanctions and tariffs to isolate adversaries. President Donald Trump’s recent 25% tariff on Indian goods—threatened with additional penalties over Russian oil purchases—exemplifies this approach. The U.S. argues that India’s reliance on Russian oil (now 36–40% of its imports) undermines efforts to weaken Russia’s war machine. Yet India, prioritizing economic stability and energy affordability, has resisted, framing its purchases as a pragmatic response to global price volatility.

This standoff reflects a broader realignment: India is leveraging its role as a major energy consumer to assert strategic autonomy. By maintaining ties with Russia, India seeks to diversify its energy sources and protect its economic growth trajectory. However, the U.S. views this as a challenge to its influence, particularly as India’s partnership with Russia in arms, energy, and technology deepens. The resulting friction highlights how emerging markets are increasingly balancing short-term economic pragmatism against long-term geopolitical alignment.

Supply Chain Disruptions and Equity Market Volatility

The U.S.-India-Russia tensions have already disrupted global energy supply chains. India’s purchases of Russian oil, which account for 70% of Russia’s crude exports, have helped stabilize global prices, preventing a spike to $130 per barrel. However, the threat of secondary tariffs—up to 500% on countries trading with Russia—risks creating a supply shock. If India and other importers are forced to abandon Russian oil, global crude prices could surge to $100–120 per barrel, triggering inflationary pressures and reshaping trade flows.

Asian equity markets are particularly vulnerable. Energy-linked sectors, such as refining, manufacturing, and transportation, face margin compression as oil prices rise. For example, India’s state-owned refiners, which process 1.8 million barrels of Russian crude daily, may see profitability decline under higher costs. Similarly, China and Brazil—also major Russian oil buyers—could face similar pressures, amplifying regional economic instability.

Central banks in Asia are already navigating this volatility. While India’s headline inflation has eased to 2.82%, the risk of a price rebound looms large. Investors must monitor how policymakers balance energy affordability with inflation control, as rate hikes or subsidies could further strain equity valuations.

Strategic Alliances and the Future of Global Trade

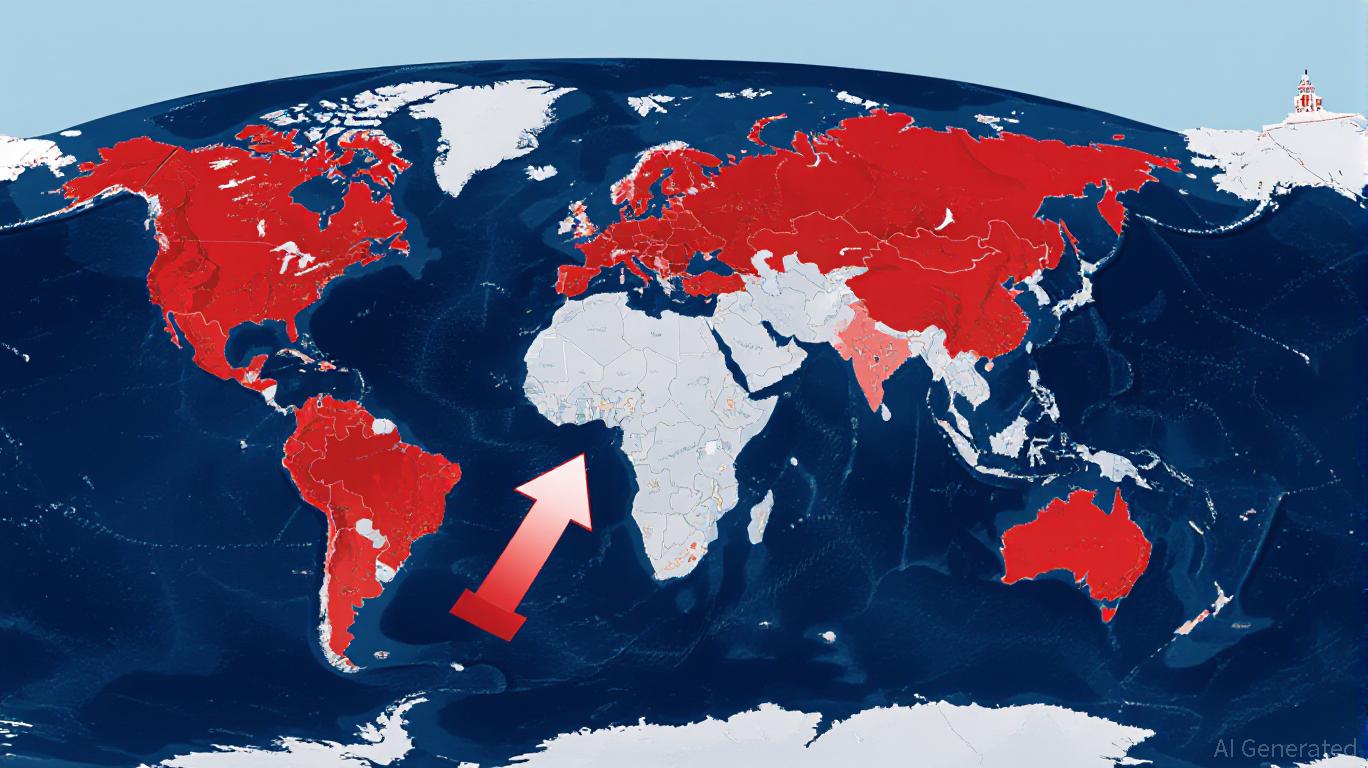

The U.S. tariff threats are not merely economic but geopolitical. By targeting India, the U.S. seeks to weaken the emerging “de-dollarization” trend, where countries like India, China, and Brazil are exploring alternative currencies and payment systems. India’s refusal to comply with U.S. demands signals its alignment with BRICS nations, which are increasingly prioritizing economic interdependence over Western-led frameworks.

This shift has profound implications for global trade. Emerging markets are diversifying supply chains, with India exploring partnerships in Africa and the Middle East for oil and uranium. Meanwhile, China’s yuan-based trade and Brazil’s energy investments are reducing reliance on U.S. dollars and Western markets. For investors, this suggests a long-term realignment of trade blocs, with BRICS economies playing a larger role in shaping global commerce.

Investment Implications: Navigating Uncertainty

For investors, the key lies in balancing risk and opportunity. Here are three strategic considerations:

Sector Diversification: Energy and commodity-linked sectors in Asia are exposed to volatility. However, sectors less dependent on oil, such as technology and consumer discretionary, may offer relative stability. Investors should overweight equities in regions with strong fiscal buffers and underweight those in energy-intensive economies.

Geopolitical Hedging: Diversify portfolios across emerging markets to mitigate regional risks. Countries like Indonesia and Vietnam, which are less entangled in U.S.-Russia-India tensions, may provide safer havens.

Long-Term Exposure to BRICS Growth: As BRICS nations strengthen their economic ties, companies operating in these markets—particularly in infrastructure, technology, and renewable energy—could outperform. Consider thematic investments in green energy and digital infrastructure, which align with India’s and China’s growth strategies.

Conclusion: A New Equilibrium

The U.S.-India-Russia oil dispute is a microcosm of the broader struggle for influence in a multipolar world. While the immediate risks to global supply chains and equity markets are significant, the long-term trend toward diversified trade networks and regional economic blocs is inevitable. Investors who adapt to this reality—by diversifying portfolios, hedging geopolitical risks, and capitalizing on BRICS-led growth—will be better positioned to thrive in an era of persistent uncertainty.

In the end, the lesson is clear: Geopolitical risk is no longer a peripheral concern but a central driver of investment strategy. Those who recognize this shift and act accordingly will navigate the crossroads of conflict and opportunity with resilience.